⛴ Su$tainable Mobility, Volume 29

This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s issue features a Deep Dive on The Big Picture on Maritime Decarbonization.

➡️ On June 21st, I’ll be co-hosting a webinar with A2Mac1 on EV Secrets for Startups and Investors. Register here. More information at the bottom of the email.

QUICK HITS: Notable news from the last 2 weeks

👍🏼 Corporates make big green commodities pledge in Davos. This First Movers Coalition is a small but very significant step in demonstrating the market demand for green steel and green aluminum. Knowing that Ford and Volvo Group are committed to minimum purchases should help make a lot more ideas venture fundable.

🛣 Paris is going on a highway diet. A good idea for most cities.

⛽️ Vancouver will require gas stations and parking lots to install EV chargers. Requiring large parking lot operators to install chargers makes sense. But for gas stations? Not so much.

🧐 We’re building EVs with too much battery capacity. This is one of the most expensive consumer psychology challenges of our era.

🔹EVs will be a reason why car dealerships shrink. The unbundling of the dealership is just beginning in the US, with Europe moving faster.

😳 Faraday Future only has 401 paid pre-orders. That’s going to be tough to come back from.

⚖️Renault has received partnership bids for its internal combustion unit. Chalk this one up as a mix of financial desperation and strategic foresight.

🇺🇦 Soldiers in Ukraine are using e-dirt bikes to avoid detection. When your life is on the line, relative silence can be a virtue.

🛴In micromobility, BCG is betting on growth in the subscription model over sharing and owned. But a big breakthrough can come in the form of a mobility wallet that unifies payment bundles across public transit and shared micromobility. If micromobility is your jam, be sure to keep an eye on next week’s Micromobility Europe conference.

🚕 Uber adds taxi networks again, this time in Italy. The transition to a super-app is a long and winding road.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🔋 Dynami Battery Corp (Washington, D.C., USA): Electrode manufacturer

💧HGen (California, USA): Cost-effective green hydrogen

🚁 LuftCar (Florida, USA): Autonomous eVTOL

♻️ Octave (Belgium): Energy storage from 2nd life EV batteries

🛠 Posh Robotics (California, USA): Automated EV battery disassembly

🚙 TaiSan Motors (United Kingdom): OEM making ultra-low cost sodium-ion EV quadricycle

🔋Volinergy (Canada): Batteries designed for electric aviation

DEEP DIVE: THE BIG PICTURE ON MARITIME DECARBONIZATION

It’s hard to overemphasize how challenging it is to decarbonize maritime transportation. Boats and ships account for about 3% of all global emissions, spewing pollutants like sulfur oxide. Even worse, shipping, like aviation, lies outside the legal framework of the Paris climate accord.

Maritime rightfully falls into the category of “hard to abate” sectors like steel and cement production and alongside other forms of heavy-duty transportation. Thankfully, maritime decarbonization is coming of age and offers investors some opportunities outside the usual suspects.

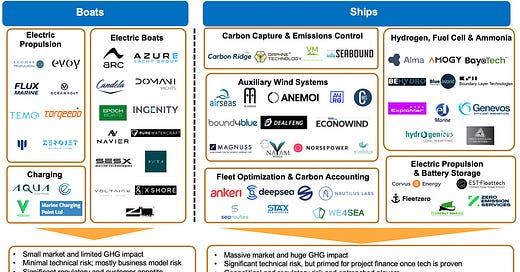

To simplify, the maritime sector can be broken into two categories: boats and ships. While there are many imprecise differences between ships and boats, the boats vs ships distinction provides a handy way to think about investment opportunities: Boating decarbonization is already here via electric batteries and powertrains, so it’s more an issue of finding the right business model. Shipping decarbonization, on the other hand, will take significantly longer and carry significantly more technical risk among competing technologies.

The boating side is the relative “good news” side of maritime decarbonization. Originally, boats were all decarbonized; it’s only relatively recently that oars and sails were joined by motors for propulsion. For motorized boats, decarbonization is quickly picking up momentum: regulators are increasingly mandating zero-emissions power, customers are often environmentally conscious, and many boats are significantly more modular than, say cars. Taking a decade-old Honda Civic and trying to convert it to electric is complex and of dubious economic benefit, but taking a decade-old boat and installing a new electric outboard motor is a simple task.

The use methodologies for boats also favor a transition to electric charging. Marinas, for example, already provide an array of services to boat owners, including power. Adding electric boat chargers to marinas is an easy evolutionary transition.

Alas, while boating decarbonization is good news, it’s not exactly high impact. The overall size of the boating category is hard to pin down, but it’s definitely modest in revenue versus other mobility categories. Brunswick is the largest boat company in the world at about $5B in annual revenue and was built up over a century of acquisitions like Lowe Boats, Harris, and Navico. For every large company like Brunswick, there are dozens of smaller boat players that take in $300M a year. There’s no reason to assume that the EV boat market will end up significantly larger than the gas and diesel boat market dominated by Brunswick.

Shipping, on the other hand, is the big leagues from both a revenue and a climate impact perspective. Alas, it’s also significantly more complex.

To start with, shipping decarbonization suffers from an “out of sight, out of mind” challenge. Like aviation, it got excluded from the Paris climate accord partly because so much of the sector’s emissions happen outside the control of any individual nation and instead by the relatively ineffective International Maritime Organization (IMO). There are policy levers available (e.g., the Port of LA example), but much of the momentum will come from publicly-traded giants like Maersk who have made meaningful commitments to decarbonize their operations.

Over the next decade, a large portion of ships will be optimized for emissions reduction rather than emissions elimination. For that reason, a number of startups are emerging to tackle carbon capture onboard ships, as well as to add auxiliary wind technology to help cargo ships to consume fewer gallons of diesel as they cross oceans. Additionally, startups are trying to assist via fleet optimization and carbon accounting by adding real-time data to improve decision-making.

Full decarbonization of ships is a technical challenge: While today’s batteries are able to handle the water resistance that boats encounter, they’re ill-equipped to handle the water resistance of larger ships. Moreover, while boats often have a less frequent usage cycle that can align well with recharging times, many ships have punishing usage cycles, such as the cargo ships that take two to five weeks to get from China to the West Coast of the US, with little available down-time for charging.

So while some ship-related startups are banking on battery-based approaches to ship decarbonization, many more are assuming that advances in fuel-cell technology and ammonia production will lead the way. In particular, “green ammonia” is made by mixing nitrogen from the air with hydrogen produced by electrolysis using clean electricity. Green ammonia could then either be burnt in a ship’s engine or used in a fuel cell to produce electricity.

All of this underscores why project finance is likely to play a role on the asset deployment side of shipping decarbonization, as you’ve got many of the necessary ingredients: a stand-alone asset, predictable revenues, predictable costs, long asset life, etc.

From an investment perspective, it’s a nice duality. For those looking for lower-risk, smaller opportunities, there are dozens of electric boat startup opportunities out there. For those looking for bigger rewards and massive climate impact, whether they be venture capitalists or project financiers, shipping decarbonization is looking for some heavy hitters to place their bets.

More on the webinar!

EV Secrets for Startups and Investors

Electric vehicle sales are booming, but how does a startup or venture investor separate the hype from reality in terms of EV product development and costs?

Since 2013, A2Mac1 has torn down and analyzed more than 100 electric vehicles from different markets and brands, which gives you the most definitive understanding of the state of the art in EV powertrains, including dynamic performance and costing.

Whether you are a startup or an investor, this real-time reverse-engineering market intelligence is an invaluable source to figure out how to be cost-competitive and reach necessary product milestones. It also helps objectively validate company progress versus competitors along product and cost.

On June 21st from 10:00am Pacific time, our experts Leila Emadi, Sascha-Andre Voglgsang, and A2Mac1 advisory board member Alex Mitchell will give startups and mobility investors “behind the curtain” access on 7 emerging product insights. Audience Q&A with A2Mac1 EV experts will be welcomed towards the end of the session. Join us for a deep dive on:

Battery chemistries

Battery costs

ADAS

Power Electronics

eDrives

Thermal systems

Component integration

Register here to make sure you get ahead in the EV race.