This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

In this issue, we’re celebrating the one-year anniversary of the newsletter. With now over 200 startups in the Startup Watch database, it’s a great time to sift through the data and see what lessons emerge. So this issue’s deep dive is a portfolio analysis of sustainable mobility startup funding.

Also, I’ll be speaking at Move America in Austin, Texas Sept 27-28. If you’re going as well, please let me know!

QUICK HITS: Notable news from the last 2 weeks

🏔 Denver’s e-bike program is a massive success. Denver gave e-bikes to 13 low-income workers, who were soon taking a whopping one-third of their trips by e-bike. It’s hard to find any sustainable mobility spending that can match that kind of ROI.

🗽New York City may ban e-bikes in public housing out of fear of fires. We do not ban kitchen sinks in housing because some have overflowed and caused water damage. We should not ban e-bikes for similar issues, especially given how amazing they can be in reaching our sustainable mobility goals.

🥖 In Paris, the “republic of super neighbors” is showing how we can make streets thrive. This is a fantastic return to the pre-automotive logic, where the city streets belonged to the people.

🏴 Wales lowers the speed limit to 20mph in cities. There’s fantastic data to show that lower speed limits for automobiles in cities improves safety but doesn’t hurt travel time for automobiles.

🇨🇳 A new International Energy Agency report shows just how much of the downstream market for EV batteries is dominated by China. Time for North America and Europe to step up their game. Quickly.

🚫 The Guardian asks whether cars should be banned from cities. It’s a fair question.

🪖 GM announced a nationwide EV charging network with Pilot Co and EVgo. Danger awaits OEMs who make customer promises in the EV charging network space while outsourcing charging network execution to third parties who have different interests. This isn’t just service level agreement issues, it’s also fundamental UI/UX.

Ford announced big plans on EV materials and batteries. It’s great to see more car companies launch more lithium iron phosphate (LFP).

🧭 Google Maps launches adaptations for EV drivers. The rate of change in Google Maps and Waze over the past decade has been glacial. There’s a genuine innovation opportunity for startups in this space.

🛟 Walmart gives Canoo a lifeline with a 4,500 electric van order. This may be less about Canoo’s prowess in vans and more about Canoo moving from LA to Bentonville, Arkansas as well as Walmart’s ardent desire to avoid procuring electric vans from those committed to Amazon, such as Rivian and Stellantis.

🇻🇳 Vietnam’s Vinfast launched 6 EV showrooms in California. It’s been a while since we’ve had a Hyundai-type breakthrough from an emerging market player, but Vietnam is nothing if not tenacious.

💣 VW announced that VW of America CEO Scott Keogh was appointed “President and CEO of Scout, an independent company that is being established in the U.S” (italics added). This is code that VW is open to outside investors for Scout and that VW, like Ford, is going to rip up the traditional dealer model for Scout and instead pursue direct sales like Tesla and Rivian. VW and Audi dealers were nervous this would happen; they loathe the idea of competing with their car manufacturer for retail customers.

💣💣 VW dismissed their global CEO without explanation. Rumors abound about whether the reason was an office HR issue, Deiss’ communication style, or some sort of backlash to the aggressive EV plan he implemented.

🙈 The “Uber files” have dropped, reminding us of the Travis Kalanick-era Uber. I agree with those who say this doesn’t unveil much about Uber we didn’t already know, but I do think it sheds some light on regulatory capture within Europe.

🤖 Tesla loses its self-driving lead. The company’s “full self-driving” has had frequent delays; losing its lead just months before this year’s supposed launch doesn’t inspire confidence.

