Autonomous Vehicles are Getting Messy

Vol 82

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s Deep Dive, at the bottom, is about how Autonomous Vehicles Are Getting Messy. And I’ve also got part 3 of the 3 things I want to talk to you about.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

8inks (Switzerland): Multi-layer coating technique for lithium-ion battery manufacturing

BusCaro (Pakistan): Commute optimization software

Carbon Mobile (Germany): Replacing metal with sustainable carbon fiber for electric mobility

Gro Club (India): D2C bike subscription with a focus on youth

Install (Illinois, USA): Predictive maintenance algorithm for property owners to identify potential issues with electric appliances (including EV chargers)

Montis Corp (Alaska, USA): Weather systems software for aviation

Proptly (Norway): Order-to-installation software for contractors doing cleantech hardware, including EV chargers

Quantum Charge (Arizona, USA): EV charger network leveraging real estate JVs

Ultrium (Michigan, USA): Predictive maintenance software for vehicles

Valternative Energy (South Africa): Integrated e-bike and battery swap network

💰FUNDING: Capital raises from startups previously featured in Startup Watch

GridMatrix (Vol 2) raised $3M for its seed round (investors undisclosed)

Princeton NuEnergy (Vol 24) raised a $10.3M Series A extension from SCG Chemicals and Tech Council Ventures

Orange Charger (Vol 28) raised a $6.5M seed round led by Climactic and Munich Re Ventures

Torev Motors (Vol 40) raised $525K in seed funding (investors undisclosed)

Active Surfaces (Vol 48) raised a $5.6M pre-seed round from Safar Partners, QVT Financial, Umami Capital, Type One Ventures, and others

Correntics (Vol 52) secured a 1.5M EUR grant from Eurostars

Halcyon (Vol 72) raised a $10.8M seed round from Obvious Ventures, Overture VC, and Congruent Ventures

BetterSea (Vol 73) raised a pre-seed round from Forum Ventures (amount undisclosed)

Recharged (Vol 74) raised a $1M seed round (investors undisclosed)

Clearwatt (Vol 78) raised $330K in funding from Prova and others

Startups in the database have now raised $1.9 billion in follow-on funding.

Let’s Talk. Yes, I Mean You. (Part 3 of 3)

For those of you who don’t know me, my LinkedIn should give you a decent sense of who I am. I want to spend more of my working hours on innovative new projects or roles that matter to me in the climate/cleantech space. I am passionate about:

Getting More Family Offices and Foundations Off the Climate Sidelines (Part 1)

Creating Novel Financing Structures for Climate Investing (Part 2)

Addressing The Micromobility Funding Paradox (Today)

As part of my fellowship at the MIT Mobility Initiative, I am focused on what it will take to scale public-sector and private-sector investment in micromobility.

If you are or have been the founder of a micromobility startup, please take this 3” survey here! And please share with other micromobility founders.

I am also running a survey with VCs to get their sense of what would need to be true for them to invest VC $ into micromobility (goods and services, hardware and software). If you’re a VC and haven’t received my survey, please reply to this email.

Not yet a subscriber?

📰QUICK HITS: Notable news from the last two weeks

🚌 Oakland is the first city in the US to have a 100% school bus fleet that is electric and vehicle-to-grid (V2G) capable. The V2G wars will be fought in school buses before they come to cars.

🚊San Francisco secured billions from the US federal government to connect Caltrain high-speed rail to downtown’s Salesforce center. Eventually…

🔔 The California Senate passed SB 961, a first-in-the-nation bill that requires vehicles to be equipped with passive speed governors. With advanced sensing technology, it’s no longer hard for a car to know the speed limit on a particular road.

🇵🇭 The Philippines has extended its zero-tariff policy on EVs to include e-bikes and e-motorcycles. Love to see it…

🇨🇳 China, one of the high-speed rail darlings of the world, is being forced to raise fares to cover costs. If the US has moved far too slowly on high-speed rail, China might have built too much capacity to too many smaller cities.

🇺🇸 The Biden Administration hasn’t clarified yet which vehicles classes might be included in the China EV tariffs. If e-bikes are included, it would massively disrupt the market, as the vast majority of e-bikes sold in the US come from China.

🔬Markets & Research

⛑️FIA launched a road safety index to improve organizations’ safety footprints. A cool way to help companies take action.

🧾 The Tax Foundation has published a white paper on the importance of moving to a VMT (vehicle miles traveled) road tax. With gas taxes becoming a rounding error over time due to EVs, and better technology, charging a VMT tax is likely the end game for financing road infrastructure.

Enjoying this issue? Share it with 3 folks…

🏭 Corporates & Later Stage

🦈 BYD has launched the Shark, a plug-in hybrid pickup truck. While there are no plans to sell the Shark in the US, this is still a huge long-term threat to many legacy automakers who derive huge profits from pickup trucks.

🤷♀️Honda unveiled its fuel cell heavy-duty truck in partnership with Isuzu. Honda historically hasn’t touched the heavy-duty truck segment, but its decades of fuel cell research need to go somewhere given that fuel cell cars are a dud.

⏲️ Tesla racked up some good news (a nice commitment from Pepsi for 50 more semi trucks) and more bad news (major damage control with fleet customers in Europe, and another lawsuit). The big moment of truth will come on the June 13th shareholder meeting when votes will be tallied about whether Elon’s pay package gets reinstituted or not.

🚕 Uber is offering London drivers up to 5,000 GBP to go electric. In some cities like NYC, London, etc, most ridehail will have to be zero-emissions in the next few years.

🐣 Startups & Early Stage

🦾 Kyle Vogt, the founder of Cruise, started The Bot Company, an autonomous robot startup that raised its first financing round of $150M. He snagged a Tesla AI exec as his technical co-founder.

🛟 Hydrogen player Plug Power secured a $1.6B loan guarantee from the DOE Loan Program Office. The company likely had to resolve its “going concern” status to get final approval.

♻️ Redwood Materials secured a supply agreement to recycle battery scrap materials from General Motors. The average battery manufacturing process generates 5-10% scrap, so it’s vital to reuse the material rather than let it go to waste.

🛥️ SWITCH Maritime (Vol 51 Startup Watch) launched the first hydrogen-powered commercial vessel in the United States with US Coast Guard approval.

🛥️ Arc Boats (Vol 4 Startup Watch) now has a boat ready for test ride in Austin. At a starting price of $258K it won’t be cheap, but neither was the first Tesla Roadster.

🛩️ Sweden’s Heart Aerospace has made LA the home of its North American HQ, poaching SpaceX alum and Parallel Systems founder Benjamin Stabler as its CTO. Given Ampaire’s LA HQ, this boosts LA’s role one of the emerging global hubs for electric planes.

