This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s Deep Dive is focused on New York City’s epic battle to implement congestion pricing, which would make it the first North American city to do so.

Some personal news: Last week, I joined the most recent cohort of Recast Enablement, a program for emerging fund managers in the venture space. Also, I’ve become a scout for Enduring Planet, a fantastic funding solution for cleantech startups to get revenue-based financing and grant advances. I also had a chance to join the Capital Light Assembly podcast to talk about all things contract manufacturing in mobility.

Also, I’ll be in Europe in a few weeks. There will be a mobility happy hour in Paris on March 13 and in Brussels on March 14; send me an email if you would like to join us.

Submit startups & ideas for the newsletter here.

🌱STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

AeonCharge (Washington, USA): One app to book and pay for any EV charger in the US

Assembly (California, USA): Software for virtual power plants powered by EVs

BaTTeRi (Israel): A DC mobile charging-as-a-service robot for parking lots

Blue Innovations (Florida, USA): Manufacturer of electric leisure boats

CO2Rail Company (Washington DC, USA): Direct air capture system for trains powered by regenerative braking

EV Realty (California, USA): DC fast charging infrastructure solution for commercial EV fleets

La Wawa (Venezuela): Digital microtransit solution

MetaFuels (Switzerland): Sustainable aviation fuels from green hydrogen and CO2

Pointz (Rhode Island, USA): Consumer app (mobility aggregator) for cyclists and scooter riders

Signol (United Kingdom): Software to help employees in aviation make real-time carbon-based decisions

💰FUNDING: Capital raises and updates from startups previously featured in Startup Watch

BuuPass (Vol 25) raised a $1.3M pre-seed round from Founders Factory Africa, FrontEnd Ventures, and others

Torev Motors (Vol 40) was awarded an undisclosed amount of funding through the Virginia Innovation Partnership Corporation

Reminder: The startup data set is open, for free. If you’re a subscriber interested in accessing the Airtable with all the raw data on 300+ companies, please let me know.

📰QUICK HITS: Notable news from the last two weeks

Frankfurt is getting rid of on-street parking (except for handicapped and delivery vehicles) in the city center (article in German). Lots of European cities are about to undertake a parking diet, if they haven’t done so already.

Dubai has unveiled plans for a 93km-long "sustainable urban highway” for cyclists and pedestrians. Dubai has a long history of big projects, but little traction on sustainable urban life.

In the center city of Brussels, the new traffic plan has resulted in a 20% reduction in car use. A good reminder that congestion pricing isn’t the only way to reduce traffic.

New York is clamping down on pollution near e-commerce warehouses. It’s getting harder for communities to love warehouse jobs, especially as they become more automated. Watch this video to see how high-tech an Amazon fulfillment center can get.

New Jersey has now joined New York, California, and the European Union in ending internal combustion engine (ICE) car sales by 2035. In reality, many car manufacturers will move more quickly, at least in developed markets.

In an open letter to the EU Commission, 30 leading companies such as SAP, Unilever, and Tesco have proposed a ban on ICE company cars from 2030. Such a measure would be deeply meaningful in Western Europe, where company cars can often represent 50% of vehicles sold.

The 15 minute city concept has become a rallying cry of UK conspiracy theorists. Quite the communications challenge to be overcome.

Railroad fiascos abounded, with a toxic train wreck in Ohio, and the resignation of Spain’s secretary of transport over a massive rail procurement error. Overall, the rest of the world will continue improving rail while the US is stagnating.

The Economist showed how young people all over the developed world are falling out of love with cars; the Y-Combinator message board went wild with reactions. This is a great, comprehensive article, but don’t get too excited yet - it can take a decade just to confirm a trend like this.

Tesla agreed to open up its Supercharger network in the US to rivals to access federal funds. Keep an eye on how Tesla’s execution (e.g., getting Tesla’s app in the hands of non-Tesla drivers) keeps the Tesla Supercharger flywheel going.

Tesla is also inching closer to announcing a factory in Mexico. Tesla appears to be slowing investment in Europe in response to the opportunities afforded by the US Inflation Reduction Act.

Ford undertook layoffs in Europe, citing the smaller labor force needed for EVs. I believe this is the first automaker on record citing EV-related layoffs, but it certainly won’t be the last. Related: VW is having employees use escape room simulations to manage their EV employment concerns.

Ford also unveiled a battery joint venture in Michigan with China’s CATL and suffered some serious blowback. It was an expedient solution, but another in the long list of recent Ford missteps on execution.

bp purchased Travel Centers of America, the national full-service truck stop chain. This acquisition isn’t really about selling more diesel fuel; heavy-duty electric trucks just found their logical charging hubs.

Amazon’s Zoox unit started deploying its self-driving vehicles on public roads, albeit only for employees, while Tesla had to recall over 300,000 vehicles due to “Full Self Driving” risk. Some players like Waymo, Cruise, and Zoox are moving in more measured paces; others are not.

Google is improving Google Maps to make it friendlier to EV drivers. Google Maps remains slow to innovate, so this is more than welcome.

