This newsletter aims to separate the signal from the noise for making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week’s Deep Dive is on how electrification is driving the potential United Auto Workers (UAW) strike next week.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Ammobia (California, USA): Distributed green ammonia production

AMPD.CAMP (Washington, USA): Software to turn electric RVs into vehicle-to-grid assets

Arinto (Germany): Software for shipping operators to determine the optimal time for ships to arrive, improving the efficiency of trips

Battri (France): Lithium-ion battery recycling

EvolOH (California, USA): Low-cost electrolyzer hardware

Goodwings (Denmark): Sustainable travel management system for employers

Kwest (Germany): Field operations automation software for the energy transition, including EV charger install

PontoSense (Canada): Measuring human movement & vital signs for multiple applications, including safer mobility

Qilo (Illinois, USA): Software to help electric grids forecast demand, including from EVs

Salient Motion (California, USA): Inverters, motors, and software for electric aviation

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🌆 Mayor Sadiq Khan dropped plans for a zero-emissions zone in central London. Paris moved forward with its shared e-scooter ban. Lagos launched its metro. Boston is launching an e-cargo bike delivery pilot. Los Angeles is piloting one of the first uses of a mobility wallet in the US. Northwest Arkansas may become the biking epicenter of the US. And Moses Lake, Washington is becoming an EV powerhouse. Cities continue to be the test bed of mobility.

🧑🏽🏫 American university campuses are starting to ban e-bikes. Concerns over fires and collisions are the two major factors.

🧑⚖️ California’s SB 253 bill, which would require scope 3 emissions by private sector players, is inching closer to adoption. Another example of where California standards exceed those planned by the federal government.

🇨🇳 China is building way more battery factories than it needs for domestic purposes, similar to its solar panel approach. Keep an eye out for accusations of Chinese battery overcapacity getting “dumped” in North America and Europe.

🤥 U.S. auto regulator NHTSA has some very pointed questions for Tesla about Autopilot and a potential “cheat mode.” Hidden features in production-grade safety systems are the kind of thing that drives regulators nuts.

🇵🇦 Drought conditions at the Panama Canal may continue well into next year. That should help West Coast ports regain market share.

🔬Markets & Research

🥽 Tim Lee makes the case that driverless cars are already safer than human drivers. Nice to see a data-first approach.

🛟 A new study from startup Recurrent (Vol 12) indicated that frequent use of DC fast chargers doesn’t degrade Tesla’s battery life. Perhaps we’ve been too cautious about DC fast charging and its potential for battery degradation.

🔋 A study funded by the German Federal Ministry for Economic Affairs and Climate Action points to the superiority of battery-electric for heavy-duty trucks over fuel cell. The window of opportunity for fuel-cell heavy duty trucks used to be wide open; it’s getting narrower.

📉 US carbon emissions are down 5% in 2023 through May versus the prior year, based mostly on falling coal consumption. Some good news to celebrate.

🚢 Meanwhile, more coal is being shipped by sea globally than ever before thanks to China and India, but China may have reached peak gasoline thanks to EVs. The US is weaning itself off coal, but China is weaning itself off gasoline.

🏭 Corporates & Later Stage

🥷 Lufthansa CEO tells automakers that electrofuels aren’t for cars. He has a point: if e-fuels work (still a big if), they should be put in hard-to-abate sectors like aviation, not passenger cars.

🔌 A New Hampshire electricity co-op is piloting incentivizing vehicle-to-grid charging with its customers and Duke Energy is launching flat-rate home EV charging. We’re just beginning with smart charging programs.

🏃🏾♂️ Did VW’s Electrify America inadvertently unit push everyone towards Tesla’s charging standard in North America? Some fantastic reporting by friend John Voelcker.

🧰 EGO power tools has leveraged its battery expertise to move into electric micromobility and Nissan has started selling portable power packs by harvesting Leaf EV batteries. Some interesting parallels to how Honda’s gasoline-era focus puts power tools and cars under one engine-centric roof.

🗺️ Google launched a suite of environmental APIs linked to its Map product. For a reminder on Google Maps, check out the Vol 62 Deep Dive.

🛺 Amazon now has 6,000 electric 3-wheelers in its fleet in India. Uber, meanwhile, launched its electric motorcycle service in East Africa. In emerging markets, its 2- and 3-wheeled vehicles that dominate the EV market.

📿 Hertz might be running out of charger cables for Tesla rentals. Still some kinks to work out.

