✈️ Su$tainable Mobility: Turbulence in the Race to Decarbonize the Skies

Vol 50

This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s Deep Dive is focused on the challenges in decarbonizing aviation.

There will be a mobility happy hour in Paris on March 13 and in Brussels on March 14; send me an email if you would like to join us. Also, feel free to submit startups & ideas for the newsletter here.

🌱STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

B2U Storage Solutions (California, USA): Energy storage solutions using second life EV batteries

Blooman Clean Energy (India): Olivine-structure lithium iron phosphate (LFP) cathodes

ELOOP (Austria): Tokenized EV car sharing and car subscriptions

Evenergi (Michigan, USA): Enterprise SaaS for managing zero emissions fleet transition

Evoqe Auto (Oregon, USA): EV subscription service

Ionic Mineral Technologies (Utah, USA): Drop-in, domestically-sourced nano-silicon to boost power capacity and charging speed for lithium-ion batteries

Minviro (United Kingdom): Lifecycle assessment software for sustainable mining applications

Shovels (California, USA): API software for building permit data, including EV charger installs

Upshift (Washington, USA): Marketplace to decarbonize heavy-duty trucking for shippers

Uze.Energy (Belgium): SparkCharge-like mobile charging network in Belgium

Zero Logistics (Canada): Zero-emissions same day delivery service for sustainable brands

💰FUNDING: Capital raises and updates from startups previously featured in Startup Watch

Voltpost (Vol 7) and BattGenie (Vol 12) were both accepted into Google for Startups Accelerator for Climate Change

itselectric (Vol 26) raised a $2.2M pre-seed round from Brooklyn Bridge Ventures and others; more here and here

Rolling Energy Resources (Vol 33) received an equity investment from Generac Power Systems (amount undisclosed)

📰QUICK HITS: Notable news from the last two weeks

New York City passed an e-bike battery safety law, following a spate of fires in apartment buildings; Congressman Richie Torres (D-NY) introduced a House bill mandating safety standards for e-bikes and e-scooters with lithium batteries. A good next step would be an e-bike rebate program a la Denver, prioritizing those who already bought e-bikes that will no longer be compliant with new regulations.

The European Union’s plan to ban sales of internal combustion engine (ICE) cars by 2035 hit a snag, with Germany belatedly piping up to offer up e-fuels as an alternative. There’s a wide gulf between the EU creating an exception for niche Porsche situations and giving all carmakers a get-out-jail-free card.

A new study reveals that vehicles with driver-assist technology may be less safe than vehicles without. Partial autonomy is fraught with human factors challenges, as inattentive drivers give the systems more credit than they deserve.

Deloitte shared research on the future of automotive mobility through 2035. This report is a great way to compare consumer attitudes about mobility in Europe versus the US.

On the Pacific Island of Nauru, the push for deep-sea mining continues in order to meet our battery appetite. Deep-sea mining is currently viewed as rogue behavior, so it’s worth keeping an eye on which actors advocate for it.

VW announced a new EV plant in South Carolina to build Scout SUVs. VW thoroughly evaluated going the contract manufacturing route before deciding on a greenfield site.

VW put a hold on plans for a battery plant in Europe to prioritize North America. Another data point for those who claim that the US Inflation Reduction Act’s “build here” requirements are stoking trade tensions between the US and the EU.

Tesla’s investor day to launch the Master Plan 3 was mostly a dud, capped off by a slight fall in the stock’s price. The plan was long on vision about the energy transition, but short on what role Tesla will play.

Tesla has launched its charging membership product for non-Tesla EV owners. Keep an eye on how many Supercharger sites ultimately accept non-Tesla drivers.

Redwood Materials shared data from one year’s worth of EV battery recycling. Unsurprisingly, Redwood claims that the best model avoids a singular non-profit Producer Responsibility Organization (PRO) for EV battery recycling.

The USPS pivoted again in its quest to secure electric vans, this time by procuring from Ford. The custom-designed Next Generation Delivery Vehicle (NGDV) from Oshkosh Defense is slow to scale production versus off-the-shelf electric vans.

Autonomous truck company Embark is shutting down, Rivian’s finances are underwhelming, Lordstown won’t build more trucks unless a new partner comes in, and some are questioning whether Tesla’s Cybertruck will be just a niche product. It’s a rough patch for the truck industry right now.

Someone launched a hydrogen-powered bike in China. This is as useful as a gasoline-powered Roomba.

Airlines are suing the Dutch government over flight caps at Amsterdam’s Schiphol airport. The airlines claim that the plan doesn’t reduce emissions but instead shifts them to other cities.

🤿DEEP DIVE: Turbulence in the Race to Decarbonize the Skies

If you’re looking at pollution per kilometer (mile) traveled, it’s hard to overlook aviation. UK data below, for example, shows the amplitude of the issue.

On the aggregate, aviation accounts for about 2.4% of global GHG emissions, on par with maritime; both fall under the “hard to decarbonize” category.

