🎄The 12 Charts of Christmas- Part 2

Vol 71

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

In this issue’s Deep Dive, we’re winding down 2023 with the 12 Charts of Christmas- part 2. I did this one year ago on a whim and it proved to be quite popular. This time around, we’ve split it across 2 issues, each with 6 charts.

This will be the last newsletter issue this year, with publication set to resume in January. See you in 2024!

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

Aerleum (France): CO2 capture and conversion into methanol for maritime

Ecobodaa (Kenya): Manufacturer of electric motorcycles

Electrek Explorer (United Kingdom): Sustainable travel booking platform

Floatech (Spain): High-performance silicon anodes for EV batteries

Flow Labs (California, USA): Traffic management software

Fr8Labs (Indonesia): Logistics software to aggregate small freight forwarders

ScoutIt (North Carolina, USA): Profit maximization software for end-of-life batteries

VivaDrive (Poland): Fleet electrification and management software

Voltaic Marine (Oregon, USA): Manufacturer of electric leisure boats

Zevo (Texas, USA): Peer-to-peer carsharing for EVs

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Exponent Energy (Vol 11) raised a $26.4M Series B from Eight Roads Ventures, Lightspeed, and others

TotalEnergies acquired the majority of Time2Plug (Vol 30); this represents the 8th exit in the database

Lyko (Vol 31) raised a 1.4M EUR seed round from Afri Mobility and Habert Dassault Finance

BasiGo (Vol 32) secured $5M in debt financing from British International Investment

MoEVing (Vol 35) secured an equity investment (amount undisclosed) from StrideOne

Vammo (formerly Leoparda; Vol 36) raised a $30M seed round from Monashees, 2150, Maniv Mobility, and Construct Capital

MetaFuels (Vol 49) raised $8M from Energy Impact Partners, Construct Capital, and others

As a reminder, the startup data set is open, for free to subscribers. If you’re a subscriber interested in accessing the Airtable with how these startups raised $1.3 billion in follow-on funding, please let me know.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🇨🇴 Bogotá’s leadership in bus rapid transit is fading quickly, as the idea of a new metro gains traction. New builds capture imaginations in a way that operations and maintenance don’t.

🚠 Los Angeles is getting closer to allowing a private operator to build a $500M gondola on public land, connecting Union Station to Dodger Stadium. The ultimate challenge, regardless of transport mode, is to liberate most of the giant stadium parking lot for more productive uses, like much-needed housing.

🏛️ Washington, D.C. may slash its public transit offerings. It’s a mix of the ongoing transit death spiral plus the uniqueness of the D.C. funding setup.

💧The US Treasury continues to struggle to clarify the hydrogen tax credit linked to the Inflation Reduction Act, but did release guidance allowing biofuels to count as sustainable aviation fuel. Corn-based ethanol is particularly thirsty.

🇪🇺The European Union is moving forward with new rights for platform gig workers. Ride hail and last-mile delivery operators are paying attention.

🔬Markets & Research

📦 A new study from friends at Urban Freight Lab looks at the placement of Amazon delivery stations. The communities that order fewer parcels are those that bear the biggest burden.

🏭 Corporates & Later Stage

🎭 The CEO of Stellantis says their EVs are profitable. There’s a widening gap between legacy players who are adapting well to the EV transition (e.g., Hyundai/Kia, Volvo, Stellantis) and those who are struggling (e.g., Ford losing close to $36K per EV sold).

⛔️ But Stellantis is also challenging the California Air Resources Board’s (CARB) 2019 deal with other automakers. Don’t bet against CARB.

↘️ Ford may be set to dramatically slash production of the F-150 electric truck. Ignore media doom and gloom about falling EV demand: US sales are up 50% year-over-year and will surpass 1 million this year. What’s new is that the rising tide is no longer lifting all boats.

🤖Tesla recalled almost 2 million EVs to fix autonomy software. Tesla’s fast-and-loose approach to autonomy is finally catching up with them.

🐇 Tesla, frustrated by legacy carmakers’ continued insistence on the 12-volt standard for low-voltage applications, has open-sourced its 48-volt architecture. Two truths: Tesla is helping the industry move forward and Tesla continues to tempt legacy OEMs into slowly becoming commodity manufacturers in the Tesla eco-system.

📉The purge at GM’s Cruise unit continues, with a large layoff. CEO Mary Barra has been leading GM for over a decade; whether Cruise will be a feather in her cap or a dark footnote in her legacy is TBD.