🐣 Startups & Early Stage

🕵️♂️ What happens when Product Hunt meets the world of hardware prototypes? You get Prelaunch, a site where hardware designers (think micromobility) can get product feedback from customers before going into production.

⛑️ Dutch e-bike manufacturer VanMoof was rescued from bankruptcy by a division of McLaren. Look for the new VanMoof to rely on third-party retailers and, perhaps, fewer proprietary parts.

💪🏾 Electric motorcycle startup Ryvid is inching closer to production. With only $1M in venture funding and $20M in state manufacturing subsidies, this may be a master class in an efficient capital stack.

DEEP DIVE: Fight Club: The United Auto Workers edition

The United Auto Workers’ existing contract with the Detroit 3 automakers (GM, Ford, and Stellantis) expires this Thursday, September 14. While there’s often empty threats in industrial negotiations, there’s reason to believe that the UAW will indeed proceed with a strike. For the UAW, this is a once-in-a-generation chance to counter existential threats.

In some ways, the UAW has advantageous tailwinds:

Organized labor is having a resurgence. Employers like American Airlines and UPS have granted significant concessions to their unions while other industries, like film, are in the midst of crippling multi-month strikes.

The UAW is emboldened by new leadership. 2023 was the union’s first leadership vote via direct member election instead of by union leaders. Newly-elected President Shawn Fain ran a grassroots campaign promising more militant negotiations.

Car companies are generating record profits. Stellantis, for example, generated a 17.5% operating margin in the first half in North America. Historically, double-digit margins were the exception, even for profit machines like Toyota or BMW.

The upcoming US Presidential election. While the UAW endorsed Biden in 2020, the union has held out endorsing his re-election campaign until after a new labor agreement is in place.

Last week, the Biden administration announced $12B in incentives to help legacy automakers move to zero emissions, with a clear signal that union-related projects will have a higher likelihood of winning incentives.

So with all this good news, why is the UAW facing an existential threat?

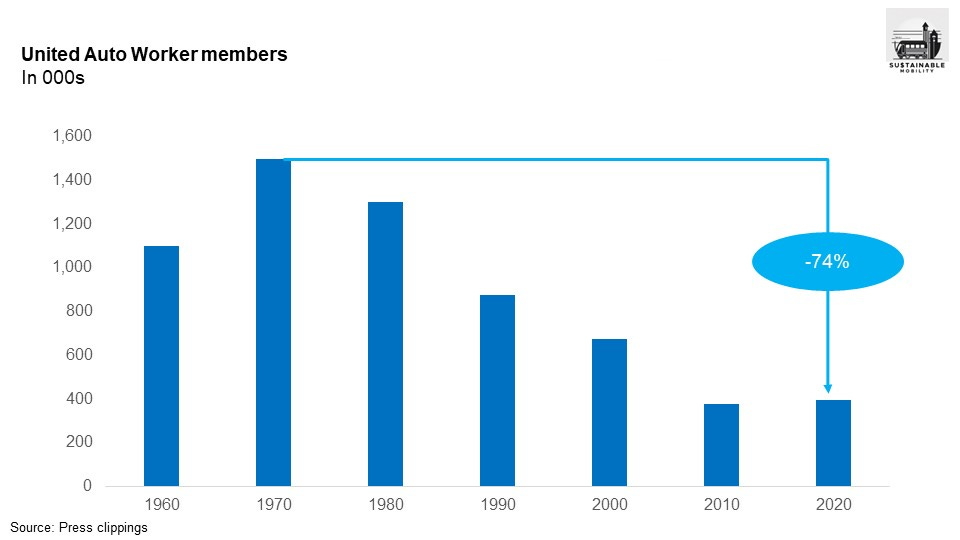

The UAW enters the negotiations significantly smaller than it was several decades ago. Membership is down almost three-fourths from its peak, driven by everything from lean production and free trade agreements to foreign automakers setting up American plants without union labor. It doesn’t help that new American automakers like Tesla and Rivian have also opted for union-free plants.

Also, we need fewer autoworkers in the EV era. It’s no secret that building a fully electric EV powertrain takes a lot fewer labor hours than building a conventional gas-powered powertrain.

And to top it all off, much of this new investment in the EV and battery economy is heading to “right to work” states in the South and West where the UAW has a slim presence, far away from its traditional bulwark in the Midwest.

Each of the four tailwinds at the UAW’s back mentioned above is transient. But the headwinds? Those are structural. Don’t plan on this new contract going down without a bitter fight.

Would have been a great article if there was some evidence that the method worked a bit more.

Interesting read! Keep us posted, Every bit of first hand experience is so valuable!