🍋 Is Lime proving that there's life in shared mobility after all?

Vol 64

This newsletter aims to separate the signal from the noise for making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

While Su$tainable Mobility normally publishes every other week, this is a special issue so that you can be fully prepped for Climate Week NYC! Also I’ll be speaking at Move America in Austin, Texas (Sept 26-27). Let me know if you’ll be there.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Allye (United Kingdom): Home energy storage from crashed EV batteries

Elby (Denmark): Curbside charging solution for buildings

Entroview (France): Software for battery diagnosis

HubOn (California, USA): Green delivery logistics network using local merchants

Hydroplane (California, USA): Hydrogen fuel cell powerplant for the general aviation

Iona Drones (United Kingdom): Zero-emission autonomous drones for goods delivery in low population density areas

Muon Vision (Massachusetts, USA): X-ray imaging for sustainable mineral deposit identification

Novali (Belgium): Next-gen lithium-ion cells

Roundtrip EV Solutions (Connecticut, USA): Electric trucks as a service for the waste industry

Verdethos (New York, USA): Supply chain decarbonization software

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Tap Electric (Vol 15) raised a 1M EUR Seed round from Fair Capital Partners Impact Investing, LUMO labs, and Shamrock Ventures

Princeton NuEnergy (Vol 24) won a $4.4M grant from the US DOE

Evolectric (Vol 27) announced a $15M investment from Seismic Capital

Theion (Vol 47) secured a corporate investment from Enpal (amount undisclosed)

Enjoying the ability to track the next cleantech startups? Share this issue with 3 folks:

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🏙️ NYC is making both sides angry in its early work to regulate e-cargo bikes. One of micromobility’s disadvantages: it can frustrate both automobile drivers and pedestrians.

🐻 Did a California state senator being overweight lead to improved biking laws? Hopefully Ozempic’s success won’t prevent more biking progress.

🇫🇷 France will push for a European Union-wide minimum price on air flights in an effort to combat climate change. France is leading the pack globally with a multi-prong strategy to reduce climate impacts from air travel.

🇫🇷 France is imitating Germany with a national monthly rail pass. That’s about half of EU GDP covered by a national rail pass.

🇮🇹 Italy is delaying plans to keep diesel-powered cars out of cities in the Piedmont region. Italy is struggling to match the pace of Germany and France on climate action.

🇪🇺 The European Union is launching an inquiry into whether Chinese automakers are unfairly competing on EVs. Germany and France are belatedly united in concern, but some of the EU’s accusations don’t hold much water.

🔬Markets & Research

🪨 What could be the world’s largest lithium deposit was discovered in Nevada near the Oregon border. More known lithium deposits in more countries helps reduce geopolitical tensions, but the bigger bottleneck is on refining capacity. See a reminder in the Deep Dive in Vol 41.

🇨🇭Swiss students have broken the world record for vehicle acceleration using an EV. 0-100km/hr (0-60 mi/hr) in under a second, while dangerous, is a good reminder of how fundamentally different EVs are from internal combustion engines.

⚡️The US DOE launched a new white paper on the potential of virtual power plants (VPPs). VPPs will be a key tool to ensure that the electrical grid can handle EVs.

🎬 Rocky Mountain Institute (RMI) shared what the end of the internal combustion engine car could look like. One of the key assertions here is that peak oil demand from cars has already been reached, thanks in part to China’s quick pivot to EVs.

🏦 Al Gore’s Generation Investment Management launched their 2023 Sustainability Trends Report, including with a section on transport. The section includes a shoutout for congestion pricing; see Vol 49 Deep Dive for more on congestion pricing.

🏭 Corporates & Later Stage

🥊 The UAW went on strike against Ford, GM, and Stellantis. The union has $825M in its strike fund and will pay $500 per week to each of its striking members, so for now it’s striking at only 3 plants. As this drags on and potentially spreads to other plants, keep an eye out for Tesla to win back EV market share. More in Vol 63 Deep Dive.

🍎 Apple committed to being carbon neutral across its entire value chain by 2030. That includes a commitment to move more towards ocean and rail freight, away from air.

👨🏾💻 Amazon has launched an open-source software project to determine priority locations for logistics EV charging in Europe. When you’re the market leader, open sourcing your plans can help keep your competitors a step or two behind.

💳 EMVCo, the payments body backed by the major credit card providers, has launched an Electric Vehicle Open Payments Task Force. Be ready, again, for a Tesla-centric approach and an “others” approach.

⚓️ The family behind shipping giant Maersk has formed a green methanol startup for maritime. The family owns 80% of the startup while Maersk owns 20%.

🚲 Trek is getting into the circular economy of bikes. Car companies have long monetized used car operations, now bike companies might too.