Privately-held micromobility operator Lime claimed to reach profitability. Lime is earning a reputation as the operator of reference over Bird.

In the San Francisco Bay Area, utility PG&E partnered to launch California’s first zero-emission electric ferry. For more about maritime decarbonization, see Vol 29.

Activists blocked private jet terminals, again. The sector will inherit the “fur is murder” wrath until private jets move towards zero-emissions.

United Airlines unveiled a new fund for sustainable aviation. Look for a deep dive on this topic next issue.

🤿DEEP DIVE: Is New York City on the Cusp of Making Mobility History?

To make meaningful impact on our climate goals, transportation electrification is a necessary but not sufficient step. There’s a “yes and” required to hit both our emissions and traffic decongestion ambitions in cities that involves greater use of travel choices like public transit and active transit and less use of inefficient urban modes like private cars.

The good news is that we have quantified the most effective way to do it. The bad news is that it’s really politically difficult. And that’s why New York is worth watching this year.

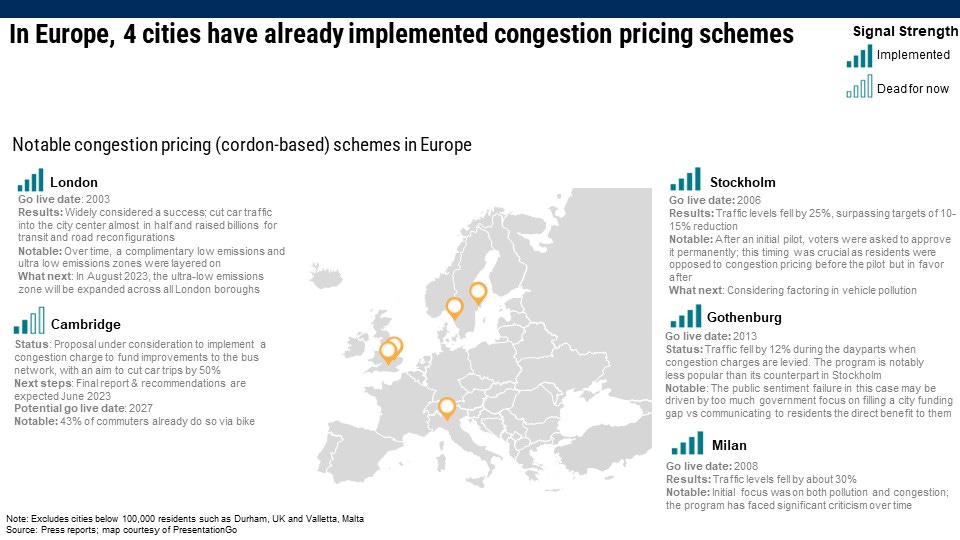

To reduce private car usage in cities, research indicates that the most effective intervention is “congestion pricing”, a fee imposed on drivers entering congested cities. (Note: this Deep Dive will focus on area-wide and cordon-based schemes, where an entire zone is subject to a congestion scheme; urban toll roads are excluded from this analysis, as are pollution-only based schemes like those in Birmingham.) Singapore pioneered the implementation in 1975 with a fee to enter the restricted zone by car, and reduced traffic by 20% within months.

Despite the clear impacts on congestion, the concept is somewhat of a “white whale” in urban planning given how much of a political landmine it can be with voters.

In Europe, four major cities adopted congestion schemes, resulting in traffic decreases of 10%-30%. Some, like London and Stockholm, have been popular with residents while Gothenburg and Milan have been less so.

The situation in North America, on the other hand, is quite different. Over the last decade or so, it felt like a city in Canada or the US was finally going to catch up to Singapore and the Europeans with a congestion pricing scheme.

The turbulence of the last several years blunted that momentum. Projects that once seemed ready for prime time in Vancouver, San Francisco, and Seattle were scuttled for reasons that included changes in pandemic-influenced commute behaviors and execution concerns about how to ensure that lower-income commuters were treated fairly.

That’s not the case, however, in New York City. Despite opposition from some of the outer boroughs and New Jersey, politicians in New York City and the state capital Albany are determined to push forward with a fifteen-year-old plan to charge for vehicular access to Manhattan below 60th St. The plan currently awaits federal approval; the Biden administration is likely more concerned with how to properly execute the plan rather than whether it’s worth doing.

Despite the massive technology undertaking that such a scheme involves, it’s still not a solid fit with the venture capital model. City adoption patterns are currently too few and too infrequent to create a pattern. And even if the tide turns in favor, cities may opt more for large-scale IT implementation firms like IBM and Accenture as opposed to more agile software startups like ClearRoad and UpRoad. For now, the venture-heavy activity is in the adjacent space of digital parking & curb management, areas where cities and startups are experimenting with great frequency.

Either way, keep an eye on NYC. Potential success in New York will provide a shot in the arm to more nascent efforts in Los Angeles and Boston, and potentially revive discussions in places like Vancouver, Seattle, and San Francisco.