Su$tainable Mobility, Volume 2

This newsletter serves to separate the signal from the noise as it relates to making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This is still very much a work in progress so feedback is always welcome. I am considering adding a 4th section featuring profiles and interviews of under-resourced founders in sustainable mobility (women, Black, Latino/Hispanic, and LGBT); feel free to DM me on Twitter or send an email with your thoughts on that and what else you might like to see as content.

This week’s deep dive (at the bottom) is on how the midsize pickup market, dominated by Toyota’s Hilux, is ripe for electron-infused disruptions in emerging markets.

Disclaimer: This newsletter represents my own thoughts and not those of any employer. I will always disclose when I have a financial relationship to a company cited.

QUICK HITS

Fast takes on the the most notable news from last week

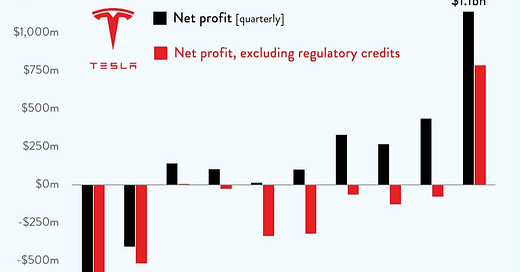

Tesla just posted breakout quarterly results. Naysayers have been pointing out that the sale of regulatory credits have been driving profit thus far. That’s no longer true. Globally, Tesla delivered 386k units in the first half of 2021. That’s a hair ahead of Volvo Cars’ first half results (381k) and within striking distance of Lexus (414k). And that’s before Tesla’s German factory comes on line. That’s the major leagues.

LA may approve a new hospital that is more parking garage than hospital. When 55% of a hospital’s construction is parking and only 45% is actual hospital, it’s clear we need cities to enact parking maximums rather than parking minimums. Even more surprising in this case is that the hospital sits on top of a metro stop (yes, LA does have a subway!). There are much more profitable and sustainable uses for urban real estate than parking.

Shell, Total, Chevron and other oil majors rushed to buy back shares in the same week that monster climate funds by Brookfield ($7bn) and TPG ($4.5bn) were announced. Stock buybacks return capital to shareholders as an implicit acknowledgement from company management that shareholders can get a better return by investing that money elsewhere than the company management can by investing in organic or inorganic growth. Given our unprecedented transition away from carbon and the fusion of mobility and energy, it’s an admission by the oil majors that they are less energy providers and more agents of extraction. If they felt they had significant value to add in the energy transition, a big swath of that buyback money would have gone towards investments in renewables and mobility.

Lucid Motors went public, raising $4.5bn. Now that Tesla’s enterprise value comfortably exceeds that of all legacy OEMs, no asset manager wants to miss out on the next Tesla. Lucid and Rivian have some of the best talent out of there in the EV OEM space.

Redwood Materials snagged another $700m for battery recycling. Demand for battery circularity will grow exponentially in the coming years, driven by economics, geopolitics and sustainability. While there are incumbents like Umicore in the mix, this area is ripe for startup-led innovation as well.

STARTUP WATCH

Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

Aeromechs (Italy) builds hardware/software solutions for reducing fuel consumption of aircraft via smart management of onboard electrical power flows.

Lift Ocean (Norway) is developing a hydrofoil systems to be offered to any boat manufacturer. The hydrofoil approach reduces water resistance and, therefore, power consumption.

GridMatrix (California, US) is building sensor-agnostic software to deliver real time insights to city traffic engineers on road usage and to also optimize signal light timing, therefore reducing emissions and congestion.

DEEP DIVE: Why the next disruption in midsize pickups might be an emerging market energy breakthrough

When Americans think of pickups, they often think of the sales champ, the F-150. Ford’s full-size pickup sales, mostly in North America, account for the lion’s share of the company’s profit.

In the rest of the world, pickups are more modestly sized (midsized) and, contrary to their US counterparts, buyers are often purchasing based on true utility needs rather than macho looks. A number of pickups abound in this segment but the player with real market power is the Toyota Hilux, the best selling vehicle in at least 16 countries, including Australia, Panama, Peru, Côte d’Ivoire, Kenya, Thailand and Fiji. The Hilux is a workhorse of undeniable reliability, resulting in a price premium and exceptional profits for Toyota.

But there’s likely some genuine innovation coming to this market and it may not be Toyota that captures the upside; to date, electrification hasn’t been at the top of the company’s priority list.

As you look at both the nature of pickup trucks, and the consumer needs in these markets, it’s quite clear that the midsized pickup may be ready for some “bottom of the pyramid” electron-related innovations. A few points to consider:

Grid connectivity and reliability is insufficient in many emerging markets. In parts of West Africa, diesel generators provide the equivalent of 40% of the grid capacity. Vehicle to home technology (V2H) is already announced for the Ford F-150 Lightning. While the cost is high, the utility of such a solution is highest in emerging markets with unreliable electrical grids.

Solar prices continue to plummet and are reaching a point where solar roofs in vehicles might actually work, especially in sunlight rich countries. Aside from a bus, the pickup is probably the most perfect vehicle form factor to integrate solar. Solar tonneau covers may start to make sense in the coming years.

Whether these new innovations come from Ford/VW, Stellantis, OEM startups, or energy storage startups remains to be seen, but there’s a confluence of factors to suggest that (partially) electrified midsize pickup trucks in emerging markets make sense sooner rather than later.

Forwarded this email by someone else?