This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s Deep Dive looks into how quickly ferries are going electric on every continent.

Sponsored by ErthTech Talent

Low-Cost ClimateTech Sales Recruiter

At ErthTech Talent, we specialize in placing top sales professionals at climate companies across the U.S. Whether you need a Chief Revenue Officer or an Account Executive, we deliver proven talent—FASTER and CHEAPER* than traditional recruiters.

*Our Fees: 12-15% of First Year Salary

Why work with us?

70+ placements so far

Save hundreds of hours reviewing resumes

Unlock passive talent (~70% of top candidates aren’t actively job hunting)

Hire battle-tested sales pros who drive revenue

Limited-time Offer

Lock-in a complimentary 6-month placement guarantee (usually 5% up charge) by booking an intro call before April 7th. Book a call now!

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Blueshift (Massachusetts, USA): Redox chemistry to extract minerals from industrial waste

BusPas (Canada): Hardware and software for cities to improve mobility

Celluol (France): Using bacteria to more efficiently produce corn ethanol

Evera (France): EV fleet subscription service

GoodMaps (Kentucky, USA): Software to improve indoor mapping and movement

Longbow Motors (United Kingdom): Electric sports car manufacturer

Mothium (Spain): Emerging manufacturer of micromobility for goods delivery

Motoring Labs (Indiana, USA): Computer vision technology to improve commercial fleet and warehouse operations

Zed Motors (Benin): Battery swap network for micromobility

💰FUNDING: Capital raises from startups previously featured in Startup Watch

theion (Vol 47) raised a $16.4M Series A from Team Global, Enpal, and Geschwister Oetker

Evenergi (Vol 50) raised a $15M Series A from Remarkable Ventures, Aligned Climate Capital, and Ecosystem Integrity Fund ($5M of which was noted in Vol 69)

DG Matrix (Vol 73) raised a $20M seed round from Clean Energy Ventures, with ABB, Chevron Technology Ventures, Piedmont Capital Investments, and Cerberus Capital Management

SunTrain (Vol 74) raised $112K from crowdfunding on Republic, alongside raising over $1M in venture capital from LvlUP and others

nlcomp (Vol 83) raised 600K EUR from CDP Venture Capital and Samer & Co. Shipping

Elm AI (Vol 94) raised its seed round (amount undisclosed) from Beta Boom, Boro Capital, Working Capital, and others

As a reminder, the startup data set is free (for now) to subscribers. If you’re a subscriber interested in accessing the Airtable with how these startups raised $2.6 billion in follow-on funding, please let me know.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🗽In New York City, congestion pricing continues to prove its worth, including an almost 70% reduction in noise complaints and not rerouting traffic to other boroughs. The NY Governor plans to defy the Trump administration’s demand to end the program by Friday, March 21.

🚉 Speaking of NYC, a new group called Grand Penn Community Alliance is pushing for Madison Square Garden (MSG) to be relocated, allowing Penn Station to grow and flourish. There have been four locations for Madison Square Garden so far, so moving it again shouldn’t be considered sacrilegious.

🚨The US federal government continued its rapid dismantling of sustainability initiatives: the EPA will aim to roll back tailpipe emissions, the US DOT head Sean Duffy has ordered the agency to review all green infrastructure grants, and the DOT is also threatening to withhold funds for the NYC metro system. And that’s all before tariffs bring sheer chaos to the auto sector.

🚄 The CEO of Amtrak is stepping down. A few weeks ago at a conference, Musk said “Amtrak is a sad situation” and that privatizing it would be the only way to have a feedback loop for improvement. Musk may be unaware that most successful passenger rail operators in other countries are publicly owned.

Not yet a subscriber?

🔬Markets & Research

↗️ EV sales are up 20% year to date in the US versus 30% globally. The federal administration can slow things down, but it’s impossible to stop the EV transition.

🏭 What happens if the US government repeals the federal EV tax credit? Sales slow down some, but jobs get decimated as new and existing factories close.

🔌 According to Consumer Reports, Tesla and Rivian run the most reliable charging networks in the US. Over time, retail operators like Starbucks, Walmart, and Whole Foods will understand the customer profitability impact of poor charger reliability from legacy networks and demand changes.

🗽The National Bureau of Economic Research has a new paper out on The Short-Run Effects of Congestion Pricing in New York City. You love to see it.

Know someone who invests in the space?

🏭 Corporates & Later Stage

🤯 BYD shocked the world with its plans to charge EVs in 5 minutes. Few players have the credibility to make this happen at both the vehicle and charger level. BYD will build up a nationwide network in China of up to 4,000 chargers operating at a peak standard of 1 megawatt!

📡 Apple is inching away from plug-in charging and towards wireless charging. Many charging innovations start on Apple phones before they hit electric vehicles.

🧨 Tesla’s problems continue to multiply: a cratering stock price, accounting questions, a brutal viral video takedown from Mark Rober on its autonomous capabilities, and at least one notable shareholder asking for CEO Elon Musk to step down. US Attorney General Pam Bondi has labeled the growing spate of Tesla vandalism as “domestic terrorism.”

🔂 Toyota group member Toyota Tsusho shelled out almost $1 billion to buy a metal recycler. The company aims for a closed loop of metals used in automotive.

🚗 Toyota unveiled its 4-wheeled micromobility vehicle for Europe: FT-Me. It will rival Stellantis’ Citroen Ami and the Renault Duo.

🚙 Not to be outdone, Stellantis partnered with 'Light Urban Vehicle' startup Luvly to evaluate how to use its electric flatpack technology in future vehicles. If anyone can figure out how to scale IKEA flatpack vibes in micromobility, it’s Stellantis.

