Your cheat sheet for CES 2024

Vol 72

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

Reminder for all early-stage Sustainable Mobility startups! The deadline to apply for the U.S. Venture Sustainability Accelerator Spring 2024 Cohort is end of day January 12th. Click the link for more info!

Also, I’m pleased to share that this year I’ll be a Senior Fellow (part-time) at the Massachusetts Institute of Technology Mobility Initiative, the interdisciplinary hub for all things transportation at MIT. I'll be focused on how investments in transportation can be aligned towards climate impacts. I’ll be staying in LA but spending more time in the Boston area.

Also, I’m planning on being at the Bloomberg New Energy Finance Summit in SF on Jan 30-31. Let me know if you’ll be there.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

Acorn Delivery (Georgia, USA): Containerization solution for last-mile delivery

Byway (United Kingdom): Flight-free travel planner

Chiral Energies (Israel): Controlling electron spin to improve batteries

Couri (California, USA): Smart-lock and delivery container for last-mile delivery

Curo (California, USA): "Virtual depots" for fleet operators and EV charging hosts using existing sites

Halcyon AI (California, USA): Data platform to help individuals manage decarbonization

Redivivus (Colorado, USA): End-of-life battery recycling technology

Paua (United Kingdom): Fintech solutions for EV charging payments

Undertow.AI (California, USA): OFDM radar solution to conslidate depth-sensing functions for urban mobility applications

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Electra (Vol 5) secured 27M EUR in project finance funding from Eiffel Investments

Fettle (Vol 19) was acquired by Kwik-Fit; this is the 9th exit in the database. Fettle founder Jeyda Heselton was also on the newsletter’s 2022 list of 10 Women-Founded Sustainable Mobility Startups to Follow

BatX Energies (Vol 34) raised a $5M Seed round from Zephyr Peacock, Lets Venture, and others

eyeGauge (Vol 41) raised a 535K EUR seed round from angel networks

Swap (Vol 46) raised a $22M Series A from Ondine Capital, GGV Capital and Qiming Venture Partners

As a reminder, the startup data set is open, for free to subscribers. If you’re a subscriber interested in accessing the Airtable with how these startups raised $1.3 billion in follow-on funding, please let me know.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🚌 New York City is cracking down on those who block the bus lane. Like other cities, it will start using onboard cameras to automatically issue tickets.

🚲 San Francisco is expanding its e-bike delivery pilot. Cities continue to experiment with a carrots and sticks approach to shift deliveries away from vans to smaller form factors.

🚛 Los Angeles continues to be ground-zero for heavy-duty truck decarbonization in the US. Look for other ports to follow the lead set by Ports of LA and Long Beach.

🚫 Under Governor Ron DeSantis, Florida is becoming the only known state to turn down federal funding focused on emissions reductions. DeSantis stands alone (so far) among Republican Governors in turning down this amount of money.

👎🏼 Ohio Governor Mike DeWine signed a bill into law that would prevent Ohio from adopting California EV standards. EVs are a political lightning rod.

💸 West Virginia Senator Joe Manchin continues to second guess the executive branch’s rollout of the EV tax credit. He may not be running for re-election, but Senator Manchin continues to keep an eye on the Inflation Reduction Act implementation.

🇫🇷 France has launched a 40 EUR/month EV leasing scheme. An interesting collaboration between the public and private sectors.

🇨🇦 Canada has announced its new EV standard. As with many countries, 2035 marks the end of sales of internal combustion engine cars.

🔬Markets & Research

🔬Harvard’s Belfer Center has a great report out on the required investment in EVs by car manufacturers. A great perspective based on merging disparate data sources.

🌎 S&P has unveiled its 2024 EV Forecast. In 2024, new car sales in China are expected to be 29% EV, with Europe at 22% and the US at only 13% (below the global average of 16%.)

Enjoying the insights? Share this issue with 3 folks:

🏭 Corporates & Later Stage

🤖 Consumer Reports says the Tesla “Autopilot” software recall isn’t sufficient. Keep an eye out for how Musk embeds Tesla’s autonomy software in the broader conversation around AI regulation.

🐭 Tesla has removed the Disney+ app from vehicles, likely in retaliation for Disney not advertising on X (aka Twitter). These decisions excite some employees at Tesla and cause other employees to ponder leaving to become a startup founder.

1️⃣ BYD has dethroned Tesla in EV sales. BYD and Tesla can cohabitate just fine; it’s everyone else who should be worried. See Vol 66 for BYD is the New Android.

🇨🇳 Chinese EV maker NIO was saved by a $2.2B investment from Abu Dhabi government fund CYVN Investments. Be ready for an upcoming announcement from NIO about a commitment to vehicle manufacturing in Abu Dhabi.

⚡️Wondering how Apple’s electric grid prediction tool works? Apple’s ambitions in the demand response market are still unclear.

🚛 Pilot J truck stops finds itself in the crosshairs of a lawsuit between Warren Buffet’s Berkshire Hathaway (who owns 80% of the company) and Jimmy Haslam (who owns 20%). Keep an eye on how truck stop operators like Pilot J become crucial in the buildout of heavy-duty EV charging infrastructure.

🚏Germany’s FlixMobility may be stripping Greyhound Bus for valuable urban real estate. While many downtowns could benefit from more real estate for housing, we may eventually regret letting go of this mobility infrastructure.

🛤️ Deutsche Bahn, Germany’s rail operator, has finally put its DB Schenker logistics unit up for sale. Sale proceeds will likely support much-needed investment in Deutsche Bahn’s core operations, which haven’t kept pace with European rivals.

🐣 Startups & Early Stage

🦤Micromobility operator Bird filed for Chapter 11 bankruptcy (excluding Canada and Europe). The filing came 3 days after the Dec 17, 2023 newsletter issue that predicted Bird would go bankrupt in 2024.

🚟 Hyperloop One shut down. Elon Musk kicked off a funding race for hyperloops with a 2013 paper that eschewed real-world realities like land acquisition costs and human comfort; the enthusiasm for hyperloop is on life support.

🔌 Aviation startup Maeve has announced a pivot from an all-electric plane design to a hybrid-electric design. There’s a format war between those who believe hybrid electric is the fastest way to decarbonize aviation (e.g., Ampaire, Electra, etc.) and those betting that all-electric is already primed for takeoff.

🛥️ Blue Innovations Group (Vol 49) unveiled its solar and electric-powered boat. There’s now a critical mass of startups who are trying to electrify leisure boats and ferries.

Not yet a subscriber?

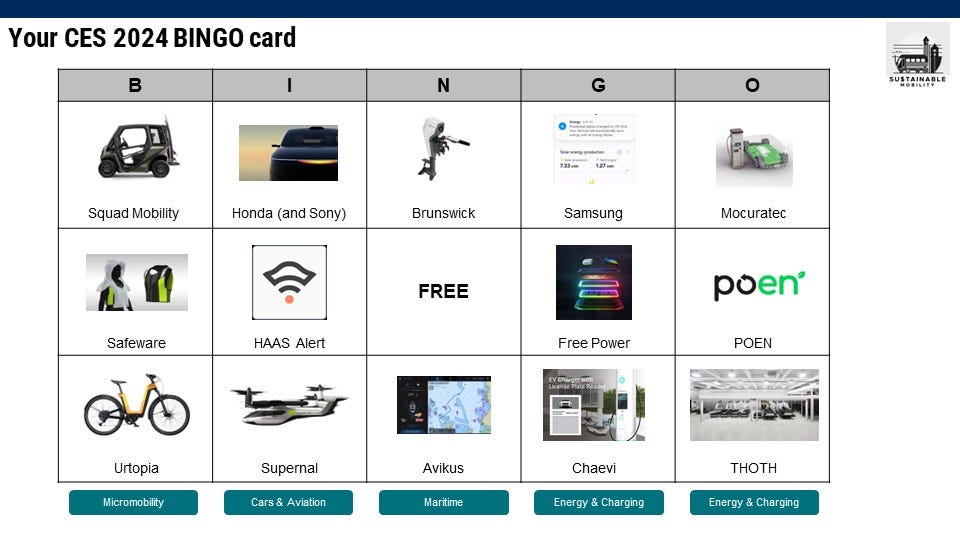

DEEP DIVE: YOUR CHEAT SHEET FOR CES 2024

For many in tech, CES is one of the “can’t miss” events of the year. A lot of what is happening at CES 2024 next week is known ahead of time, so here’s your cheat sheet for what matters at CES 2024 for where climate tech meet logistics, supply chain, transportation, and mobility. Whether you’re heading to the show and want to know what to check out or whether you’re bypassing Vegas but want to know what you missed, this is what’s worth your time and why.

Micromobility

Micromobility is a great industry but a terrible business. From an industry perspective, sales are up 269% from 2019 to 2022 and e-bikes now outsell electric cars. And it’s a fiendishly efficient way to decarbonize. But it’s been a terrible business: the small-ish pool of revenue is spread across a long tail of subscale, unprofitable firms. Success here generally comes to those doing “picks and shovels” plays (IoT devices, B2B services, etc.) versus those trying the umpteenth variation on a 3-wheeled e-scooter.

Given the endless stream of small micromobility businesses, you can’t have CES without dozens of micromobility players. Among the noise, here’s the signal:

Dutch startup Squad Mobility will be showing a special edition of their quadricycle with a solar roof and battery swap. Nobody has cracked the code yet on “minimum viable car” but hopefully Squad or someone else will figure out how to get us out of giant EV SUVs and into small fun 4-wheeled devices.

Safeware is showing off Personal Mobility Airbag Vest, designed to protect micromobility riders and pedestrians from vehicle impacts. An example where the lack of political will to create a safe biking environment results in a product category.

Urtopia will be showing off the "world's first ChatGPT integrated E-bike.” What can come across as mindless hype is actually rooted in a very real pain point for users: Nearly any task like wayfinding on micromobility is burdensome and dangerous — just ask any cyclist who has checked their iPhone screen while riding to figure out the next left turn.

Cars, Trucks, & Buses

There’s a more muted presence this year than in prior years, partly because of the divergence on electrification vs autonomy. Vehicle electrification surged again in 2023, while autonomous vehicles had one of its worst years ever with GM’s Cruise crisis. So expect fewer breathless announcements this year about imminent deployments of autonomous vehicles.

Honda and Sony will share more about their EV plans, including the potential Afeela EV from Honda and Sony. Japanese automakers are woefully behind in the EV race; Honda’s attempt to make up for lost ground by partnering with Sony at least shows they’re trying. For more info see this Deep Dive.

HAAS Alert will be showcasing the “first-ever cross-brand car-to-car communication capability between Volkswagen and Stellantis vehicles.” We’re just beginning to build the application layer that connects the infrastructure layer of cars, buses, bikes, stop lights, etc. to improve traffic flows and reduce collisions.

Aviation

CES loves air taxis (eVTOL), a product category that carries infrastructure adaptation risks and induces a new form of mobility that might turn out to be a net negative from a sustainability perspective. Do we really need Helicopter 2.0 siphoning travelers away from using the upcoming metro connection to the LA airport? Or do we actually need Airplane 2.0, capable of flying LA to SF with zero emissions? Smarter money is focused on the latter.

Hyundai’s Supernal unit will unveil its eVTOL concept vehicle. Supernal will compete with the likes of Joby and Archer who count Toyota and Stellantis among their investors.

Maritime

This climate tech opportunity isn’t on most people’s radar screen yet, so the pickings are few at CES 2024.

Brunswick will be showing off their electric outboard motor. Wild to think that traditional fossil-fuel outboard motors are dumping mini oil spills into the water as a feature, not a bug.

Avikus (from Hyundai) is showing off its autonomous navigator. Autonomy isn’t just for Waymo robotaxis.

Energy & Charging

Lots of innovations are on display, but the emerging risk is that Tesla ends up playing the Google/Apple role, dominating the standards and application ecosystem layer while a long tail of infrastructure and hardware players in the ecosystem struggle to survive.

Samsung is the first to integrate into Tesla’s Fleet API for home energy management. Tesla, not Google or Amazon, may end up dominating home energy ecosystem, much in the way it now dominate EV charging.

FreePower gives a glimpse into the next era of wireless charging. Wireless will open up lots of charging use cases from micromobility to heavy-duty trucking.

Chaevi is showing off an EV charging with automated license plate reader (ALPR) technology. Still so much work to be done to make public charging less painful than a visit to the dentist.

Mocuratec’s Li-Juvenator, POEN, and THOTH’s Eco Dismantler are all focused on the EV battery end-of-life process. It will take a village to scale battery recycling and Redwood Materials can’t do it all alone.

Not yet a subscriber?