This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This issue is being posted off the normal cycle due to the US Labor Day holiday.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

AeroFuse (California, USA): Nuclear powertrains for aviation

Elements World (California, USA): Employee carbon management software for scope 3 (e.g., commuting)

ENVGO (Canada): Manufacturer of electric hydrofoil boats

Hydroflyer (Canada): Manufacturer of recreational electric hydrofoils

Mardeca (Germany): Zero-emissions retrofits as a service for the maritime industry

Ride Rise (Belgium): Manufacturer of a micromobility alternative to the e-cargo bike and motorcycle

revoltech (Germany): CO2-neutral, plastic-free & biodegradable alternative to leather made from hemp residue

Shift Clean Energy (Canada): Battery solutions for maritime decarbonization

Vidde (Sweden): Manufacturer of electric snowmobiles

Zerofy (Switzerland): Home energy management software, including EV charging

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Sunswap (Vol 10) raised a 17.3M GBP round from Barclays Corporate Banking, Business Growth Fund, Clean Growth Fund, Move Energy, and Shell Ventures

Realize (Vol 59) has announced a merger with Store My Truck

GridTractor (Vol 66) secured a $28M grant from the California Energy Commission

Fleet (Vol 69) raised $5M from Congruent Ventures, Virta Ventures, and others

PuriFire Energy (Vol 70) raised a 2.7M GBP seed round from HICO and others, and secured a 525K GBP grant from Innovate UK

Wright Electric (Vol 76) secured a $3.3M grant from the Federal Aviation Administration

Foundation Robotics (Vol 84) raised $11M in pre-seed from Tribe Capital and angels

Know someone who likes to follow startups in this space?

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🇨🇳 Shanghai will switch to plug-in buses and taxis by 2027. It might be a few years behind, say, Shenzen, but Shanghai is still far ahead of American cities.

🚫 US states are increasingly banning imports of Japanese kei cars (minicars). Its not ideal that we have to ban cars for being too small in order to sustain our addiction to large vehicles.

🇪🇹 In Ethiopia, EVs are approaching 10% of all cars on the road. For a refresher, see the Deep Dive “Why East Africa May Leapfrog the US in EVs.”

🇷🇸 🇨🇦 In Serbia, a potential lithium mine is exposing deep rifts. And, following the lead of the EU and the US, Canada imposed a 100% tariff on Chinese EV imports. For a reminder of the geopolitical battery wars, see the Deep Dive in Vol 41.

🔬Markets & Research

🚂 The New York Times examined just how bad Amtrak’s infrastructure is. You can’t run modern trains on century-old infrastructure.

☠️ The Economist looked at the deadly American obsession with big cars. Time for American crash standards to incorporate the collision impact on others, not just those inside the vehicle.

🪵 Wondering how the Amish are adopting solar and EVs? Meet the Amish solar entrepreneur who drives a Cybertruck.

👮♂️A cybersecurity engineer helped police crack an international bike theft ring. Data from Facebook Marketplace helped find what police couldn’t.

🏭 Corporates & Later Stage

🚌 Waymo is becoming the secret school shuttle in San Francisco for busy parents. This violates the terms of service, but don’t expect it to stop anytime soon.

🤖 Uber has partnered with GM’s Cruise on autonomous vehicles and inked a partnership and investment deal with autonomous startup Wayve. Lyft is awfully quiet these days.

♻️ In Korea, Hyundai is offering a lease on its Casper EV based on battery suitability for second-life applications. The future of EV leases is all about the battery value.

🍂 Rivian is losing lots of exec talent. Things won’t likely get materially better for Rivian for two years when the cheaper (and potentially profitable) R2 model arrives.

🚊Bay Area residents are celebrating Caltrain’s switch to electric. Beyond comfort, the electric train cuts travel times by as much as 25% due to faster acceleration and braking.

1️⃣ BMW has overtaken Tesla in European EV sales. It will take longer for Tesla to lose its sales crown in the US.

🐢Tesla is massively lagging on executing its agreements to open its charger network. Partners are getting anxious that this is a bait and switch by Tesla.

🕳️ Tesla is still struggling with getting autonomous software to work in its Boring company tunnel in Vegas. Not encouraging news.

🐥 Lyft partnered with Bird to bring e-scooters to the Lyft app. Uber scooped up the partnership with Lime years ago.

🍋🟩 Scooter operator Lime has entered Japan. Lime continues to show signs of pulling off the path to success in micromobility.

🦈 Lufthansa is piloting fake sharkskin covers on its planes to reduce drag. Every little bit helps.