🚐 The new venture capital fund Leitmotif turned out to be fully backed by VW. Interestingly, Leitmotif invested in Harbinger, a rival of VW-backed Rivian.

🥊 Bolt, the European ride-hailing star, is entering the North American market to take on Uber and Lyft. Time will tell whether this is just a nice story for the upcoming Bolt IPO or whether they’re in it to win it.

🤪 Ousted Uber founder Travis Kalanick said the company erred by giving up its robotaxi program. Kalanick seems to have forgotten how far behind Uber was in the robotaxi race.

🏕️ Airstream has unveiled its first fully electric trailer. The unit is powered by 600-watt solar panels and a 10.3 kWh lithium battery pack.

✈️ JetBlue will be the first regular user of Sustainable Aviation Fuel (SAF) at JFK. So far, LAX and SFO are leaders in offering SAF to airlines.

↘️ Stock in electric 2-wheeler maker Ola Electric is off 60% from its peak. Call it the revenge of the incumbents, as gas-powered rivals have finally learned how to start making electrics.

Subscribers hail from 49 US states and 89 countries. Want to join them?

🐣 Startups & Early Stage

🦾 AI startup Hugging Face teamed up with Yaak to expand LeRobot capabilities to allow robots and cars to autonomously navigate environments like city streets. Given the billions being plowed into AI, it’s inevitable that some of that money will compete against Waymo.

🗺️ Tern AI has unveiled its low-cost alternative to GPS. For more on the maps wars, see the Deep Dive in Vol 62.

👩🏻🔧 A Bronx shop is the repairer of last resort for all remaining Fiskers. Expect to see Fiskers multiply in NYC as Uber and Lyft drivers take advantage of rock-bottom lease prices.

🚁 Joby has partnered with Virgin Atlantic to launch an air taxi network in the UK. Joby’s rival, Archer Aviation, has similar deals with United and Southwest.

DEEP DIVE: IT’S BATTERIES VERSUS THE SHARKS, AND THE BATTERIES ARE WINNING*

As we decarbonize our transportation system, two heuristics around vehicles come up time and again:

Smaller vehicles (e.g., bikes, cars) go electric before larger vehicles (e.g., trucks)

Surface vehicles (e.g., cars) go electric before maritime and aviation**

In Volume 29 of this newsletter, the Deep Dive looked into The Big Picture on Maritime Decarbonization. What’s been impressive since then is the degree to which large boats, namely ferries, have been going electric. This has come down to two key factors: policy leadership across markets to mandate that ferries go zero-emissions, and prolific innovation from both legacy players and startups.

While not widespread, mandates for ferries to go electric (or at least zero-emissions) are definitely a global phenomenon, with California, Norway and Singapore off to an early lead.

Deployment, however, has been much broader. There are now believed to be over 500 electric ferries in service globally. This summer, South America will see the launch of the world’s largest electric ferry, capable of carrying 2,100 passengers and 250 cars. And in less than two years, the first electric ferry service connecting Africa and Europe is due to launch, bringing electric ferries to every continent.

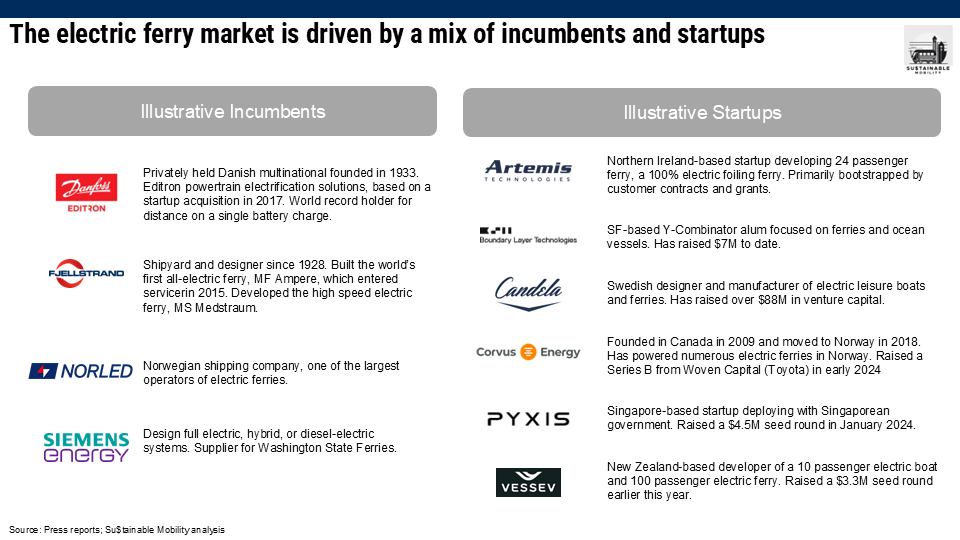

What’s still up for grabs is whether this market ends up being led by incumbents like Danfoss and Siemens or whether venture-backed startups ultimately win. As evidenced by Ola Electric’s challenges, legacy 2-wheeler manufacturing companies have caught up quite quickly to the electric era. On the other hand, BYD didn’t build its first car until 2005 and is now the EV king globally, ahead of the century-old incumbents.

Either way, I expect that venture funding in this sector increases over time as bets in technology (e.g., battery chemistry, hydro-foiling, embedded solar) and business models (e.g., vehicle-to-grid monetization) continue to abound.

*For further background on the batteries versus sharks battle, Google is your friend

**With the caveat that the long-term outlook for large maritime and aviation is still unclear

Have you heard about Navier? It's surprising that you haven't mentioned it, as it should be at the top of this list! I'm curious about your judgment and how you came to your conclusions while overlooking such an important piece of information about the future of American marine transportation