This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

I had the chance to speak at CES last week about investments in the sustainability of transportation in Vegas alongside Valeo CEO Christophe Périllat and journalist Jason Stein. A great show and experience all around. Also, I’m planning on being at the Bloomberg New Energy Finance Summit in SF on Jan 30-31. Let me know if you’ll be there.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

AlkaLi Labs (California, USA): Biological processes for sustainable mining of lithium

Autonomo (California, USA): In-vehicle payments ecosystem including EV charging

bettersea (Portugal): Maritime decarbonization software

C+UP (Illinois, USA): Carbon capture and utilization to create sustainable propane as a non-fossil renewable fuel

DG Matrix (North Carolina, USA): Compact EV chargers and microgrid technologies

Diolko (Malaysia): Sustainable last-mile delivery network

EVbots (Pennsylvania, USA): Electric, autonomous EV charging via robots

Rightcharge (United Kingdom): Consumer-facing EV charging install platform

Terminus Technologies (United Kingdom): Urban data mining for better traffic management

Watt4Ever (Belgium): Battery 2nd life process

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Electra (Vol 5) raised a 304M EUR Series B from Bpifrance, PGGM, Eurazeo, and others. It is the first known unicorn in the data set.

Recurrent (Vol 12) raised a $16M Series A from ArcTern, Automotive Ventures, Goodyear Ventures, Wireframe Ventures, Pioneer Square Labs, and others

Temo (Vol 21) raised a $6.5M Series A from At One Ventures, Bpifrance, and Blueprint Partners

Alt Mobility (Vol 26) raised a $6M round from EV2 Ventures, Shell Ventures, Eurazeo, and others

GigEasy (Vol 61) raised a $1.3M pre-seed round from Zeal Capital Partners, BBFI Fund, Bain Capital Ventures, GoAhead Ventures, Cap Table Coalition, and others

Project K (Vol 61) secured a grant advance from Enduring Planet for their $2.6M ARPA-E grant

Not yet a subscriber?

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🇸🇳 Dakar has launched sub-Saharan Africa’s first electric bus rapid transit system. Senegal continues to be a leader in sustainable transportation in West Africa, especially with the launch of a Regional Express Train in 2021.

🍑Atlanta has launched a $1.5-$2K e-bike rebate program for residents. Yet another city that was inspired by Denver’s initial e-bike program.

🚛Los Angeles Cleantech Incubator (LACI) is leading a coalition of 9 American cities to plan and test solutions for zero-emissions delivery. There’s strength in numbers.

🌁California State Senator Aisha Wahab announced a new bill, SB 397, calling on the state to build a plan to merge the public transportation agencies across the nine Bay Area counties. If there’s ever a time to consider big transit ideas for the Bay Area, now is it.

🌴California’s new budget proposes a 7% cut to climate funding, but leaves public transit money mostly intact. This saves many transit agencies from their fiscal cliff.

🧩 California Forever, the billionaire-backed approach to build a walkable city in Solano County from the ground up, wants to put its project in front of voters this year. While not car-free, interior neighborhood streets are designed to be free of most automobile through traffic. To sweeten the deal, they’re making at least $700M in funding promises to voters.

🇪🇺 The European Union, after leadership from the Netherlands, Belgium, Denmark, and Luxembourg, has agreed to a 2040 phase-out of almost all diesel heavy-duty truck sales. California and the EU are now both on the 2036-2040 phaseout timeline.

🔬Markets & Research

🛺 The United Nations has launched a great new dataset covering the manufacturing of two- and three-wheelers in emerging markets. Don’t sleep on how quickly the global south is pivoting towards electric mobility for smaller form factors.

Enjoying this issue? Share it with 3 people…

🏭 Corporates & Later Stage

📉Hertz is booking a $245M loss as it unloads about 20% of its Tesla fleet. Three truths: 1) Hertz hasn’t been a stable company for quite some time and rushed into renting EVs to ridehail drivers before it understood the market, 2) Tesla’s frequent price changes did Hertz no favors on the residual value front and 3) Tesla’s lack of a real fleet mentality, including parts discounts, also didn’t help.

🤔Elon Musk is pushing for a new comp package at Tesla to master AI. Publicly available information isn’t giving us the full story because there’s little about Musk’s statements on this that makes sense.

↪️Yamaha launched a battery swap business for micromobility in Germany. Europe, like North America, has been a laggard in micromobility battery swap so far.

🛬After grounding almost over 170 Boeing 737 Max planes, the FAA has inspected more than 40 to see whether they’re flight worthy. The long, troubled history of the 737 Max program puts our aviation decarbonization goals at risk. Long-haul aviation is a duopoly between Boeing and Airbus; if Boeing has a lost decade or two, it lowers the competitive pressure on Airbus to drive innovative approaches to decarbonization.

