This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

I’m excited to share that I’ve recently joined Virta Ventures as an Advisor. Virta Ventures invests in companies enabling the rapid decarbonization of energy, mobility, agriculture and the built environment. I’ve already been a co-investor with Virta in Plug and am excited about working with Virta’s GP Russell Sprole to invest in pre-seed, asset-light startups that can help us decarbonize the world.

In this week’s Deep Dive, we’ll analyze the growing crop of Tesla and SpaceX alums who are founding the winning climate tech companies of our era. Like the “PayPal mafia” of the 2000’s, and Google/Facebook alums in the 2010s, the 2020s may be defined by a crop of Tesla and SpaceX alums who frequently choose to focus on climate innovation. Scroll down for the full graphics.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

dustmoto (Oregon, USA): Manufacturer of electric motorcycles

EDRV (California, USA): API platform for the EV charging ecosystem

Fleet Robotics (Massachusetts, USA): Autonomous robots for cleaning hulls, reducing maritime fuel consumption

General Galactic (California, USA): Carbon-neutral fuels

Glid Rail (California, USA): Autonomous intermodal cargo trains

Mortar IO (United Kingdom): Building retrofit simulation software, including for EV charging infra

Novus Bike (Germany): Manufacturer of premium electric motorcycles

Recharged (Virginia, USA): Used EV marketplace

Sirius Technologies (Netherlands): Sustainability data layer for the metals supply chain

SunTrain (California, USA): Transporting high-capacity batteries via rail to load centers

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Deftpower (Vol 45) raised additional funding from 4impact capital, Proeza Capital, Twickelborg, Cosmic Cat, Rethink Ventures, and Koolen Industries

Crux Climate (Vol 53) raised an $18.2M Series A from Andreessen Horowitz, Lowercarbon Capital, Overture VC, and New System Ventures

Kwest (Vol 63) was acquired by Octopus Energy; this is the 10th exit in the database

As a reminder, the startup data set is open, for free to subscribers. If you’re a subscriber interested in accessing the Airtable with how these startups raised $1.7 billion in follow-on funding, please let me know.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🇰🇷 Seoul is piloting an all-in-one “Climate Card” with unlimited access to transport. Subways, buses, trains, and bikeshare all in one app, with one monthly subscription.

🏕️ Minnesota lawmakers are introducing legislation to ban parking minimums statewide. This would be the first nationwide ban I’m aware of.

🛣️ California State Senator Scott Weiner has introduced legislation requiring new cars to have a speed governor preventing drivers from exceeding a road’s speed limit by more than 10 miles an hour. Speed governors are technologically feasible and something that’s been expected from scooter companies.

🇪🇹 The government of Ethiopia took a giant step by announcing a ban on the import of gasoline-powered cars. Not in 2035, but now. More details will come, but this is worth keeping an eye on.

🚢 The Panama Canal has hired its first Chief Sustainability Officer. With a drought forcing a 40% reduction in shipping traffic, expect the Canal to focus both on maintaining water supply levels and reducing emissions from ships.

🚴♀️ A bill in the US Congress may establish federal safety standards for e-bike batteries. Prompted by a series of fires in NYC apartment buildings from low-quality e-bike batteries, members of both houses of Congress from New York State are leading the charge for improved safety.

🔬Markets & Research

📈 📉While overall emissions in the US dropped 1.9% last year, transportation emissions (the biggest contributor) rose 1.6%. The power sector sector continues its impressive decarbonization path.

🧑🏽💻 ARPA-I, the new US DOT research arm focused on infrastructure, has launched a summary of findings from its first RFI. Lots of focus here on digital infrastructure, including the potential for artificial intelligence to optimize freight routes, carrier/shipper matching, traffic flow optimization, pedestrian and vulnerable road user detection, and automated infrastructure inspection.

🏢 A new study looks at the relationship between land use policy and support for transportation taxes. Conclusion: you need housing density first, and then support for transportation policies comes second.

🔌 The ICCT has a new study on the European EV market in 2021 and 2022. The words “BYD” show up twice in the 44-page document versus 47 times for “Fiat.” Look for more mentions next time around.

🇪🇺 ACEA released its 2023 European vehicle sales results. With almost 50% plug-in penetration in 2023 car sales, Belgium is on the path to becoming the next Norway. Belgium’s perverse employer tax incentive rules are suddenly a strategic lever for electrification.

🚛 Calstart analyzed the US heavy-duty EV trucking market. They’re only at .14% penetration of the overall heavy duty-truck fleet, but poised to shift just like passenger cars did.

Enjoying this issue? Share it with 3 people…

🏭 Corporates & Later Stage

🤯 A judge has voided Elon Musk’s Tesla comp program. This could change the trajectory of Tesla over the next decade, as the board, shareholders, and Musk decide how to react. It’s hard to imagine Tesla without Musk, but no longer impossible.

🥱 Tesla underwhelmed the markets with its Q4 results. Tesla deliveries grew 38% last year while BYD grew at over 60%. Tesla predicts lower growth this year, so relief may not come until 2025 at the earliest, when a new, lower-cost Tesla is due to arrive.