🐣 Startups & Early Stage

🚌 Exponent Energy (Startup Watch, Vol 11) deployed its 1MW charging solution in India with Veera Vahana intercity buses for 15-minute recharges. Very cool.

📀 Digital infrastructure startup Dimo snagged Tesla as its first OEM partner. The startup allows car owners to sell their own data.

☢️ Nuclear startup Core Power has partnered with shipping giant Maersk to pilot a nuclear-powered ocean liner. Maersk is taking decarbonization seriously.

🏍️ Electric motorcycle startup Ryvid has started shipping its second product. With only $1M in venture funding and $20M in state manufacturing subsidies, this may be a master class in an efficient capital stack.

Not yet a subscriber?

DEEP DIVE: Is the Tesla Semi a Bust?

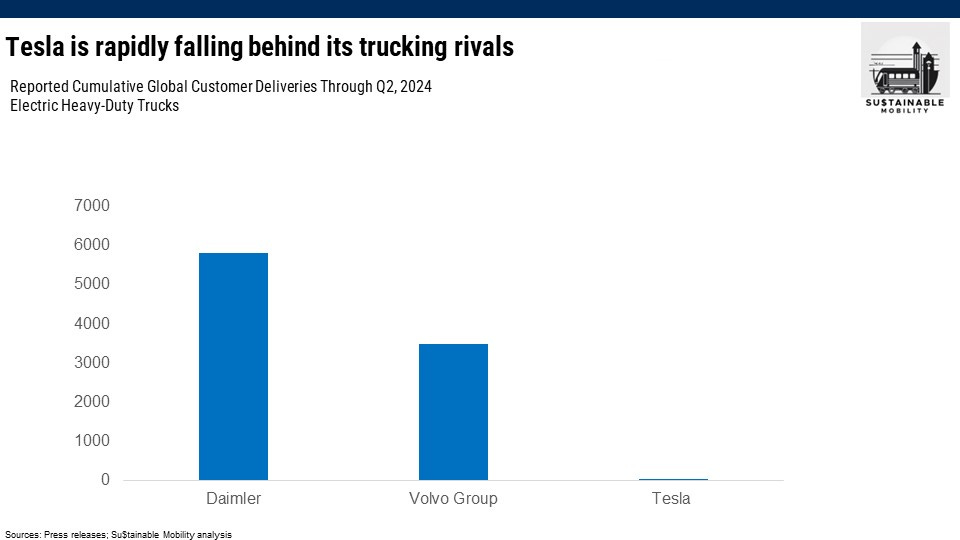

Tesla began delivering the Semis in December 2022, missing its initial launch date by about three years. In October that year, CEO Elon Musk predicted that Tesla would produce 50,000 Tesla Semi trucks by 2024.

We’re more than halfway through the year and that prediction is clearly a huge miss. In fact, more and more signs are pointing to the Tesla Semi being a let-down for the company.

The updated target is now serial production of the Semi in 2026, with an “eventual target” capacity of 50,000 units a year. That might make the project a financial albatross for the company.

What made Tesla so strong in the passenger car race was that it had a multiple-product cycle lead over the incumbents. By the time Mercedes and Ford got around to producing quality EV cars, Tesla was on its third-generation product. That’s a lot of learning to catch up on.

The opposite has been true in heavy-duty trucks. While Tesla has been publicity-hungry in the trucking space, it is rapidly falling behind European rivals like Volvo Trucks and Daimler.

So what accounts for this potential huge miss? A few potential factors:

The battery challenge. The Semi is Tesla’s first foray into the 4680 cell format versus its usual use of 2170 cells. As noted in multiple quarterly earnings, the production ramp-up has been brutal. And while vehicle fires often get overblown, it doesn’t help that the US National Transportation Safety Board has just opened an investigation into its battery safety.

Customer frustration. UPS reserved 125 Semis in late 2017, but has not received any of them. It’s allegedly still waiting patiently, but other customers have opted for the Daimler and Volvo units they can get now.

A lack of B2B orientation. Tesla is focused on business-to-consumer sales via its direct sales channel. Organizationally, it has little patience for the kind of B2B sales and marketing efforts needed for success. You could argue that Hertz’s challenge with Tesla EV cars was almost as much about Tesla’s fleet practices (rapid MSRP changes, lack of attention to fleet parts pricing and service) as it was about Hertz’s naivete.

It’s not game over for the Tesla Semi, but it’s going to take a lot of hard work to turn this one around.

Enjoyed this issue? Share it with three people: