🌎 MaaS Without Borders: Global Pilots You Should Know (and Learn From)

Vol 109

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Artificient (Germany): Vehicle safety software using cellphone data

The Dandy Horse (New York, USA): Software to validate micromobility miles for employers and others

Moddule (Washington, USA): Supply chain optimization software

Nox Mobility (Germany): Night train network with dedicated sleeper cabins

Sava (California, USA): Automated sheet metal manufacturing to reduce supply chain waste

Travaras (California, USA): Travel booking platform for low-carbon travel

Ultra (California, USA): Delivery robots, starting with warehouses

US Coastal Service (New York, USA): Blue highway solution to move freight by inland waterway rather than trucks

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Natrion (Vol 48) secured a $250K grant from the Upstate New York Energy Storage Engine

Shovels (Vol 50) raised a $5M Seed Round from Base10 Partners

Glid (Vol 74) announced that its backers now include DraperU Ventures, Antler, and The Veteran Fund ($ amount undisclosed)

ENVGO (Vol 89) raised a $2M Seed Round from Two Small Fish Ventures, with Garage Capital and angel investors

What do Bolivia, Morocco, Uganda, Bangladesh, Luxembourg, and Iceland have in common? They’re all home to subscribers of this newsletter.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🥺 Washington, D.C. became yet another American city to tear out protected bike infrastructure. Not good news.

🚲 New York City demanded that Citibike operator Lyft limit its e-bike fleet to a top speed of 15 miles per hour. There’s benefit in having some national regulations on micromobility; right now it’s a sub-scale patchwork of rules.

🅿️ Los Angeles City Council has made its first step toward eliminating parking minimums. It’s early in the process, but encouraging.

🔥As political protests spread in Los Angeles, Waymo robotaxis became a target for arson. Waymo captures an immense amount of surveillance data, but is quiet about what it shares with law enforcement. Over this weekend, Waymo has suspended operations throughout LA and is scaling back in others cities.

⚓️ Norway is funding one of the most ambitious maritime decarbonization efforts, including battery-powered ships that will be able to carry 850 containers. For more on the electrification of maritime, see the deep dive in Vol 29.

What do Lyft, Honda, Alstom, Arup, Toyota, and the US Dept of Energy have in common? Subscribers to this newsletter!

🏭 Corporates & Later Stage

📍Apple’s new map update will learn your commute. For more on the mapping wars, see the deep dive in Vol 62.

🦿Amazon is training humanoid robots for parcel delivery. It’s not an issue of “if”, it’s an issue of “when.”

🍋🟩 Uber has renewed its partnership with Lime. If it ain’t broke, don’t fix it.

🔋 Battery maker AESC is halting the construction of its US EV battery plant due to “political uncertainty and weakening market demand.” Construction of its French plant is moving forward.

🔌 The opening of Tesla’s Supercharger network to non-Tesla vehicles is going…okay. It’s proving difficult for all players to match software and hardware in a more open ecosystem.

🙈 In Tesla news, French owners have started a class action lawsuit, Cybertruck sales are getting worse, and the robotaxi launch in Austin is delayed. Shareholders are waiting to see whether President Trump will punish both Tesla and SpaceX now that he and Tesla CEO Musk are in a cooling-off period.

⚡️ Dutch car-sharing operator MyWheels has started to deploy a fleet of 500 Renaults with vehicle-to-grid (V2G) capabilities. Fleets will be a key to scaling V2G in the early years.

🎖️ Renault has begun drone production in Ukraine. Multiple European automakers are diving into the defense industry, just like during World War II.

🏍️ Chinese cell phone maker Transsion, who dominates Africa’s cell phone market, now has its eyes set on e-motorcycles. They’ll be competing with a slew of local startups, some Indian transplants, and other Chinese players.

💰As Waymo robotaxis scale, it appears that consumers are willing to pay a price premium vs Uber and Lyft. We’re at the early adopter stage, so time will tell whether this pattern holds at scale.

🚄 High-speed rail operator Eurostar has announced it will start serving Geneva and Frankfurt. The company needs to up its game as other high speed operators plan to compete with Eurostar’s use of the Chunnel connecting France and the UK.

🐣 Startups & Early Stage

♻️ Bib Batteries (Startup Watch Vol 40) has announced a pan-European partnership with Bird scooters. We love to see the scaling of battery circularity.

Infinite Machine (Startup Watch Vol 93) revealed its seated scooter that will cost $3,495 when it ships later this year. Infinite is now backed by Andreesen Horowitz, so expectations are high.

🦄 Nigerian-born fintech-meets-mobility startup Moove is aiming to raise $300M at a $1B plus valuation. Being loved by both Waymo and Uber has its benefits.

