🏎️ Uber founders in climate

Vol 77

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

I will be one of the MCs at the upcoming Curbivore conference in Los Angeles on March 28 and 29. Readers of the newsletter get a special code for $20 tickets: Sustainable20

In this week’s Deep Dive, we’ll look at the Uber alums who are founding the climate tech and mobility companies of our era. This is a follow up to volume 74 that looked at Tesla and SpaceX alums in climate startups.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Anelo (Australia): Consumer software for EV charging and payment

Conifer (California, USA): Manufacturer of electric powertrains

Fused (California, USA): Next-generation mapping software

Green Yachts (California, USA): Electric conversions for maritime commercial vessels

Kaiyo (Washington, USA): Marine algae for use in biofuels

Mantaray Climate (Australia): Software to help small businesses decarbonize, including transportation

Moonware (California, USA): Software to automate airfield operations

Motowatt (France): Manufacturer of electric motorcycles

Propel Aero (Michigan, USA): Manufacturer of electric powertrains for aviation

Velodrive (Ireland): Manufacturer of 4-wheeled micromobility

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Rolling Energy Resources (Vol 33) has been acquired by ev.energy; this is the 11th exit in the database

Magpie Aviation (Vol 54) has been acquired by Ampaire; this is the 12th exit in the database

Telo Trucks (Vol 54) raised $5.4M from Neo and Spero Ventures

As a reminder, the startup data set is open, for free to subscribers. If you’re a subscriber interested in accessing the Airtable with how these startups raised $1.7 billion in follow-on funding, please let me know.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🚲 In New York City, bicycle deaths are on the rise. The city is grappling with a new type of fatality: e-bike drivers who didn’t collide with a vehicle or pedestrian in their death.

🤖 Bus drivers in the Columbus area have a new contract that requires union approval for adoption of autonomy in buses. As autonomy begins its gradual deployment, unions are pushing back, even those in industries with chronic driver shortages.

🚚 The US Joint Office of Energy and Transportation and the Environmental Protection Agency have issued a national Zero-Emission Freight Corridor Strategy. While not a funding commitment, the study will strongly influence where the public and private sectors invest in heavy-duty EV chargers (and, to a lesser extent, hydrogen).

📈 The US Securities and Exchange Commission made imperfect progress by mandating emissions disclosure for scopes 1 and 2, but not 3. Alas, the EU and California will move the market in the meantime; see Deep Dives in Vol 25 and Vol 65 for more.

💧The European Commission's Joint Research Centre says major subsidies will be needed to help hydrogen vehicles compete against battery electric ones. Some of the remaining hope for hydrogen vehicles is based on geo-political concerns about China’s dominance of the battery supply chain.

🛰️ MethaneSAT, a satellite funded by a nonprofit, will collect data about methane leaks from 300 locations worldwide. The non-profit hopes to shame oil and gas companies for highly polluting methane leaks; among other uses, methane is an alternative fuel in heavy-duty vehicles.

Not yet a subscriber?

🔬Markets & Research

‼️ New data from Stable Auto shows that the public charger utilization rate in the US doubled last year, from 9% to 18%. High utilization rates may be a necessary but insufficient step for a well-functioning public charger industry.

🔋 A new study shows that using EVs for vehicle-to-grid (V2G) applications has minimal impact on battery life. This increases pressure on car makers to open up their batteries for V2G.

📉 In the UK, emissions are now at their lowest levels since 1879. The bad news is that transportation is the main barrier to further progress.

🏭 Corporates & Later Stage

🇦🇺 Tesla, Polestar, and VW, wanting more stringent emissions targets, have left the Australian auto lobbying group. Australia lags far behind its developed market peers in regulating vehicle emissions.

📦 Volvo Group’s Mack Truck unit has unveiled an off-grid charging unit. Mobile charging is becoming more common as a way to avoid waiting years for permitting and interconnection on heavy-duty charging.

🚐 Belgian bus maker Van Hool may go bankrupt after missing the electric bus transition. While Van Hool was a marginal player, this should be a sounding call for other vehicle manufacturers who are slow on the electric transition.

📲 Uber has launched a feature to allow riders to track emissions savings. Perhaps one day consumers will be as fluent in CO2 per trip as they are in $ per trip.

🛬 A Boeing whistleblower was found dead the day after providing testimony against his former employer. For more on the climate implications of Boeing’s woes, see last issue’s Deep Dive.

🛢️ Saudi Aramco may mine lithium in its oilfields. That’s in contrast to oil majors like Exxon, who are looking to mine lithium from brine.

🐣 Startups & Early Stage

🔌In an effort to reduce recharge times, Volvo Cars has invested in battery management software startup Breathe Battery. This further underscores the importance of software in EVs.

🛴 Swedish micromobility player Voi raised $25M, showing there’s life still in micromobility. On the other hand, the company has raised over $540M and is valued at around $380M.

