💪 Analyzing the big startup raises

Vol 94

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s Deep Dive will not be about what a new US presidential administration will mean for EVs, Tesla, energy, high-speed trains, and sustainable aviation fuel. I’ll dedicate a future issue to that.

Instead, we will look at the 46 companies in the Startup Watch database that have gone on to raise more than $10M since being mentioned in this newsletter, whether that money came from venture capital, project financing, or grants.

Also, next week I’ll be at ComotionLA and speaking at Micromobility America. I look forward to seeing you there!

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Bimotal (California, USA): Aftermarket device to turn a pedal bike into an e-bike

Elastic Energy (Canada): Interoperability layer for the electrical grid, including home-based DERs like batteries and EV chargers

Elm AI (New York, USA): AI to enable more responsible supply chain sourcing

Hyroad Energy (Texas, USA): Turnkey hydrogen fueling for heavy-duty trucking

GoCimo (Sweden): Micromobility w/battery swap network

Groundley (Denmark): Software to integrate ESG into manufacturing

Mapless AI (Pennsylvania, USA): Remote driving operations for fleets

Shadow Power (New York, USA): Bi-directional energy as a service to support the grid

Tobe Energy (Oklahoma, USA): Low-cost hydrogen electrolysis with no waste heat production

Zevifi (California, USA): EV leasing and transition support for medium and heavy-duty fleets

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Aviant (Vol 4) secured a $1M grant from the GENIUS NY accelerator

GreenGo (Vol 69) raised a 3M EUR Seed round from 4Ventures, Climate Leaders Fast Track, and INCO Ventures

Aerleum (Vol 71) raised a 5.5M EUR Seed round from 360 Capital, Norrsken VC, and others

Infinite Machine (Vol 93) raised a $9.3M Seed round from Andreessen Horowitz, Necessary Ventures, and others

Fun fact: Newsletter subscribers live in 86 countries. Holdout countries include Paraguay, Laos, Moldova, and Madagascar. Not yet a subscriber?

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🚫 Central Paris is now closed to through traffic. The traffic ban will go citywide in 2026.

⏳ New York City’s congestion pricing “un-pause” is on a collision course with the Trump administration. If Gov Hochul can’t make it happen in the next few months, it would likely be a generation before the US revisits the topic.

🗳️ In Massachusetts, ridehail drivers won the right to unionize. This came about by ballot versus the judicial path, so expect legal challenges.

🇨🇳 China has imposed trade sanctions on US drone manufacturer Skydio. China could wreak havoc on the US economy by taking similar measures with EVs, but only if the US doesn’t find a way to decouple the supply chain as EV sales grow.

🔬Markets & Research

↘️ Emissions in Europe fell 8% in 2023, thanks to renewable energy. Alas, emissions in the transport sector fell by only 1%.

Fun fact: Newsletter subscribers live in 49 US states. Is this the week that North Dakota joins the party?

🏭 Corporates & Later Stage

📍Google is adding more AI and virtual reality to Maps. Alas, it’s still a pretty primitive tool for multi-modal planning.

🛟 Geely’s Volvo Cars unit is taking control of its battery JV with struggling Northvolt. A cautionary tale for Europe and the US on how hard it is to near-shore the battery supply chain.

⚡️Ford is pausing production on the F-150 electric until next year and Yamaha is exiting the North American e-bike market. Almost every manufacturer of electric transportation is struggling to match supply and demand.

🥊 Volkswagen’s US dealers are up in arms about VW’s plan to sell Scout electric SUVs directly to consumers. This will surely be challenged in court, but the economics of EVs for car dealers are challenging. See the Deep Dive in Vol 30 for more.

💰Doordash posted its first quarterly profit since its IPO and announced a partnership with Lyft. The two could provide a real counterweight to Uber.

🐣 Startups & Early Stage

🚁 Archer Aviation signed a deal to bring air taxis to Japan. Perhaps Japan is ready to be as friendly to air taxis as the Gulf states.

🚛 Quantron AG, a maker of fuel-cell-powered trucks, has entered insolvency. The window for hydrogen-powered trucks is closing…

⛴️ Navier, the electric hydrofoil boat manufacturer, has delivered its first unit and Swedish startup Candela, which has developed a hydrofoil electric ferry, has begun its first commuter operations. See the Deep Dive on Maritime Decarbonization for more.

