This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s Deep Dive is focused on Foxconn, better known as the contract manufacturer of choice for Apple’s iPhone. In a very short period, it’s acquired the ingredients to be a kingmaker in the EV space with more power than, say, Ford or Nissan.

Also, I’ll be at the Bloomberg (BNEF) Summit in San Francisco on Jan 30 and 31. Reach out if you will be there as well.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🧪eLyte (Massachusetts, USA): Lithium-metal battery chemistry

🔌Fulle (Australia): Charging + battery intelligence for micromobility

🧪 Theion (Germany): Quasi-solid state lithium/sulfur and silicon/sulfur batteries

🤳🏽Tram Global (Massachusetts, USA): Mobility aggregator using tokens to incentivize low carbon transportation by Ryan Chin (founder of Optimus Ride)

QUICK HITS: Notable news from the last two weeks

🚲 Delhi is planning to launch an e-bike/e-scooter network. The 2,500 fleet would make it about one-tenth the size of today’s NYC Citi Bike operation.

🛴 In Paris, Mayor Anne Hidalgo will allow voters to decide whether to continue with free-floating e-scooters or not. Hidalgo is against the scooters, but will follow the will of the voters.

🚄 Paris and Berlin are teaming up for direct high-speed rail service next year. A good reminder that better high-speed rail is a question of political will.

🅿️ Amsterdam launches an underwater garage for 7,000 bikes. A good reminder that better bike infrastructure is a question of political will.

👌🏾In New York City, Uber and Lyft will be required to go zero-emissions by 2030. This complements California’s existing law for 2030; expect many states and cities to follow suit.

👮♂️ In Orange County, California e-bikes are menacing beach goers. This is one of the first times I’ve seen local road rules differ between traditional bikes and e-bikes.

🛺 3-wheelers in Thailand and Kenya are rapidly going electric. In Africa, South Asia Southeast Asia, the 3-wheeler will tip towards zero-emissions much faster than the 4-wheeler.

🇳🇱🇧🇪🇩🇰🇱🇺The Netherlands, Belgium, Denmark and Luxembourg are proposing that the EU phase out sales of fossil-fuel powered heavy duty trucks and buses. It’s going to be hard to get Eastern Europe nations behind this.

🇪🇺The European Union (EU) is still itching to counter the US Inflation Reduction Act with its own protectionist measures. Read volume 41 to see why trade friction is inevitable in the EV arena for the next decade.

🤦🏽♀️The Guardian ran an article with a 1,000x error about lithium shortages for EVs. Alas, the correction was seen by only a fraction of the people who saw the original.

🪦Britishvolt went belly up, though someone may buy the assets. The UK used to have a car manufacturing base to rival Germany and France; those days are now gone.

🛠️US Senator Joe Manchin continues to throw a wrench in the EV tax credit plan. Consumers are justifiably confused whether their imminent EV purchases qualify.

🌅Akio Toyoda stepped down as CEO of Toyota. This leadership change increases the likelihood that Toyota embraces EVs. For example, the rumor mill suggests that Toyota might (gasp) adopt a dedicated EV platform.

🐚Shell acquired the Volta charging network in the US, which follows Shell’s 2019 acquisition of Greenlots. Shell picked up Volta for $169M, a far cry from Volta’s $2B 2021 SPAC valuation.

🌆Hertz and BP Pulse announce public private partnership for EV charging infrastructure in Denver. Expect Uber and Lyft to be key clients as they try to hit mandates in places like California and NYC.

🪙In related news, Uber drivers in the US are still struggling to get by financially. While driver pay is highly variable, car payments are usually fixed, which can wreak havoc on drivers’ finances.

🚕Uber claims to be working with automakers to custom design EVs. See below for why Foxconn might win the business instead of Ford or Stellantis.

DEEP DIVE: The Fox(conn) is Guarding the Henhouse

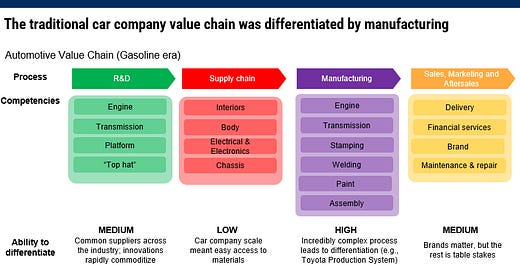

It’s insanely hard to launch a car company. In the second half of the 20th century, for example, only one notable success story emerged with South Korea’s Hyundai. This isn’t to stay that many didn’t try, whether at the premium end (remember DeLorean?) or mainstream (remember Yugo?). The barriers to entry are legendary even if you have several billion dollars on hand. Most importantly, manufacturing served as the key differentiator.

In the EV world, however, certain processes become much more complex and others became much simpler. A gasoline car engine might involve 2,000 moving parts and weigh ~150 kg/330 lbs. An EV motor, on the other hand, could be less than 20 moving parts and weigh 32 kg/70 lbs.

Given these additions and subtractions, the car-making business moves from a manufacturing-defined business to a software-defined business. Software, indeed, is eating the world.

What Foxconn has decided to do about this is revolutionary. You may know Foxconn (or its official name Hon Hai Precision Industry) as the contract manufacturer of choice for Apple’s iPhone. Contract manufacturing in the auto industry isn’t new; I touched on the historical practice of contract manufacturing by firms like Magna in volume 4.

Over the last two years, Foxconn has moved with lightning speed to vastly outpace Magna in scope and business model. And that’s without taking into account that the last few years have been rife with supply chain disruptions in chips and batteries. No battery or chip supplier wants to be on the bad side of Foxconn given their all-important role in manufacturing consumer electronics.

This should be a code red for legacy car manufacturers, as the threat posed by Foxconn is existential.

For legacy automakers, Foxconn is a doubly concerning:

It dramatically raises the chances of success for the next emerging automaker. At this stage, a car company can built with a powerful brand, excellent software, and a solid distribution plan. The rest can be outsourced to Foxconn. In addition to startups, think established companies like Amazon, Nintendo, Samsung, and Home Depot.

It dramatically raises the likelihood that major fleet customers will defect from major automakers. Fleet buyers such as cabs, pharmaceutical sales reps, and last mile delivery services are brand indifferent; they care about total cost of ownership and reliability. Why, after all, should a taxi operator in Chicago opt for the Ford brand if Foxconn is offering a private label solution at a lower cost? Foxconn is likely to be more flexible with product customization than the legacy automakers who fear potential brand dilution.

Most OEM’s are sleeping on the Foxconn risk like they slept on the Tesla risk a decade ago. And we all know how that one turned out. Time to wake up.

Is the early days of the industry there were coach builders who put a body on a drive train from another manufacturer. Reading and Morgan do this today for trucks. See https://jbpoindexter.com/ REE https://ree.auto/ is attempting to sell a sled to other companies who will put a body on top of the sled. Could Foxcon become the maker of the complex capital intensive parts that allows others to make bodies and interiors that are suited to local tastes? Could Foxcon create an infrastructure that allows others to innovate without building expensive manufacturing operations?