🐣 Startups & Early Stage

⛽️ United Airlines agreed to buy up to 1 billion gallons of sustainable aviation fuel made from recycled carbon dioxide under a deal announced with startup Cemvita. That’s one third of the 3 billion gallons of SAF per year by 2030 that the Biden administration is targeting.

🪖 eVTOL manufacturer Beta Technologies is installing the first electric aircraft charging station at a U.S. Air Force base. Notably, the charger is designed to recharge both aircraft and ground electric vehicles.

💧Hydrogen aviation startup Universal Hydrogen cleared an FAA hurdle. As a pioneer, Universal Hydrogen is going to be setting the bar by which other hydrogen aviation startups will be judged by.

🚐 Mexican startup Kolors acquired Urbvan, a B2B transportation mobile app, from Middle East-based SWVL for $12 million cash. That’s roughly the amount raised by Urbvan to date.

🧑🎓 Is school bus startup Zum leaving students stranded? A good example of wanting to move fast meeting the realities of the labor market.

🤖 The founders of Argo AI have secured a $1B investment from Softbank (not the Softbank Vision Fund) for Stack AV, an autonomy startup focused on trucking. Time will tell how having Softbank as the sole investor works out.

DEEP DIVE: Is Lime proving that there’s life still in shared mobility?

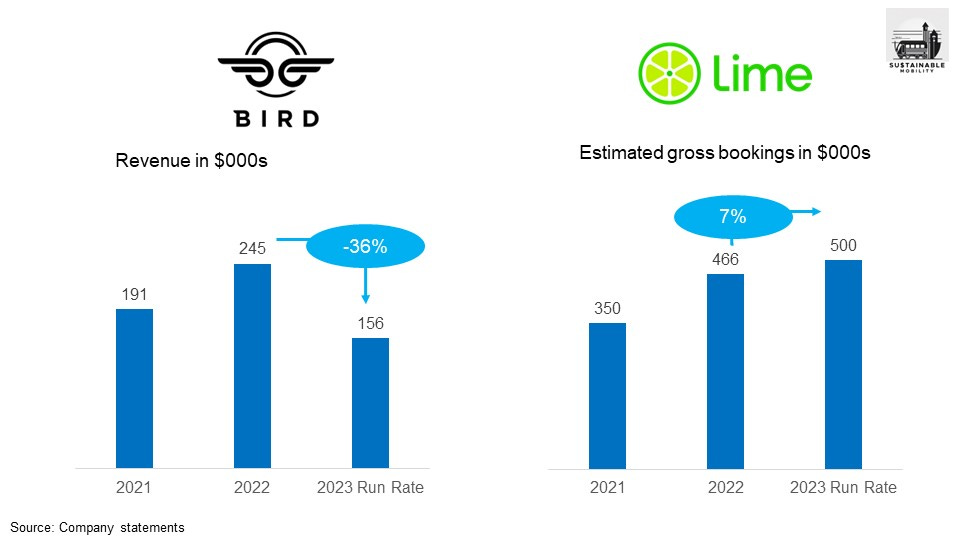

Investors have long ago written shared mobility off as a disaster. Bird went public via SPAC in November 2021 at $8.40 a share and now trades at $.81, down about 90%. With a market cap of about $10M, Bird is valued roughly on par with a seed-stage startup.

But maybe there’s a tiny glimmer of hope for the category. For the last 18 months or so, Lime has been dropping hints that it’s getting ready for an IPO. Earlier this week, Lime noted that gross bookings (not the same as revenue) in the first half of this year was up 45% over the same period last year and that it reached real world EBITDA profitability.

So is Lime bluffing or have they cracked the code in a way that Bird can’t?

There’s definitely some skepticism on Lime’s numbers. As a publicly-traded entity, Bird must report its losses accurately on a consistent basis. Privately-held Lime can share what it wants, when it wants, and with a lot of spin, at least until it files the appropriate documents with the authorities regarding intentions to go public

On the other hand, Lime did pick a different approach on operations than Bird. Lime, for example, to choose to invest in swappable batteries, a decision Bird vocally avoided. Similarly, Lime reports aiming for five years of scooter life while Bird last commented on two to three year target.

Alas, this might be a case of Lime winning the scooter battle and no one ultimately winning the scooter war. Lime’s peak private valuation was $2.4B in 2019. By 2023, investors have plowed $1.5B in the hopes of reaching an exit. For many of Lime’s investors, just getting some money back on their investment in an upcoming IPO may be the best outcome.

That’s the update on all things schools, airports, batteries, and bikes so that you’re ready for Climate Week NYC!

Enjoyed this issue? Share it with 3 friends in your network: