🔋Su$tainable Mobility, Volume 28

This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s issue features a Deep Dive on how California is Diving into EV Battery Recycling with Both Feet.

Next Wednesday, I will be joining my friends at E8 Angels as a panelist for a Climatetech Pull-up, covering a variety of topics on angel investing, cleantech and climate policy. Join us!

QUICK HITS: Notable news from the last 2 weeks

🔋 The Biden administration launched a $3B program to kickstart the US battery economy. Signs are popping up every day that the EV market is already supply-constrained; it’s likely going to get worse before it gets better.

⛏ Russia’s invasion of Ukraine is increasing mining focus on Africa. With rapidly rising geopolitical tensions, everyone is facing difficult decisions about where to secure minerals for EVs.

☀️ California hit (almost) 100% renewable energy generation for the first time. A good reminder of how EVs get cleaner over time as the electric grid gets cleaner, especially when a rigorous new study from SAE shows how important real-time grid data is for understanding the emissions of EVs and hybrids.

✈️ We might have been undercounting the climate impacts of air travel. This will bolster EU support for Sustainable Aviation Fuels (SAFs), zero emissions flight mandates for short-haul, and a mode shift to high-speed rail.

🛵 Ola has become the Indian market leader in the 2 wheeled EVs in just 5 months. Quite a feat for the spin-off of a ridehailing company. As shared in Vol. 11, the ridehail companies have diverged in their quest for profitability. Lyft stock was hammered by disappointing earnings, and Uber is no profit machine either.

🚕 A great new study shows that to minimize ridehail congestion, we need fees for pickup and dropoff in dense neighborhoods. This brings us back to the importance of curb management solutions.

🚙 Stellantis’ Free2Move bought the assets of BMW’s and Daimler’s ShareNow car sharing business, instantly becoming one of the largest car-sharing operators in Europe and North America. Car sharing is a notoriously unprofitable business, but the Stellantis team has proven time and again how their discipline on pricing and cost can eke out profits where others can’t, first with Peugeot-Citroën, then with Opel, and then with FiatChrysler. Time to see whether that holds true in the car-sharing space.

🏭 Foxconn snagged its first EV factory in the US, with Fisker and Lordstown Motors as first customers. Foxconn may well end up being the most disruptive EV player of the decade. Read more about contract manufacturing in Vol 4.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🚛 Aeromutable (California, USA): Aftermarket system using air injection to dynamically improve the aerodynamic efficiency of semi-trucks

🔐 Angoka (United Kingdom): Secure machine-to-machine communications for mobility

⚙️ C-Electric (India): Tier 1 supplier of ePowertrains for 2 and 3 wheel vehicles

🏠 Clay Energy (Canada): On-demand electric vehicle charging for multi-unit buildings that scales with tenant EV adoption

🏬 Davinci Micro Fulfillment (New Jersey, USA): Urban micro-fulfillment warehouses

🚐 JeGo Technologies (Ohio, USA): EV chargers and EV shuttles for last-mile delivery

🦼HawKar (Tunisia): 4 wheel micromobility solution for those with physical disabilities

🏠 Orange Charger (California, USA): EV charging network for multi-unit dwellings

🧑🏽💻 Marain (California, USA): EV fleet planning and deployment software

🛴 Scooty (Canada): Kick scooter and e-bike access via pay-per-use or subscription

🚛 SixWheel (California, USA): Aftermarket solution to turn heavy-duty diesel trucks into hybrids

DEEP DIVE: CALIFORNIA DIVES INTO EV BATTERY RECYCLING WITH BOTH FEET

In 1997, the European Union developed a policy on end-of-life vehicles, explicitly outlining roles and responsibilities for how to properly recycle and dispose of a vehicle. On the other side of the Atlantic, the more laissez-faire approach prevailed in the US, with the free market left to figure out how to handle vehicle recycling and hazardous waste disposal.

Until last week.

On May 9, 2022, California’s Lithium-Ion Battery Recycling Advisory Group shared its final policy recommendations with the California state legislature on how to handle electric vehicles at the end of their life.

For the moment, these are policy recommendations, not law, and only for California, not the US. But history suggests that most of the recommendations will become law and set the precedent by which other states will regulate.

The process started in 2018 when California Assembly Bill 2832 (AB2832) required the convening of an expert Advisory Group to draft policy recommendations for the Legislature to ensure “that as close to 100% as possible of lithium-ion batteries in the state are reused or recycled at end-of-life.”

Two particular elements jump out in the final recommendations. First, it’s clear that, like in Europe, the vehicle manufacturer (OEM) will bear ultimate responsibility for end-of-life treatment. Second, it’s still an open game whether the all-important battery data will available to everyone or only the OEMs.

On the first front, the policy recommendations are unambiguous in creating a framework where the vehicle manufacturer is the handler of last resort. In 10 years, if there’s an electric Ford rusting on the side of a California road, it’s Ford’s responsibility to see to it that the battery gets properly reused, refurbished, or recycled.

The notable drawback of this policy is that OEMs will likely only be called upon when the battery is presumed to have a negative value. In positive value situations, dismantlers will choose to acquire the vehicle and profit from the battery repurposing.