🧾 My employer LACI is again procuring some innovative mobility solutions for e-bikes and EVs in LA. Startups selected are additionally eligible for application for LACI’s later-stage Market Access program, joining companies like Envoy, Zoomo, Automotus, and Pedal Movement.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

Bavertis (Germany): Software-based power electronics for e-vehicles that increase battery lifetime and range

Janus Electric (Australia): Battery swap for heavy-duty vehicles

Juice Serve (United Kingdom): Autonomously operated EV charging

Mobilyze.ai (Massachusetts, USA): Buy now, pay later for EV charger install

Rolling Energy Resources (Colorado, USA): Smart charging software interface between utilities and automakers

Slé (Massachusetts, USA): Mobility aggregation app w/Fitbit for CO2 gamification

Spoke Safety (Colorado, USA): Cellular V2E for micromobility safety

FUNDING: Capital raises from startups previously featured in Startup Watch

XFuel (vol 6) raised 8.2M EUR from AENU, Union Square Ventures, and SOSV/HAX

Ride Beyond (vol 25) raised $100k from Google Latino Founder Fund

DEEP DIVE: PORTFOLIO ANALYSIS ON THE SU$TAINABLE MOBILITY STARTUP DATABASE

In each issue’s Startup Watch section, I share a handful of startups that have come across my radar screen. To celebrate the one-year anniversary of the newsletter, I’m sharing a bit of portfolio analysis of what has been learned so far.

Of the 212 startups posted over the last year, the average company had raised about $432k in funding across equity, debt, and grants by the day they were published in Startup Watch. (Note: If no reliable funding information is found at the start, $25,000 is used as a placeholder.)