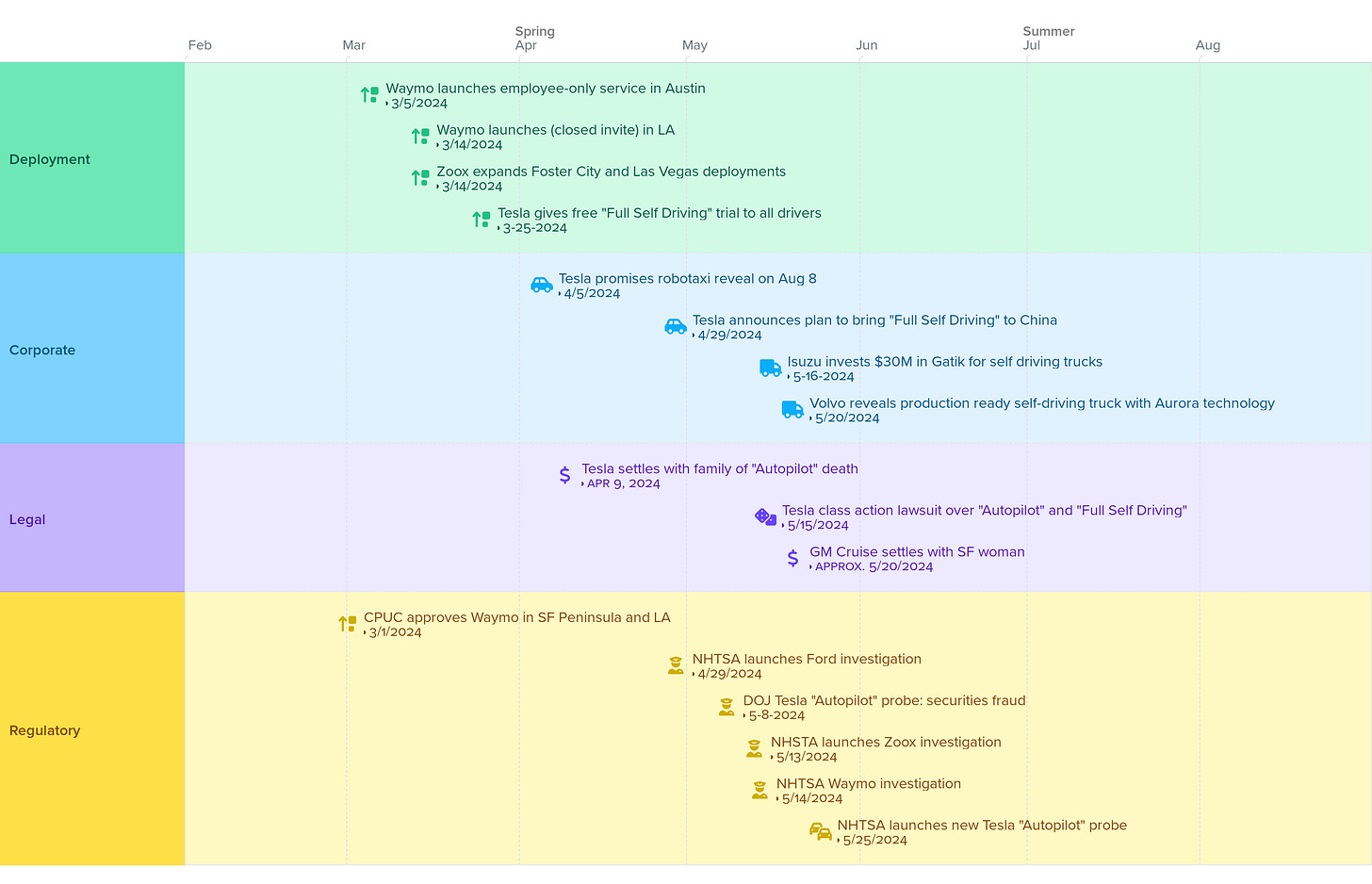

DEEP DIVE: Autonomous Vehicles are Getting Messy

It’s 2024 and autonomous vehicles are still mostly a rounding error in vehicle deployment. But the news over the last few weeks has been a whirlwind, with both new deployments (Waymo and Zoox), as well clear signs that the US federal government is getting serious about regulating the Wild West of autonomy.

There’s a pattern to keep an eye on among all the headlines: Silicon Valley heavyweights like Google (Waymo) and Amazon (Zoox) have behaved remarkably like their old industry counterparts such as Volvo Trucks and Ford. In both cases, they aim to be good corporate citizens by ensuring they adhere to evolving federal guidance.

The same doesn’t hold true for Tesla, who seems interested in thumbing its nose at regulators in DC, Sacramento, and elsewhere. This tension will be exacerbated as the year goes on, with Tesla promising an August reveal of its robotaxi. The company hasn’t yet filed any of the required paperwork with entities like the Public Utilities Commission in California.

The game plan for Tesla’s robotaxi may not be all that dissimilar to Uber’s scorched earth policy in the ridehail wars, when the startup would operate in cities where they were banned, relying on drivers and riders to personally lobby regulators.

Except this time around, the safety stakes are an order of magnitude higher, so don’t be surprised if Google, Amazon, Apple, and others take actions to keep Tesla in check.

Not yet a subscriber?