This newsletter aims to separate the signal from the noise for making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

Be sure to check out episode 13 of The #CitiesFirst Podcast featuring Jerome Horne.

This week’s Deep Dive is whether Amazon, Microsoft, Meta, and TomTom are Teaming Up to Try to Dethrone Google Maps.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Charge (OVH) (California, USA): Software to manage grid and vehicle interactions

EVLUV (California, USA): EV charging scheduling software

KB Powertrain (California, USA): Manufacturer of e-drivelines for commercial vehicles

New Day Hydrogen (California, USA): On-site hydrogen fuel generation for fleets

SiriNor (Norway): Zero-emissions engines for aviation

TekTracking (New York, USA): Digital monitoring solutions to improve rail network performance

WideSense (California, USA): EV fleet management software

Yank Technologies (New York, USA): Wireless charging and wireless power solutions

💰FUNDING: Capital raises from startups previously featured in Startup Watch

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🇮🇱 Tel Aviv opened its first metro line. Better late than never!

🚇 Boston hackers figured out how to get infinite free subway rides 15 years ago, and improved upon it more recently. This time around, Boston transit authorities have welcomed the findings.

🤖 Robotaxis are all over the news this summer in San Francisco. Citizen frustrations frequently echo those originally leveled at horseless carriages.

👨🦽Cambridge, Massachusetts authorized sidewalk EV charging using a mat to cover the charging cord. This is a big step forward given the need to be compliant with the Americans with Disabilities Act.

💸 Colorado is launching one of the biggest e-bike rebates in the nation. What started in Denver is scaling everywhere.

🔋 Caltrain is piloting the first train using electric and battery power. The batteries allow the trains to run on both electrified and non-electrified tracks.

🇫🇷 France is raising taxes on flights to pay for trains. France continues to be one of the most aggressive countries in trying to suppress intra-country air travel and promote rail instead.

🇩🇪 Germany’s 49 EUR per month transit pass looks like a huge success. New customers are using the plan to take regional vacations by rail.

💧The US Treasury missed its deadline to clarify Inflation Reduction Act guidelines for green hydrogen tax credits. Only 1% of hydrogen production today uses fossil-fuel-free methods; whether other methods will qualify is the subject of much debate.

🌆 A group of Silicon Valley investors appears to have purchased enough land to build a highly walkable city on the edge of the Bay Area. Part of the moonshot here will be getting the land rezoned for residential use.

🔬Markets & Research

🚌 American school districts are buckling under a nationwide bus driver shortage. Impacts include canceled classes.

🏭 Corporates & Later Stage

🥊 United Auto Workers (UAW) members have authorized a strike against GM, Ford and Stellantis. Reminder: it takes many fewer workers to build an EV than it does to build an internal combustion engine car.

💰 The UAW won wage increases for GM’s Ultium battery plant. Many North American battery plants are JVs between car manufacturers and Asian battery giants; whether the UAW will represent these workers is an open question.

🍔 Tesla won approval in LA for a combined diner, drive-in, and supercharger experience. This integrated model might prompt existing retail operators to take their EV charging experiences more seriously.

🚐 Amtrak rolled out its first electric bus. The rail operator uses bus lines for connecting routes.

⛴️ Cargill is testing wind power on ocean-going vessels. It’s like the 15th century all over again.

🐣 Startups & Early Stage

🚛 US micromobility manufacturer ElectraMeccanica aims to merge with London-based EV truck maker Tevva. An odd pairing, but the Inflation Reduction Act production incentives and ElectraMeccanica’s Arizona factory make for an attractive combo.

🚍 American EV bus manufacturer Proterra went bankrupt. This is a loss for the US, as many other major players in the market are European, Canadian, or Chinese.

🇻🇳 Vinfast went public via SPAC and is now worth more than many legacy car companies. Only 1% of Vinfast shares are publicly traded, which distorts the real picture.

DEEP DIVE: Why Are Amazon and Microsoft Teaming Up Against Google Maps?

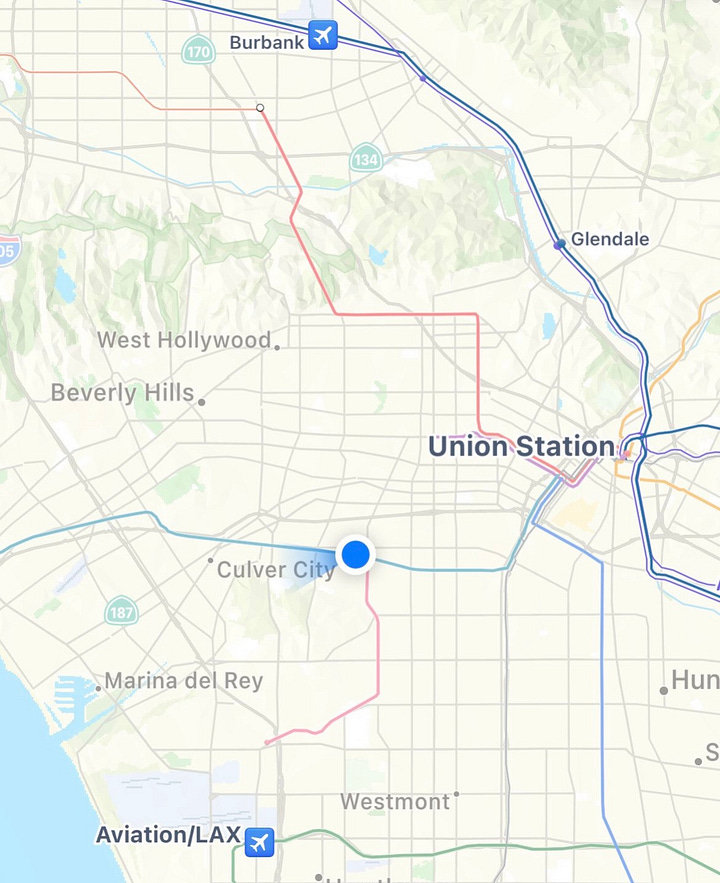

Maps have been one of the cornerstones of mobility for centuries. And then they took a giant leap forward in the digital era. Digital natives might be surprised that Americans used to telephone AAA to generate custom, spiral-bound TripTik map booklets ahead of major road trips. In our smartphone era, we replaced TripTiks with Google Maps and the runner-up, Apple Maps.