🐣 Startups & Early Stage

🇻🇳 VinFast, having failed so far to generate excitement for its EVs in the US, is turning its attention back to Southeast Asia. VinFast’s reason to win in EVs is still unclear.

🧑🏽💻German startup Vay launched its remotely driven car service in Las Vegas. An interesting alternative in the field of autonomy.

🚛ElectraMeccanica, having failed to merge with London-based EV truck maker Tevva, is merging with Xos, the Los Angeles-based EV truck maker. Xos stock jumped 18% on the news that it would get access to ElectraMeccanica’s cash pile.

🛴German micromobility provider Tier merged with Dutch-French provider Dott to create a European champion. The move is a loss for Sweden’s Voi, which was rumored to have been courting Tier.

🅿️Startup Oonee, in partnership with Jersey City, created America’s first municipal secure bike parking & charging system. Very cool.

🚁Electric air taxi maker Joby disagrees with the electric aviation industry about the consensus charging standard. Tesla swam against the current on the charging standard in North America and won. Whether Joby is the Tesla of electric aviation is much less certain.

⛴️Stripe is partnering with Navier to deploy electric ferries in the Bay Area. Longer term, Naiver hopes to go autonomous.

🚋The Federal Railroad Administration is seeking public comments on the test of Parallel Systems autonomous, battery-electric freight cars. Another example of SpaceX alums doing cool decarbonization work in mobility.

If you are enjoying this issue, please share with 3 people in your network.

DEEP DIVE: Are High-Speed Trains Coming to America?

