This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

Last week, I got to launch a cleantech debt fund (our press release here, plus coverage from Axios, GreenBiz and Canary Media, the last of which I think did the best job of really diving into the what and why). It’s been exciting to work with a team to address a gap in the capital stack for cleantech, including sustainable mobility. As equity markets get more challenging, the timing of this alternative was fortuitous.

I also got to be a guest on the Future of Mobility podcast. On June 21st, I’ll be co-hosting a webinar with A2Mac1 on EV Secrets for Startups and Investors. Register here. More information at the bottom of the email.

QUICK HITS: Notable news from the last 2 weeks

🇪🇬 Egypt is moving ahead with high-speed rail. North Africa is joining Europe and Asia in willingness to invest in high-speed rail. It’s still a long shot in North America.

🇪🇺 The EU reached alignment to phase out sales of internal combustion engine automobiles by 2035. While member states still need to enact, having alignment between the EU Parliament and the EU Commission makes this mostly a done deal.

🗽 NYC is slowing down plans for congestion pricing. The Feds aren’t supportive as they could be, but the concept is still a matter of when, not if, in major American cities.

💂♀️London cyclists pull off PR stunt to show how cars are clogging roads. Hats off to micromobility startup Dott for a picture that speaks a thousand words.

🇺🇸 Washington, DC wants drivers of oversized vehicles to pay more. Other countries don’t have such an addiction to overweight cars, partly because their crash tests focus not just on occupant safety, but also on pedestrian safety.

🚎 The dreaded commute may be one of the biggest barriers to getting people back into offices. Will our pandemic response to office work alter our understanding of Marchetti’s constant or will we have to wait for the metaverse for that?

🧐 The New York Times showed how NIMBY homeowners create generational wealth while holding back everyone else from addressing our housing and transportation challenges. Many American transportation challenges stem from catering to homeowner demands. If we can’t change development rules, then congestion pricing and parking management are our next best shot. Misguided op-eds, like this one in The Orange County Register, illustrate the work to be done.

🌽 Farmers are allying with environmental groups to oppose ethanol pipeline projects. America’s ethanol program is a wasteful concession to special interests.

🟰A new scientific study looked at how to align EV incentives with climate goals. This is important, but e-bike incentives are probably the most effective and underrated bang for the buck in hitting our climate goals.

🌍 BYD snapped up 6 lithium mines in Africa and grew sales in the first month after discontinuing sales of internal combustion engine (ICE) only vehicles. The sales bump helped vault BYD to the third most valuable automaker (by market cap) globally.

🛰 Baidu (and Geely) unveiled their autonomous EV. A fascinating example of collaboration between a tech giant and a very forward-think automaker.

⚠️ Tesla Autopilot just moved one step closer to a safety recall. Beta testing safety-related software on the general public isn’t the right move.

⁉️ Tesla is undertaking mass layoffs, except it’s not. And Elon is buying Twitter, except he’s not. The only certainty is that it’s not easy to be an employee of either organization right now.

✈️ The ICCT says that the aviation sector can meet its decarbonization goals, but only if we scale low-carbon fuels now. Long-haul aviation may be a rare case where sustainable fuels is the way forward.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🚲 Avocargo (Germany): Shared e-cargo bike network

🚙 Beev (France): Managed marketplace for EV leasing

🚌 BusRight (Massachusetts, USA): School bus optimization software

🔋 Electric Era (Washington, USA): Battery banks with EV chargers

⛵️ Newport Electric Boats (California, USA): Electric propulsion systems for sailboat retrofits

⛴ SailPlan (Florida, USA): Emissions optimization software for ships

🔋 The Stack Charge (California, USA): Network of DC fast charging lounges

🔌 Time2Plug (France): Managed marketplace for EV charger installation

🚤 ZParq (Sweden): Electric motors for maritime applications

FUNDING: Capital raises from startups previously featured in Startup Watch

GridMatrix (Vol 2) raised $3.5M from 8VC and Cota Capital

Arc (Vol 4) raised $30M from Eclipse Ventures, Lowercarbon Capital, Andreessen Horowitz, and others