🍎 Apple has delayed the launch of its EV to 2028. Apple has massively scaled back its ambition for the vehicle’s self-driving capabilities. Without a breakthrough in autonomy, the car is going to have to rely on something else to justify why Apple needs to enter the market.

🤔 Toyota Chairman Akio Toyoda predicts the car market will peak at 30% EV penetration. A bold statement when S&P sees EV sales growing ~40% this year for a 16% global penetration.

😳 GM’s Cruise problems are going from bad to worse. With both active DOJ and SEC investigations, execs in GM’s Detroit HQ must be seriously rethinking how much autonomy Cruise execs in San Francisco are given.

🔌 Daimler, Volvo Trucks, and VW’s Navistar unit have created a consortium focused on heavy-duty charging infrastructure in the US. Tesla has agreed to the same charging standard as the legacy players, but whether it wants to play nice with the Swedes and Germans is still to be determined.

🤝 Uber is teaming up with Tesla to get more drivers into EVs via data sharing and purchase incentives. Uber hasn’t cracked this one yet, but has to in order to maintain its social license to operate.

↘️ Brightline has lowered its forecast for 2024 ridership. Nobody ever said it would be easy to run private passenger rail in the US.

🐣 Startups & Early Stage

🚴♀️E-bike ownership app Tempo* (Vol 56) has launched its consumer app. Think maintenance & repair, AAA, etc. for e-bike owners. Newsletter readers can get $25 off an annual membership using promo code SUSTAINABLE.

🔌 XCharge, a Chinese manufacturer of EV fast chargers, filed for a $50m IPO. This may be a comp for leaders in the US like FreeWire.

If you are enjoying this issue, please share with 3 people in your network.

DEEP DIVE: Teslarati and X SpaceX, 2024 Climate Founders Edition

In the early 2000s, Silicon Valley became obsessed with the “PayPal mafia,” a group of former PayPal executives (including Elon Musk) who went on to become successful founders. By the 2010s, former Google and Facebook founders became the go-to founders to watch.

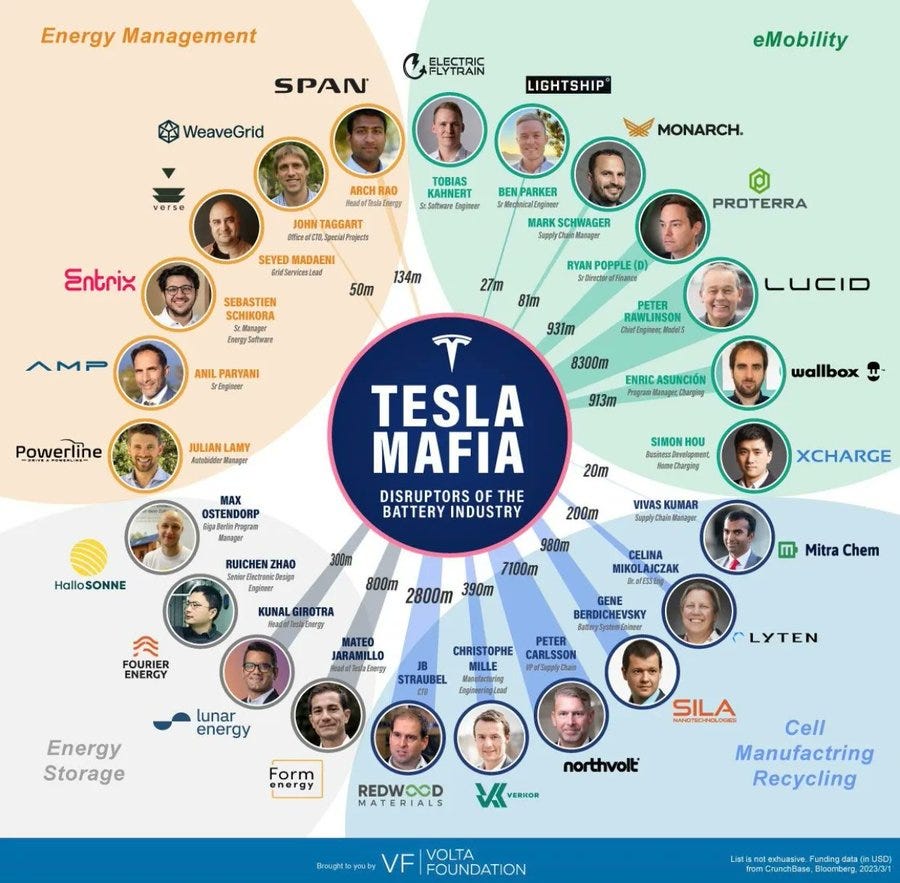

As the 2020s progress, it’s clear that the founders to watch, particularly in climate tech, are those from Tesla and SpaceX. The excellent folks at Volta Foundation put together this fantastic graphic last year on the importance of Tesla founders just in the battery economy.