✈️ Blended wing body airplane manufacturer JetZero has chosen North Carolina for its first factory. For more on decarbonization aviation, see the deep dive in Vol 50.

🚁 eVTOL startup Archer has now started piloted test flights. The pathway to commercialization now looks easier given the recent executive order from President Trump to accelerate the deployment of eVTOLs, drone delivery, and supersonic aircraft.

💡WeaveGrid has launched its V2G pilot with Toyota and Baltimore Gas and Electric, allowing customers to opt in via the Toyota app. Seamless convenience will be table stakes in making vehicle-to-grid scale.

🔁 Battery swap startup Ample has deployed with Stellantis’ Free2Move unit using electric Fiat 500s in Madrid. Battery swap is evolving slowly in cars, but at hyperspeed in micromobility, particularly in East Africa, South Asia, and Southeast Asia.

What do mobility investors like Maniv, Trucks VC, Fontinalis, and Automotive Ventures have in common? Subscribers to this newsletter!

MaaS Without Borders: Global Pilots You Should Know (and Learn From)

Imagine never needing to own a car again. Not because you gave it up, but because your phone knows exactly when, how, and with what mode you’ll get to your next destination.

That’s the premise of Mobility-as-a-Service (MaaS). But while the concept has been hyped for nearly a decade, execution has lagged, stymied by misaligned incentives, municipal red tape, and unproven business models.

Yet, several MaaS pilots are working…and evolving. In this deep dive, we spotlight the most promising global MaaS pilots you should know about, what’s made them stick (or not), and what it might take for MaaS to finally scale.

1. Helsinki, Finland: MaaS Pioneer with a Plateau

Platform: Whim

Launch Year: 2016

Integrated Modes: Public transit, taxi, car share, e-scooters, bike share

Business Model: Subscription + pay-as-you-go

User Adoption: ~16,000 monthly active user peak (pre-COVID)

Helsinki’s Whim app is the OG of MaaS. At its peak, users could access nearly every urban mode via a single interface, making it a textbook case for policymakers and mobility VCs alike. But Whim hit scaling walls. Despite municipal support, the economics never fully worked: thin margins and user hesitancy to ditch car ownership limited growth.

Key Learning: Integration ≠ adoption. Incentives must align among public and private operators, and true convenience must outweigh personal car use—not just match it.

2. Vienna, Austria: City-Led & Data-Smart

Platform: WienMobil

Launch Year: 2017

Integrated Modes: Public transport, taxis, e-scooters, parking

Operator: Wiener Linien (city-run transit agency)

Vienna’s approach was government-first and data-rich. WienMobil gave the city real-time insights into usage patterns and reduced private operator fragmentation. Its open architecture and consistent branding built trust; users viewed it as a public utility, not a startup experiment.

Key Learning: Public sector ownership + strong UX = better integration. Cities don’t have to build it all, but owning the customer relationship might be useful.