Enjoy this issue? Share it with 3 people…

🐣 Startups & Early Stage

🔂 Battery swap startup Ample snagged its first major carmaker partner with Stellantis. Stellantis will test the technology in car-sharing operations.

🔄 Chinese EV maker Nio may spin off its battery swap operations as revenue sags. Perhaps with the Stellantis-Ample deal will get investors excited about buying into battery swap.

👩🏽⚖️Prosecutors are recommending that the founder of zero-emissions truck maker Nikola Motors get a decade behind bars. Remember when Nikola’s market cap briefly surpassed that of Ford?

🔔With its Amazon exclusivity arrangement now done, Rivian announced that AT&T will be its 2nd van customer. Rivian is in a race against time to simultaneously grow sales and cut both fixed and variable costs, so every deal like this counts.

✈️ Air New Zealand is buying a Beta Technologies electric aircraft for cargo operations. Expect the first generation of electric planes to focus on lower-risk goods movement rather than high-risk people movement.

🚂 Autonomous electric rail startup Parallel Systems, founded by SpaceX alums, is piloting its technology in Australia. There’s a growing number of startups founded by Tesla & SpaceX alums focused on sustainable mobility in the verticals yet to be majorly impacted by electrification (boats, planes, rail, etc.).

🛴 18 months after raising $125M, micro-mobility sharing co Superpedestrian is shutting down its US operations and trying to sell its European operations. The new year may bring a similar fate for Bird and Tier.

Not a subscriber yet?

DEEP DIVE: The 12 Charts of Christmas: Part 2

In the non-denominational spirit of the “12 Days of Christmas”, here’s the second set of 6 charts that should orient you to some of the big sustainable mobility issues as we wind down 2023.

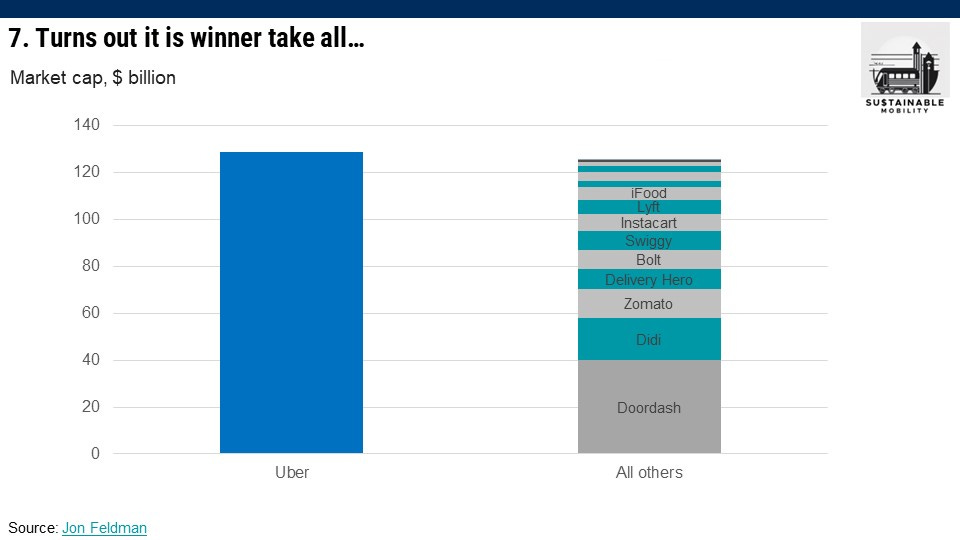

It took a long time with lots of bumps along the way, but ridehail has definitively entered its winner-take-all era. Lyft has roughly a 30% market share in the US, but only about 5% of the market cap of Uber.

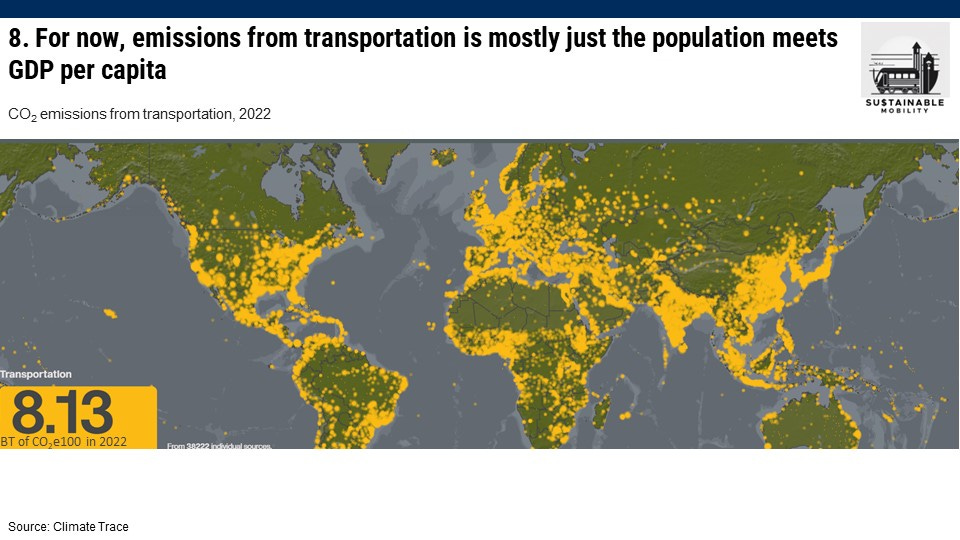

Climate Trace got a major data upgrade this month, allowing you to visualize greenhouse gas emissions at a very granular level. Some day, a visual like this will help us see how countries and cities have decoupled transportation emissions from economic activity, but for now the map looks very much like population meets per capita income.

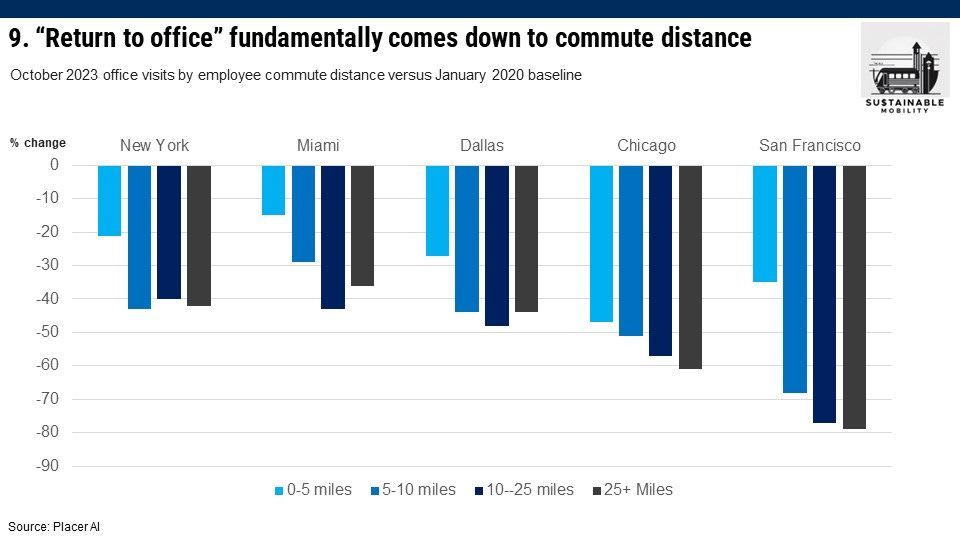

Still wondering what it’s going to take to get people back into the office more frequently? Look at the difference in office visits between those who live 0-5 miles away from work and those who are further out.

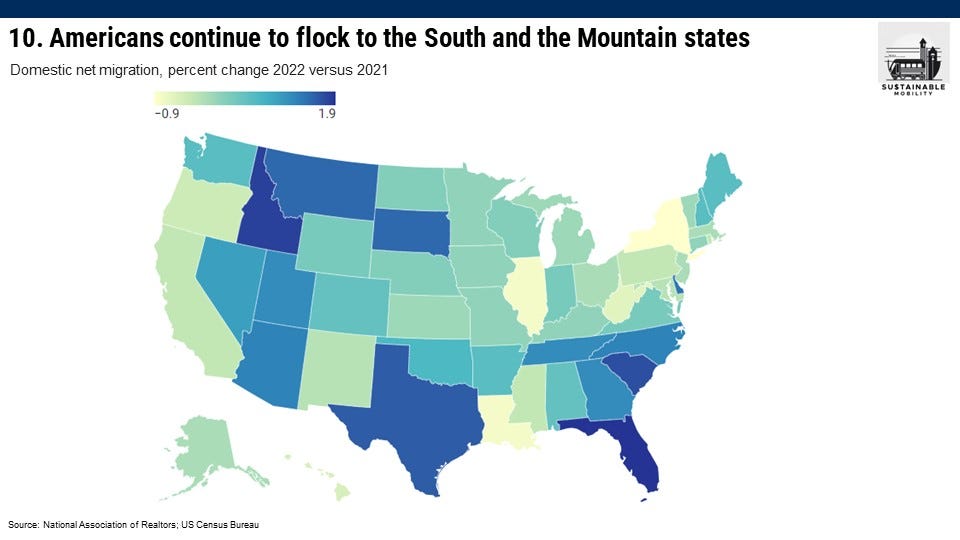

Americans continue to move away from states with functioning public transit systems (e.g., New York, Illinois) towards those without robust transit.

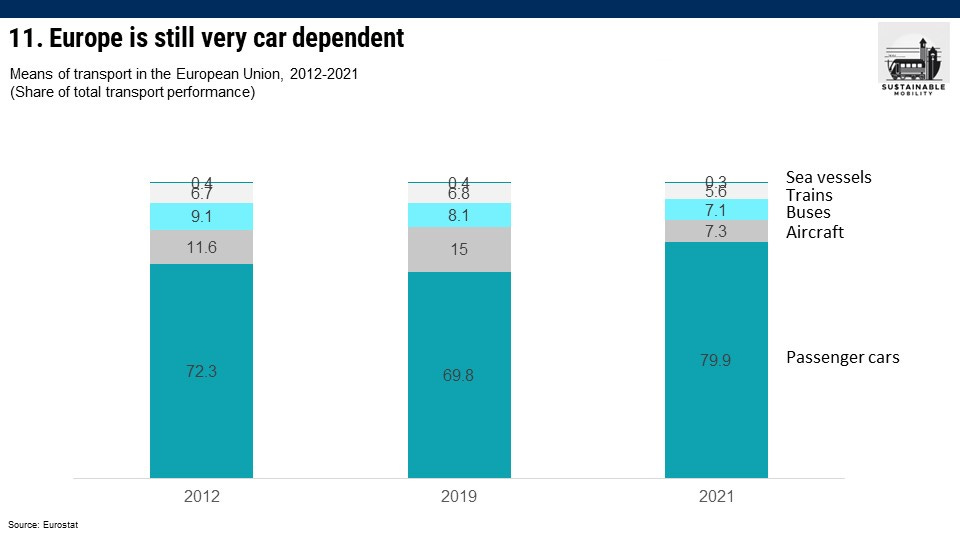

Ever think that Europe’s got it all figured out on the transportation front? Not quite. As data comes in for 2022, we will get a better sense of whether the pandemic actually made Europe more car dependent than a decade ago.

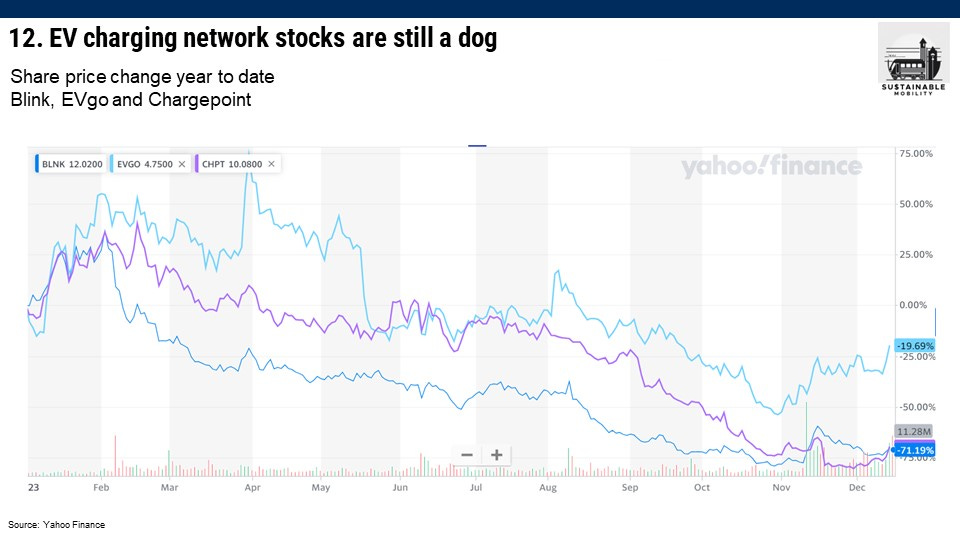

EV sales are up 50% this year. The Feds have unleashed billions to support the EV charger network buildout. But in a year where the S&P went up by 23%, the stock prices of the publicly traded charging network stocks fell about 20% to 70%. If the public operators want to reach financial stability, they have work to do on their business model (operations and maintenance, customer engagement, etc.).

Enjoy this issue? Share it with 3 people…

Thanks for reading! See you next year.