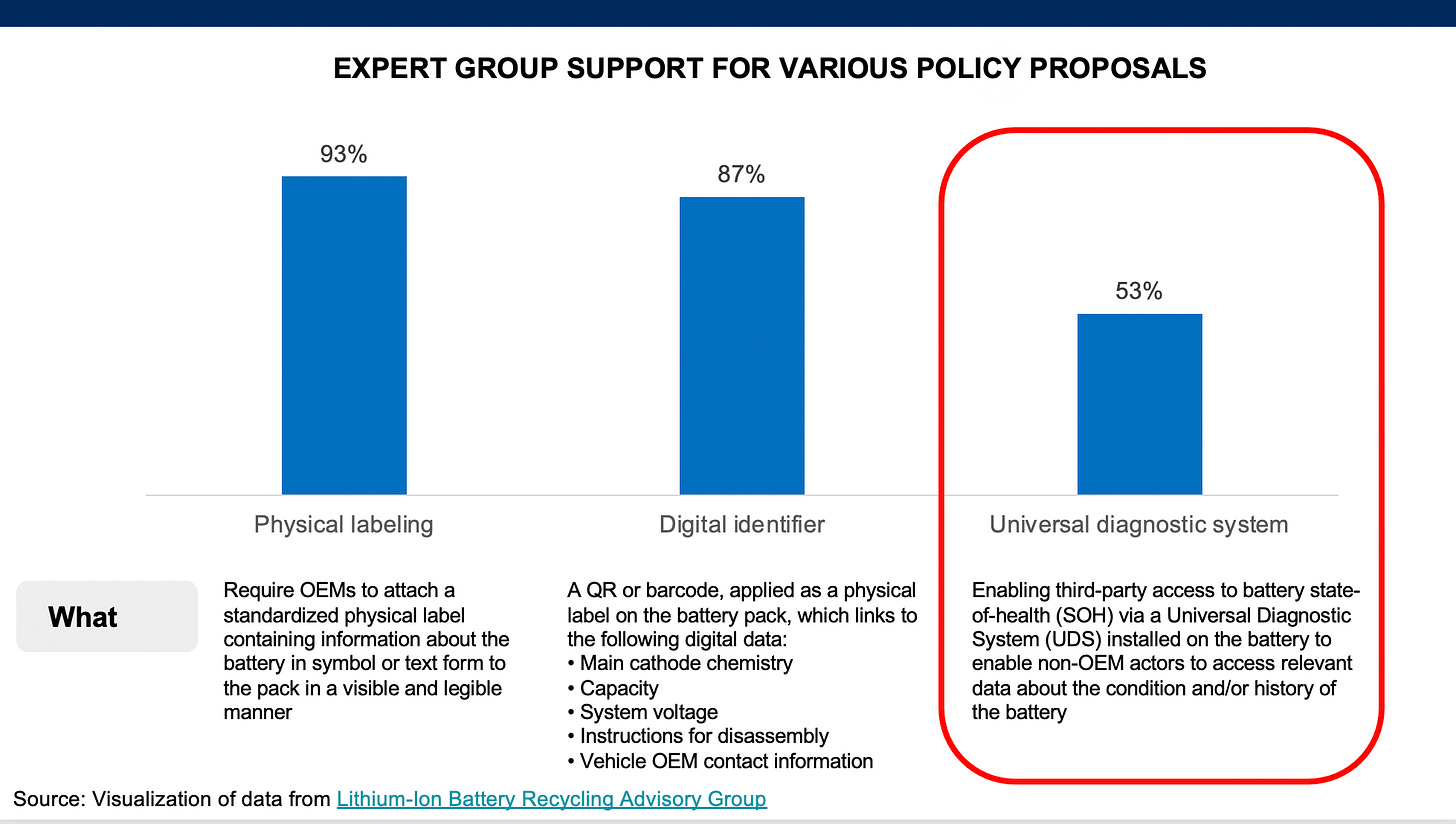

This is where the second issue comes in. The final report showed expert support for various other specific policies, including those in the category of “access to battery information”:

The touchy issue here is that batteries are incredibly complex creatures: Two identical Nissan Leafs can leave the factory with the same battery capacity, but a decade later they will likely have different actual battery health based on ten years of charging patterns, local temperature extremes, etc. And while you can have some good assumptions about the state of battery health for a 10-year-old EV, it pales in comparison to the precision contained deep inside the vehicle about the true state of each cell, module, and the overall battery pack.

Expect this universal diagnostic system to become a hot-button issue as this recommendation moves into law: If the OEMs can maintain ownership of the true state of battery health, they will have a better chance of finding information arbitrage situations to create battery repurposing profits. If they lose their monopoly on this precious information, they’ll be more likely to be stuck as the buyers of the leftovers that nobody else wanted.

Either way, California is about to make sure that the EV battery recycling market starts scaling in a meaningful way.

ALL THE REST

Xos unveiled new medium and heavy duty EV trucks. Apple poached Ford exec. Rivian gets $1.5B for its Georgia factory. VW is sold out of EVs for this year. NYC residents are demanding more parking because NYC cops are parked illegally. San Francisco’s Battery Bluff opened, a park built on top of a freeway. Organized labor is pushing back on California’s plans to wean itself from freeway expansions. Massachusetts found that most of its EV rebate money had no effect on buyer behavior. Electrify America shared a treasure trove of charging data. Self-driving cars are being used for police surveillance. Instacart filed for its IPO.