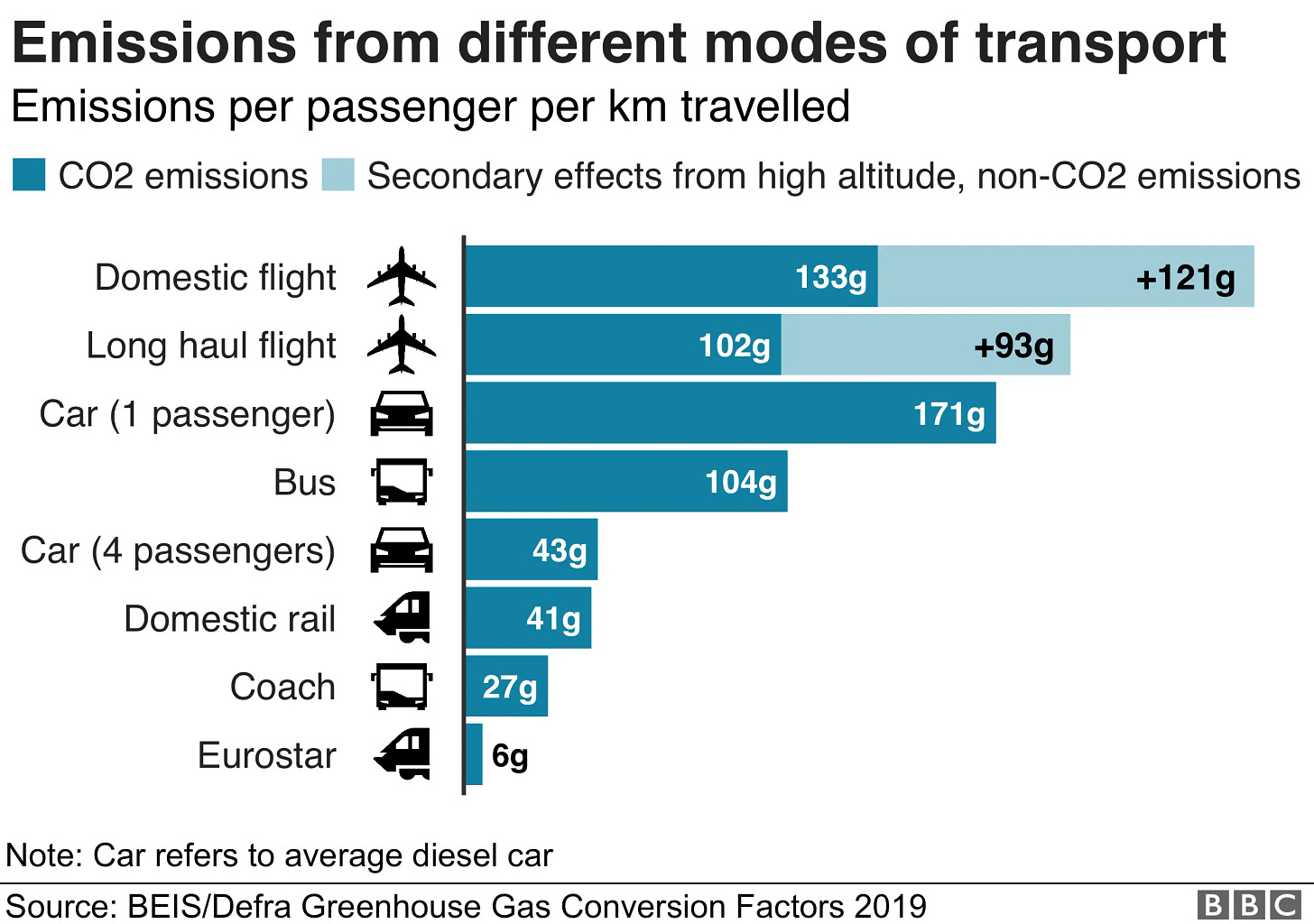

In May 2023, France enacted a ban on domestic flight routes that can be traveled by direct train in less than two and a half hours. The move wasn’t without controversy, including the objections of corporate heavyweight Air France. But the French administration justified the ban to meet climate goals: air travel is highly polluting per mile traveled and hasn’t begun to decarbonize.

At the same time, the ban isn’t a tremendous sacrifice for the French public. France, like many European countries, has a high-performing, profitable domestic player (SNCF) ready to pick up the slack with high-speed rail operations.

It’s quite a different story in the US. While SNCF generates about over $40B a year in revenue, its American counterpart Amtrak is closer to $2B. This says a lot more about the US than it does about France. China had 2.29 billion high-speed rail trips in 2019, Spain leveraged EU funding to create Europe’s most efficient high-speed network, and Morocco’s high-speed rail served 2.4 million riders in 2021.

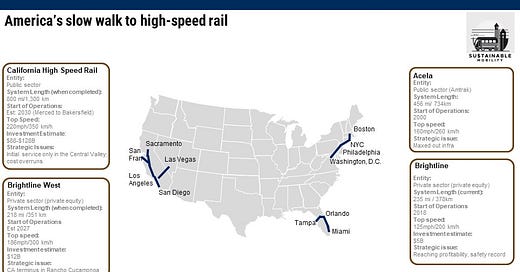

Note: the exact definition of high-speed rail varies, but many use the notion of purpose-built rail lines meant to handle speeds above 250 km/h (155 mph) or upgraded rail lines meant to handle at least 200 km/h (124 mph).

Anglophone countries like the US, Canada, the UK, and Australia have largely sat the high-speed rail revolution out. In the US, that’s been driven by a bias towards private rail ownership and an industrial policy prioritizing rails for freight.

America’s historical attempt at high-speed rail, Acela, launched in 2000. Not only is it the most profitable route in the Amtrak system, Acela has captured about 54% of the combined train and air market for New York-Boston. That’s huge climate impact.

But Acela has limitations. It’s far from the most advanced high-speed rail systems in the world: Acela tops out at 260 kilometers per hour (160mph) while Chinese trains reach a max speed of 350km/h. And unless the US learns how to cost-effectively do infrastructure upgrades in the oldest, most crowded corridor in the country, it’s reached its potential.

The turning point for high-speed rail in the US may have been Q4, 2023. While the country will never have a robust national network like Japan, signs towards the end of last year showed that high-speed rail is ready for a mini-boom in the rest of US.

Private rail line operator Brightline launched Miami-Orlando high-speed service in late September 2023. The two cities currently have 401 direct flights per week, so keep an eye out for a reduction in air travel à la Acela’s impact on Boston-NYC. While just barely high-speed, the solution is enticing enough that cities like Tampa are clamoring to host a station.

Then in December 2023, the Biden administration approved $6B in financial support for two high-speed rail projects in California. Brightline will get $3B to help fund its Vegas-to-almost-LA route and the state will get $3B for its ambitious attempt at true international-style high-speed rail connecting LA to San Francisco in 2 hours and 40 minutes. Again, the potential for a reduction in LA-Vegas and LA-SF flights could be a major climate lever if we don’t rapidly decarbonize short-haul aviation.

And if both projects somehow end up reaching Union Station in Los Angeles, we can start making the case for an actual high-speed rail network as opposed to just point-to-point connections.

These projects have each been messy in ways that would make European and Asian operators frankly embarrassed. So let’s hope that the sausage making results in what we need: city pairings that can eventually drive both profitable high-speed train operations and lower carbon intensity of travel. We’re going to need all the help we can get.

Not yet a subscriber?