3. Jakarta, Indonesia: MaaS for the Masses

Platform: JakLingko

Launch Year: 2021

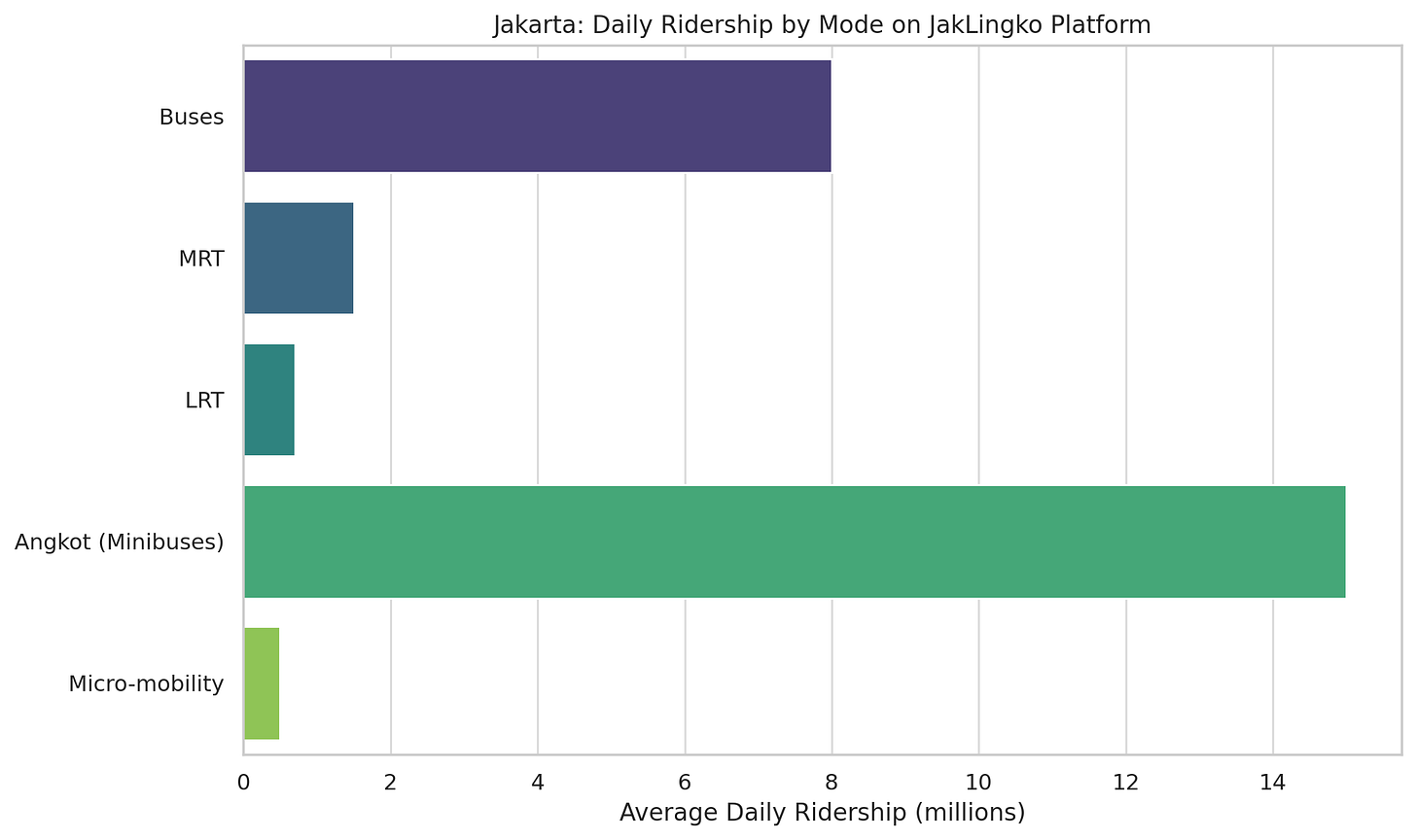

Integrated Modes: Buses, MRT, LRT, angkot (minibuses), micro-mobility

Key Feature: Unified QR-based ticketing and fare capping

Jakarta’s JakLingko system may be the most important MaaS rollout you’ve never heard of. With over 30 million daily trips, solving urban congestion at scale is critical. By integrating traditional modes like shared taxis with startup offerings from scaleup Grab, the platform appeals across income levels.

Key Learning: MaaS isn’t just for rich cities. In fact, lower-income, high-density cities may benefit most, so long systems are inclusive, intuitive, and priced fairly.

4. Dallas, USA: Regional MaaS, American-Style

Platform: GoPass

Launch Year: 2013 (revamped 2020)

Integrated Modes: DART rail and bus, Uber, bike share, paratransit

Strategy: Partnerships with ride-hailing, expanded microtransit

GoPass was one of the first U.S. attempts at multi-modal integration. Recently, it’s taken on a second life through microtransit partnerships in areas with poor fixed-route access. DART’s willingness to work with Uber/Lyft, and experiment with pricing, has made it a case study in flexibility over comprehensiveness.

Key Learning: In car-centric cities, MaaS must focus on access over choice. Think first/last mile instead of full replacement of car ownership.

5. Seoul, South Korea: The Everything Platform

Platform: T-Money

Unique Element: T-Money ecosystem used for buses, subways, taxis, bike share, even convenience stores

Though not branded as “MaaS,” Seoul’s T-Money increasingly functions as one. Its growing transition to digital, including via partnership with Kakao Mobility, could make it a dark horse. South Korea’s tech stack and public-private alignment make the transition to full MaaS highly plausible.

Key Learning: Infrastructure + platform + consumer behavior = fertile ground. Seoul didn’t start with MaaS. It started with excellent transit, then layered digital on top.

Where MaaS Could Go Next

The next wave of MaaS success stories may come from places that:

Treat MaaS as infrastructure, not a consumer app.

Provide policy carrots for shared mobility and sticks for car use (e.g., higher parking fees).

Support open APIs to foster ecosystem innovation.

And critically: MaaS must appeal to people who don’t think of themselves as “mobility users” at all, just people trying to live, work, and move better.

So who are potential winners in the space?

Payments operators like T-Money.

Mapping powerhouses. Think the next Waze.

Mobility operators like Lyft who bet that going broader on capturing a greater portion of all your trips might be more valuable in the long term than squeezing one more ridehail trip out of you.

Your next screen free device. iPhone designer Jony Ive just sold his hardware startup to OpenAI. When they launch AI-enabled hardware, it almost certainly won’t have a screen that distracts you while you’re lost on a bike or makes you look like a sitting duck as you navigate a new subway system.

Know someone who is interested in this space?