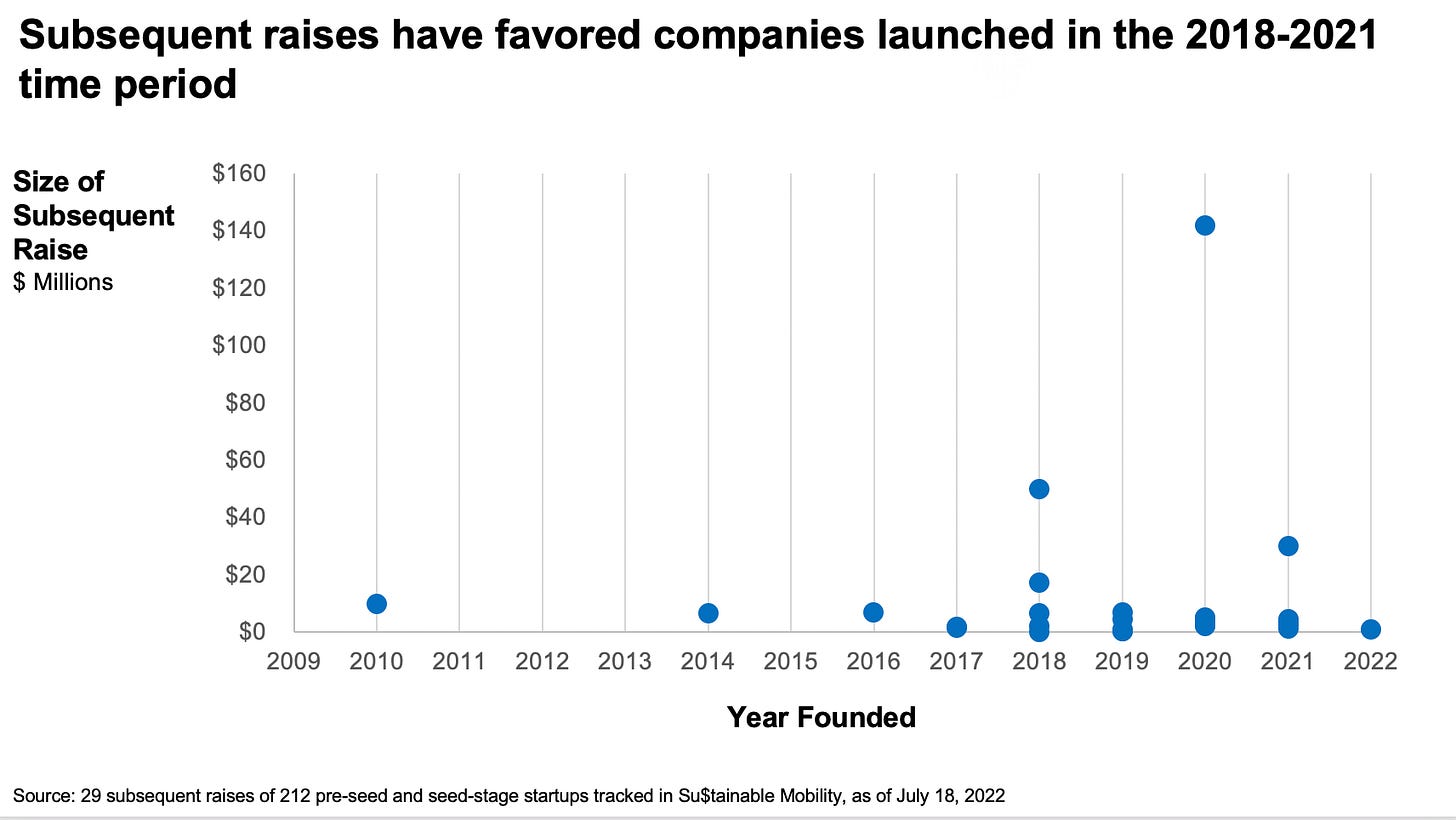

Since then, of those 212, 29 companies have raised subsequent capital, bringing the portfolio to an average of $1.97M raised. We’ll call that 4.6 ratio between initial raise and total funding as the Fundraising Multiple. Looking back, I was surprised by the small number of raises across this group, but impressed at the overall dollar amount of funds raised.