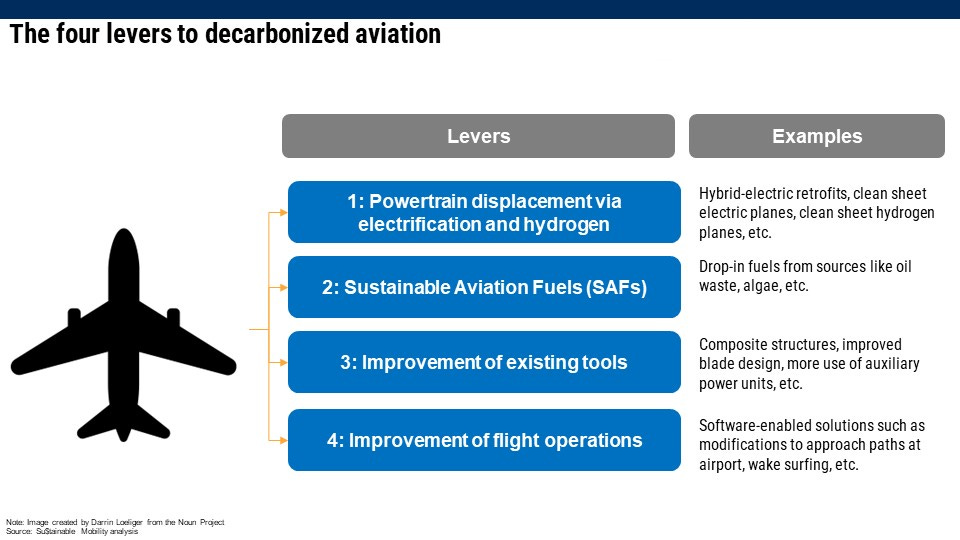

Looking to at the pathway to net zero aviation, the short answer is that there is no single clear approach. We must pursue each and every available lever. We have four levers, each of which includes a number of different technologies.

Powertrain displacement refers to either retrofitting existing planes or building clean sheet planes with a totally new electric powertrain, powered by batteries or hydrogen-powered fuel cells.

This past week, Universal Hydrogen made history with the maiden flight of its 40-person hydrogen-powered airplane. It was such a historic moment that the MIT Technology Review amended its 10 Breakthrough Technologies of the year with an 11th. Alas, hydrogen planes may never reach significant commercial scale, for any number of reasons, including the need for highly-specialized, capital-intensive equipment and the lack of sufficient green hydrogen volumes.

Electrification of aviation via batteries is seen as one of the best solutions for short-haul aviation, either via retrofits (full electrification and hybrid) as well as clean sheet designs. Expect the technology to become available for private jets and for short-haul commercial routes, especially in markets where the high-speed train isn’t a robust alternative.

Also, keep an eye out for eVTOL (electrical vertical takeoff and landing), essentially a personalized helicopter using electrical powertrain. While investors have plowed huge amounts of money into the technology, it’s not clear that it will equate to stainable mobility. Inducing people to take an air taxi instead of the metro from downtown to the airport may add to noise and space pollution and exacerbate social tensions. Hopefully some of the fundamental eVTOL technologies will find their way into electric planes.

Perhaps the biggest challenge deployment of the powertrain lever is Boeing. Combined, the Airbus and Boeing duopoly represents approximately 90% of the commercial jet market. The timing of our need to decarbonize couldn’t come worse for Boeing, which continues to suffer from a series of managerial mishaps. Boeing’s CEO David Calhoun surprised investors and staff by claiming that Boeing wouldn’t launch a new plane until mid next decade.

Sustainable aviation fuel (SAF) references liquid fuels that can be dropped in to existing infrastructure, either as a supplement to today’s jet fuel or as a complete replacement. Multiple generations of technology types have been pursued, from waste oils to algae-based solutions. It’s still early days, however, in finding solutions that are cost effective; SAF is currently two to four times as expensive as jet fuel. Moreover, solutions that have appeared cost effective in low volumes have been found to have devastating second-order effects at scale. Previous use of agriculture-derived biofuels, for example, have been linked to food riots in emerging markets. Deploying SAF at scale requires airlines to be comfortable with their decarbonization destiny linked to that of agriculture or biotech.

Airlines, airports and plane manufacturers continue to push for optimization of existing tools as a near-term solution. GE and Safran, for example, have teamed up for an open-fan engine program called RISE. Airports and airlines continue to leverage ground handling equipment to reduce emissions generated while the aircraft is parked at the ramp. For this lever, keep an eye on which technologies are viable for retrofits and which require, say, integration into the new Boeing mid-next decade. There’s any number of technologies that save fuel (e.g., replacing heavy hydraulic systems in planes with lighter electronic controls), but only make sense to implement at the point of manufacturing.

Finally, manufacturers, airlines and airports continue to experiment with the improvement of flight operations, making sure that each second of flight time is optimized for cost and therefore emissions. For example, wake-surfing technology allows one aircraft to flying within the updraft created by another aircraft. Alas, in the US progress may be held back for some of these technologies by a woefully outdated FAA infrastructure.

Each of these 4 levers needs to be applied and, even then, will likely not be enough to reach our net zero goals. For those looking for big rewards and massive climate impact, the aviation industry is anxiously awaiting further solutions from technology-minded founders.