Putting those two in the same bucket, however, is a bit unfair. Apple Maps is effectively a consumer-facing app, while Google Maps is a B2B behemoth selling data to startups and corporates alike. While Google doesn’t break out Maps revenue, analysts estimate that it generates roughly $11B in revenue per year. Much of that comes from other software developers who pay fees for data access, whether for routing for self-driving cars or determining hyperlocal advertising needs.

Google places a lot of restrictions on that map data. You don’t, for example, get the underlying data from Google; you’re just renting access. For those who chafe under Google’s rules and hefty fees, there’s the open-source OpenStreetMap (OSM). In 2019, for example, Lyft dropped Google Maps as its primary source and adopted OSM. But as with any open-source project, the quality can be uneven.

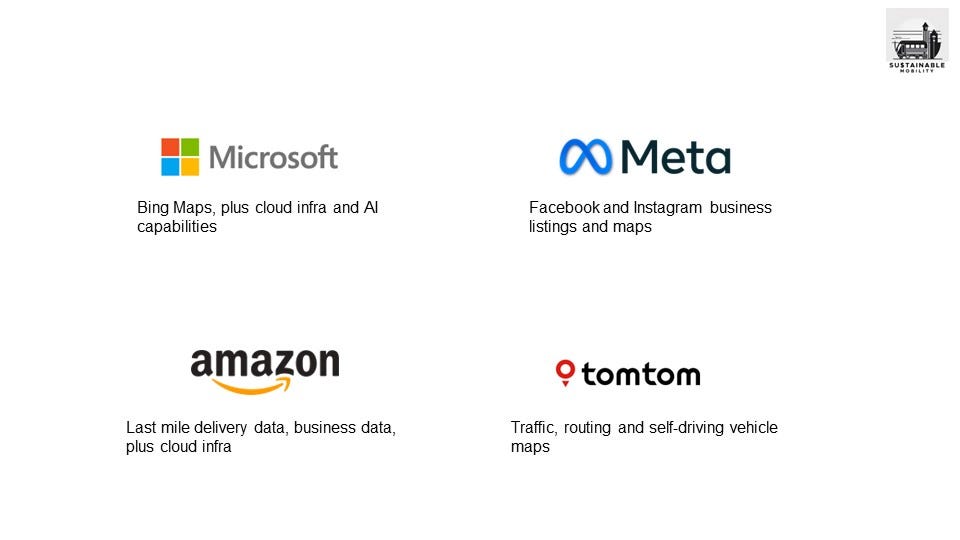

Enter Meta (Facebook), Microsoft, Amazon Web Services, and TomTom, who teamed up in 2022 to create Overture. Last month, Overture launched its first publicly available map set. In essence, Overture is building on top of dozens of sources (including OSM) to create a highly-vetted map based on the unique inputs of the 4 players. Maps aren’t core to Microsoft, Meta, and Amazon, but each of them needs maps and has unique, complementary data to add to the set.

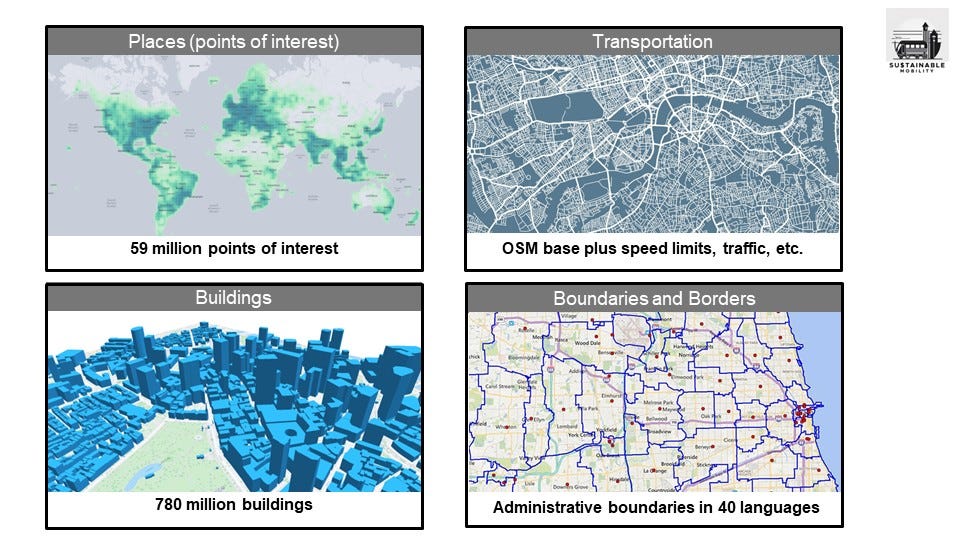

Overture features 4 unique data layers: places of interest, buildings, transportation, and administrative boundaries. And unlike Google, Overture will give customers actual access to the underlying data, allowing developers to build applications and modifications on top of it.

The next few years will dictate whether Overture has staying power as a genuine alternative to Google Maps. For now, any business, startup or corporate, that has needs on everything from vehicle routing and recharging to hyperlocal customer targeting has a genuine choice to make between Google Maps and Overture.