DEEP DIVE: Uber Alums in Climate

A few issues back, I wrote about the proliferation of climate startups founded by alums of Tesla and SpaceX.

But there’s another group who are the darlings of VC investors: alums of Uber. Allison Barr Allen of VC fund Trail Run Capital, an Uber alum herself, is kind enough to share her list of over 300 startups led by Uber alums.

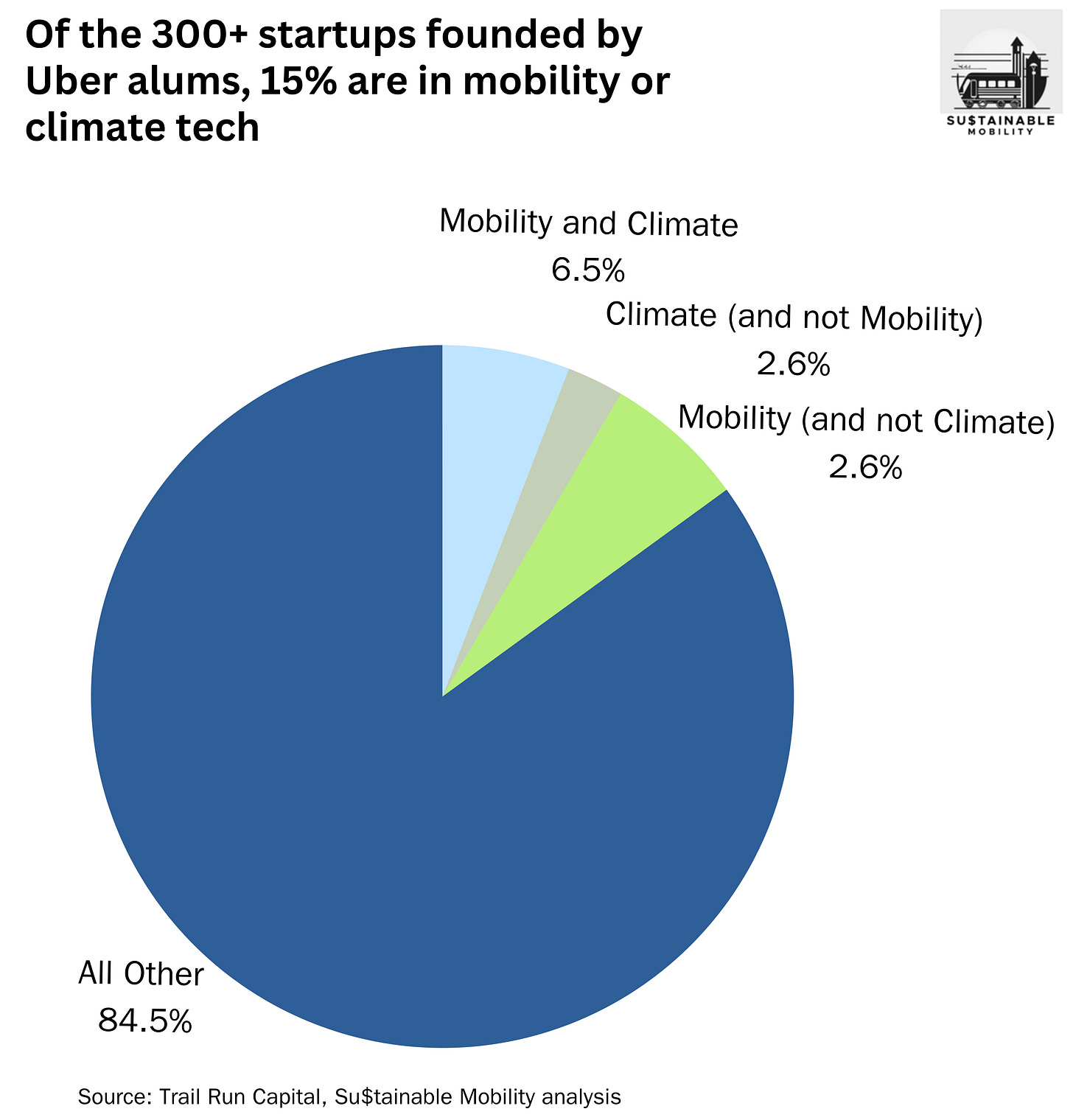

This prolific bunch has a strong bias towards areas like fintech and workforce solutions. But given the breadth of Uber, it’s no surprise that a large number of founders focus on climate, mobility, or both.

So what exactly have these founders launched? The most striking thing about the crew below is the degree to which they launched firms in spaces that Uber once coveted and subsequently deprioritized. Uber’s trucking ambitions were once enormous, but more recently the company has debated spinning off its Freight unit. Similarly, Uber spun off its Jump micromobility business to Lime in exchange for equity in the micromobility startup.

And while some of these companies have themselves already peaked (e.g., Bird), there’s multiple seed stage businesses in this cohort aiming to become the next marketplace or SaaS success story in climate.

Not yet a subscriber?