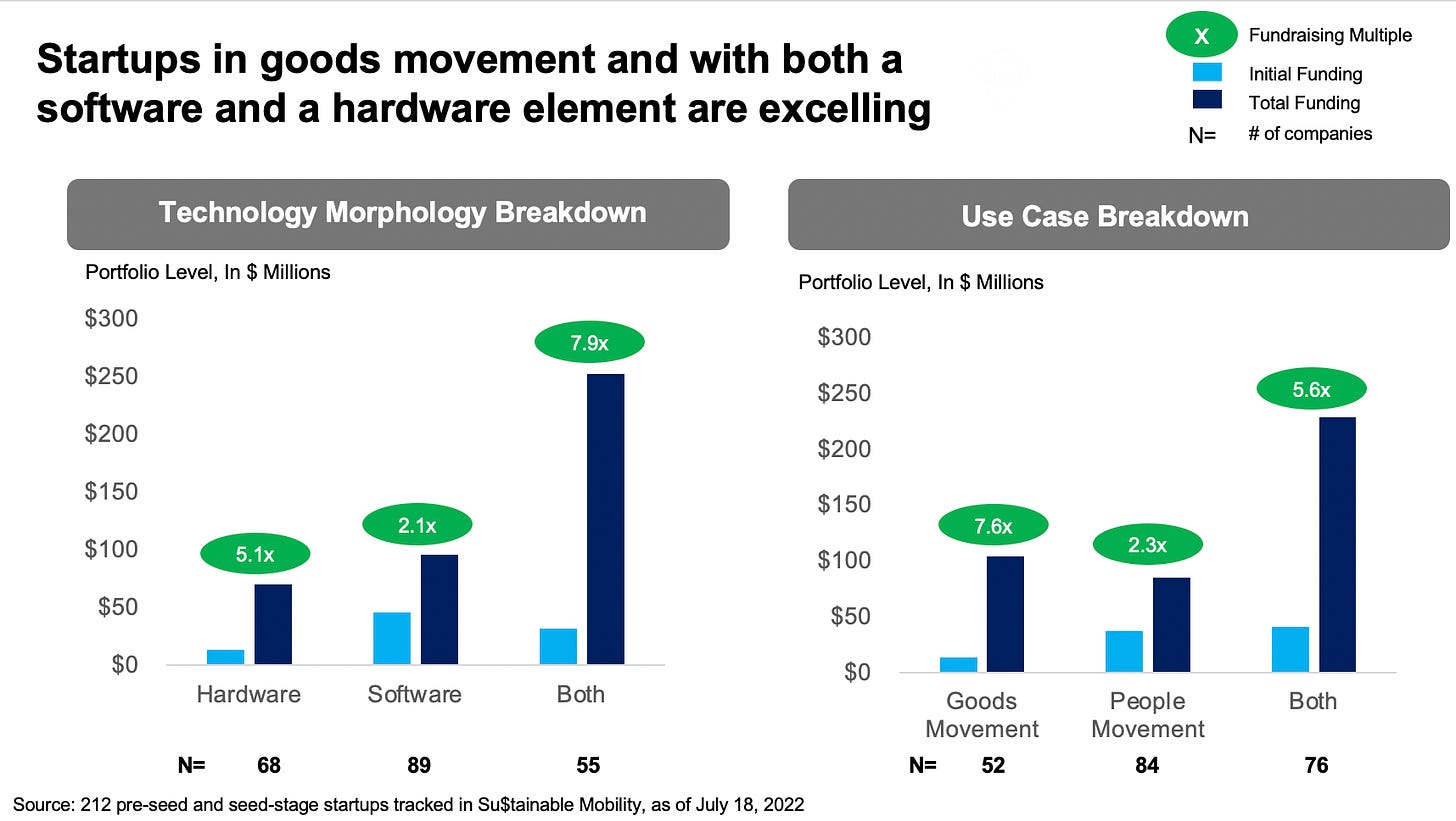

By diving deeper into Fundraising Multiples we start seeing some fascinating insights in terms of technology and use cases:

It doesn’t surprise me to see that the goods movement is taking off; in the words of a now-departed daytime talk show host “she is the moment.” People movement had earlier waves of EVs and scooters. It’s only in the last couple of years that we’ve had the technology to start decarbonizing medium- and heavy-duty trucks, along with the form factor innovation of last-mile micro-mobility solutions. From a tech morphology standpoint, I’m pleasantly surprised to see that combinations of hardware and software are winning the day.

For the next step, startups were categorized according to 11 business verticals. This is inherently subjective, as one person’s medium- and heavy-duty trucking play is someone else’s fleet management play. Such is the nature of business innovation.

At the sub-segment level, I was surprised by the discrepancy between maritime and aviation. My best guess is that there haven’t been many notable early-stage maritime decarbonization plays until the last few years, while notable zero-emissions aviation companies such as Zero Avia and Joby came on the scene over 5 years ago. Some of those aviation players have since gone public; they are, of course, excluded from this database, which started tracking companies in the pre-seed and seed stage one year ago.

Looking forward, I believe that batteries and fleet management are poised for significant investment while I expect the tepid response on cars and micromobility to carry on.

I’d be remiss not to provide a bit more detail about the subsequent raises of companies. Of the 29 raises, most were by companies launched in the 2018-2021 timeframe.

Given the recent downturn in the funding market, it means the next year will be interesting for the remaining 183 who haven't publicly announced a subsequent raise. Some of them will go on to great raises, some have already raised but haven’t communicated (e.g, bridge rounds), some will not need or want external funding, and some will surely flameout. Stay tuned for what next year’s data roundup reveals. And more to come in subsequent data analyses.

Finally, I’m excited to share with you that I am making the startup data set open, for free. If you’re a subscriber interested in accessing the Airtable with all the raw data about the 212 companies, please let me know below. Who doesn’t love free data? Thanks for joining along so far on the journey!

Also, I’m toying with future iterations of the database (e.g., who is approaching a capital raise, some external validation of readiness for funding). So drop me a line with any ideas. And if you’ve read this far, please share with someone!