Tandem (Vol 13) raised £1.75M from 1818 Venture Capital and others

Princeton NuEnergy (Vol 24) raised $7M from Wistron and others

Marain (Vol 28) was acquired by General Motors

DEEP DIVE: FORD JUST KILLED THE AMERICAN DEALERSHIP MODEL

In the early days of the American auto industry, automakers sold cars to customers directly or via channels such as mail order and department stores. As the auto industry rapidly scaled, adding franchised dealers into the mix allowed automakers to grow quickly, with dealers responsible for the commensurate capital investment. Unsurprisingly, automakers ensured that the franchise agreement was tilted in their favor; Ford kept its factories highly utilized during the Great Depression and coerced American dealers to take inventory they couldn’t afford. Thanks to grassroots lobbying and favorable legal rulings between the 1930s and 1950s, the industry settled on a legal framework still used today, which secured various rights for dealers, such as not being forced to take inventory and not having their franchise contract canceled without cause. The holiest tenet in this arrangement is that car manufacturers in most states of the US are not allowed to sell directly to consumers or otherwise compete with the dealer.

On June 1, 2022, Ford CEO Jim Farley drove a stake in that arrangement, saying that because of EVs, “We’ve got to go to non-negotiated price. We’ve got to go to 100% online. There’s no inventory (at dealerships), it goes directly to the customer. And 100% remote pickup and delivery." Farley noted this would lead to a “brutal” shakeup for dealers, estimating the dealership model is $2,000-$3,000 more expensive versus Tesla's direct-to-consumer method, mostly due to dealer advertising and inventory carrying costs.

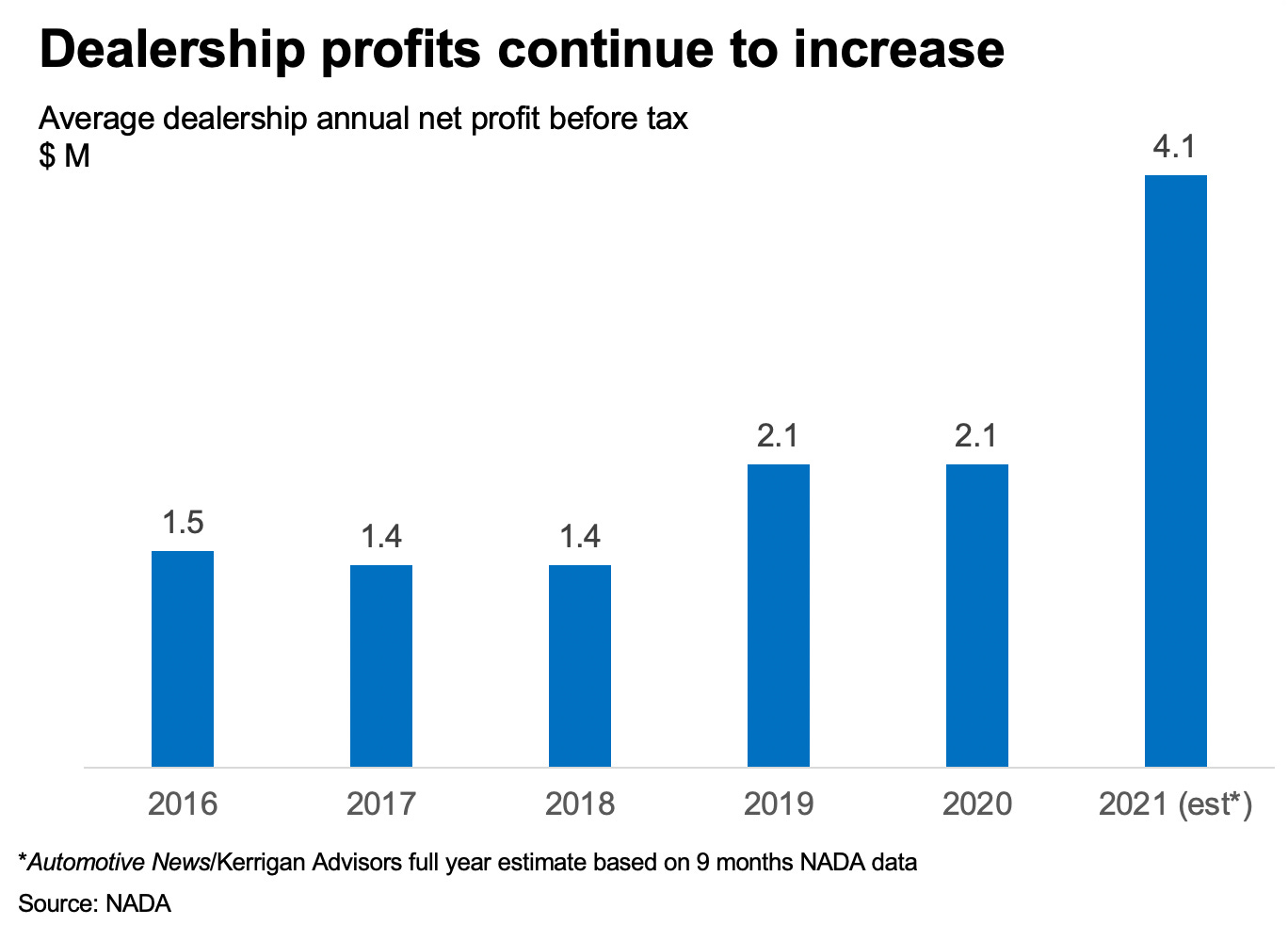

Looking at the state of the dealership today, it’s hard to see what the fuss is all about. Dealership profits are at record highs. In fact, the North American Dealer Association (NADA) took the unprecedented step of ceasing regular publication of average dealer profits, perhaps not wanting to draw attention from the public and automakers about just much money dealers are making right now thanks, in part, to supply constraints.

And over the last decade, the stock market has generally rewarded dealership groups.

So if everything is so wonderful in dealer land, why is the Ford CEO trying to take a hatchet to it? Because this is the calm before the storm and every single element of the dealer profit model is at risk. Moreover, while parts of the dealership model are very adaptive (people operations), parts of it are inherently inflexible (real estate); reform should have begun long ago.

Faced with the list of threats above, it’s understandable why Farley finally said what every automaker CEO already knows. This shift will undoubtedly result in lawsuits between automakers and dealers, but the long-term trajectory is written on the wall, even if it’s not reflected in dealership group stock prices just yet. The combination of direct-to-consumer automakers, the unique economics of EVs, and over-the-air software updates are bringing the American franchised dealer model to its breaking point. Dealership groups would be wise to reinvest their record profits into preparing for the future.

More on the webinar!

EV Secrets for Startups and Investors

Electric vehicle sales are booming, but how does a startup or venture investor separate the hype from reality in terms of EV product development and costs?

Since 2013, A2Mac1 has torn down and analyzed more than 100 electric vehicles from different markets and brands, which gives you the most definitive understanding of the state of the art in EV powertrains, including dynamic performance and costing.

Whether you are a startup or an investor, this real-time reverse-engineering market intelligence is an invaluable source to figure out how to be cost-competitive and reach necessary product milestones. It also helps objectively validate company progress versus competitors along product and cost.

On June 21st from 10:00am Pacific time, our experts Leila Emadi, Sascha-Andre Voglgsang, and A2Mac1 advisory board member Alex Mitchell will give startups and mobility investors “behind the curtain” access on 7 emerging product insights. Audience Q&A with A2Mac1 EV experts will be welcomed towards the end of the session.

Register here to make sure you get ahead in the EV race.