⛵️Transoceanic Wind Transport, a French startup, just completed its first transatlantic cargo voyage by sail. While a niche industry today, wind power as an auxiliary power source for large ocean vessels is clearly a trend.

💪 DEEP DIVE: PORTFOLIO ANALYSIS ON THE BIG RAISES IN THE SU$TAINABLE MOBILITY STARTUP DATABASE

In each issue’s Startup Watch section, I share a handful of pre-seed and seed-stage startups that have come across my radar screen. Collectively, they’ve raised $2.3 billion in follow-on funding since being cited here.

Of those, 46 companies have raised more than $10M in follow-on funding since being mentioned here, suggesting that their traction continues to impress VCs (or project developers or grant funders). What do these 46 companies have in common?

One thing is geography. 37% of the companies are based in California, far ahead of runners-up like New York (7%), Massachusetts (7%) and the UK (also 7%). In a world that has become significantly more distributed and virtual since the COVID-19 pandemic, geography still matters.

Interestingly, the success rate of California in securing any amount of follow-on funding isn’t significantly different from other US states. Startups based in California, Massachusetts, New York, Washington, and Colorado all raise follow-on funding at fairly similar rates. However, what is different is the amount raised.

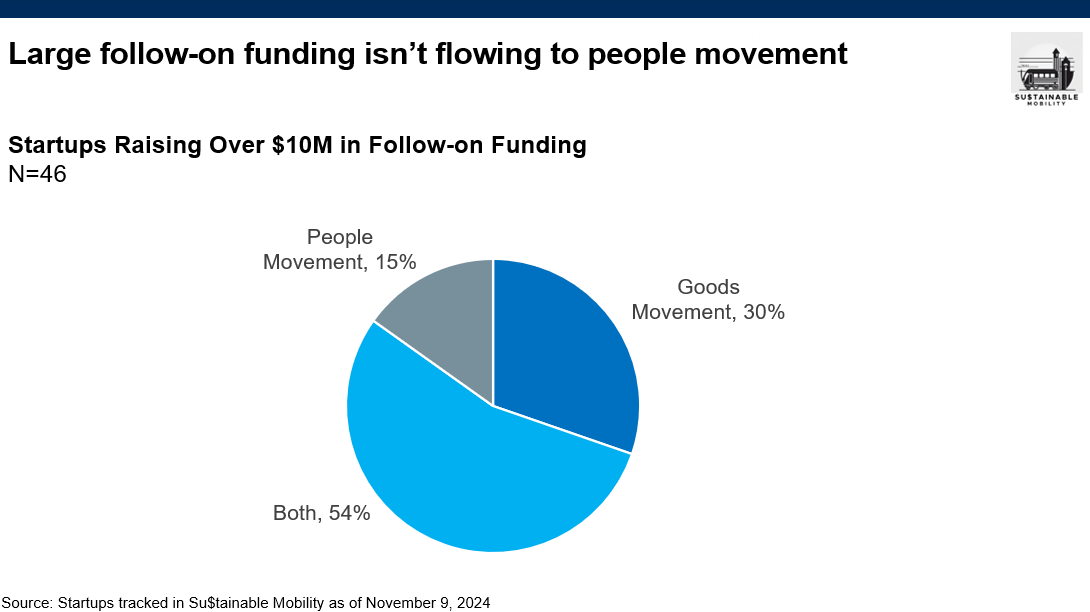

Startups in the database are classified as to whether their technology and business model are applicable to the purpose of moving both people and goods movement or only one of those. If the last decade was dominated by enthusiasm for startups focused on people movement (e.g., Uber, Bird), investment is currently focused on underlying technologies that are applicable across categories (e.g., battery technology) or focused on the challenge of decarbonizing goods movement.

As far as where future investment goes, that will dovetail into the upcoming Deep Dive on the impact of a new Trump administration. For now, founders would be well served to focus on providing a demonstrable cost (or efficiency) advantage versus incumbent competitors. That’s the kind of offense and defense that works no matter how the winds are blowing in Washington, DC.

As a reminder to the newcomers: The startup data set is currently open, for free. If you’re a subscriber interested in accessing the Airtable with all the raw data about the companies, please let me know below. Thanks for joining along so far on the journey!

Know someone who should be aware what’s happening in this space?