One year later, what's striking is how quickly a new crop of former Tesla and SpaceX founders are gaining traction, well beyond just the battery ecosystem. What makes Tesla and SpaceX founders prewired to succeed in the climate startup space?

Skills: They’re some of the few to have massively and profitably scaled hardware in the climate and transportation space. At the same time, both companies are past their highest growth eras, meaning there’s diminishing marginal benefit to sticking around for too much longer.

Beliefs: They’re genuinely climate motivated. And many are growing increasingly concerned about how their reputations might be impacted by Elon Musk’s embrace of online trolling this decade.

Finances: Both stocks are tradeable (Tesla on the public markets, SpaceX via secondary markets), meaning would-be founders can cash in their shareholdings to help get them through the first few lean years of startup life.

So who are the X SpaceX founders in the climate space? Note: We’re defining climate tech here as having a targeted impact on GHG, air quality, or waste here on Earth. We’re including anyone who was employed at SpaceX except for internships. None of these founders are aiming squarely at their former boss, but instead taking on harder-to-decarbonize sectors such as rail and maritime. One of the most notable takeaways of this family tree is on the gender front: Sadly, not a woman founder in sight, driven by SpaceX itself being 86% male employees.

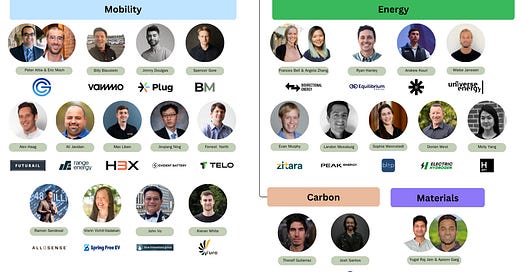

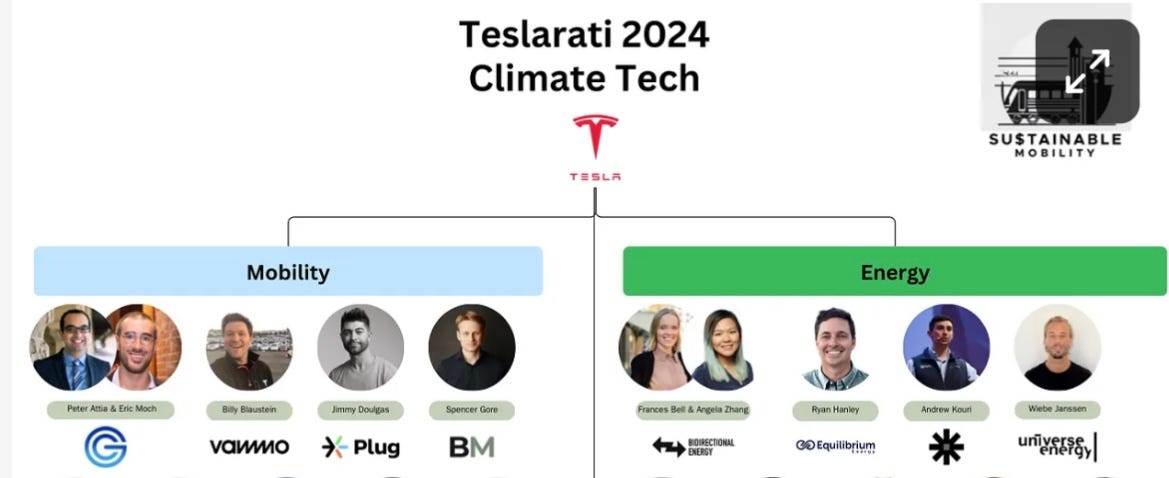

And what about the Telsarati founders in the climate space? Note: We’re applying the same rules as above, as well as excluding anyone who already made the Volta Foundation list last year. Note that there are any number of companies founded by Tesla alums that are climate adjacent like Manaflex, doing flexible circuitry for electronics, and Sibros, doing connected vehicle work.

The Tesla founders are prolific and, as could be expected, none are working on launching a full-line EV car maker to compete with Tesla. Instead, they’re working on everything from decarbonization of heavy-duty trucking (Range Energy) to micromobility (Vammo), as well as making the value chain more efficient on everything from vehicle financing (Spring Free EV) to used EVs (Plug*).

As the decade progresses, look for this family tree to become ever larger, as seasoned leaders at Tesla and SpaceX choose to leave and as some of the enterprises above become large enough branches on the tree to spur their own founder alumni clans.

Special thanks to newsletter readers who contributed to refining this list: Hayley Nystrom of Blue Bear Capital, Laura Fox of Streetlife Ventures, Hillel Zand of Maniv Mobility, Dan Ratliff of Fontinalis Partners, Rodolfo Elias Dieck of Proeza Ventures, and Teslarati superstars Charlotte MacAusland, Jimmy Douglas, Billy Blaustein, Sachin Seth, and Daniel Wohl. Additional thanks to Yen Yeh and the Volta Foundation for the 2023 list.

*Disclosure: I am an investor in Plug and Tempo.

Not yet a subscriber?

Thanks for sharing!

This is fascinating. I was planning a LinkedIn post abt this topic of talent attracts talent.