🏦 Su$tainable Mobility, Volume 12

This newsletter aims to separate the signal from the noise for making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week, we have a Deep Dive on Inside Rivian’s S-1 (part 1 of 2) by guest contributor Patrick Gaffney, a former equity analyst at HSBC, Citi and EFG Hermes. He has a long-standing interest in economic sustainability, having previously served as CFO of Good Food Markets, which targets bringing fresh produce and groceries to food desert communities. He currently serves the US Dept of State as an economic analyst in Vietnam.

Disclaimer: This newsletter represents individual thoughts and not those of any employer. I will always disclose when I have a financial relationship with a company cited.

QUICK HITS: Fast takes on notable news from last week

🚙 EVs will be cheaper than internal combustion engines (ICE) in all segments in Europe by 2027, predicts BNEF and Transport & Environment. One of the underappreciated angles here isn’t just falling battery costs, but the ever-rising cost of ICE due to rising emissions compliance and an ever smaller production base to amortize any ICE R&D costs.

🏙 Birmingham, the second-largest city in the UK, is pushing cars out of the city center. This sort of holistic approach to discouraging private car usage in cities is going to slowly become universal, spurring growth in public, shared, and active transit.

🗽Citibike is good for environmental outcomes in NYC. The system doesn’t receive subsidies (despite public support for it), though the next mayor may change that.

♻️ Pitchbook says that lithium-ion battery recycling is a $30 billion business by 2030. Multiple players will compete here, including startups (e.g, Redwood Materials), battery manufacturers (e.g, Panasonic), car manufacturers (e.g., BYD), and materials technology companies like Belgium’s Umicore.

🤖 Sidewalk robots just logged their first big fleet order. For convenience stores, delivery by sidewalk robot might be much more cost-effective than by human courier systems like DoorDash.

🗺 Google integrated carbon footprint into Google Maps and other products. This is a great addition but also serves as a reminder of how little Maps and Waze have changed in the last 5 years. They’re both ripe for disruption from a challenger.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

👨🏾💻BattGenie (Washington, USA): Battery management software to improve lithium-ion battery lifespans

🚗 Faaren (Germany): Car subscription marketplace

🐮Grassroots Energy (India): Biomethane generation from agricultural residues at a distributed scale

🏪 Recurrent (Washington, USA): Carfax for the used EV marketplace

🏍 X Mobility Motors (UK): Manufacturer of electric 2 wheelers (scooter, bike, and motorcycle)

🚤 ZeroJet (New Zealand): Supplier of electric boat propulsion systems

DEEP DIVE: Inside the Rivian S-1 by guest contributor Patrick Gaffney (part 1 of 2)

Rivian is an electric vehicle (EV) manufacturer that has long been in stealth mode. It is now enjoying its coming-out party with an S-1 filing and an initial public offering expected in the next few weeks.

I have done a deep dive into the S-1 and tried to think about the valuation of the company. There are a few things that everyone has mentioned:

The most interesting parts are not in the S-1: For example, the big deal with Amazon has no actual numbers associated with it – how big it could be, etc.

Losses: A company with no revenue is losing lots of money. It’s raised about $11 billion, and has about $4 billion in cash. So over $7 billion has been spent so far, and this is only the start. Rivian says it needs to spend another $8 billion through 2023. It turns out it’s expensive to start a car company from scratch.

Pre-orders: The company has 48,390 pre-orders for its two models, a pickup truck and an SUV. This required just a $1,000 refundable deposit. I bet that these will be pretty sticky, but ultimately, sales need to be much higher than this to justify what they are trying to raise.

Ford is doing great out of this: According to the S-1, Ford has almost 100m shares at a purchase price of $820m. If the stock trades around $70, these shares would be worth $6.7bn or 12% of its current market cap.

But these points above have been in every piece I have seen. The points below are ones that have not been discussed as much:

1) Vertically integrated, but…not: The company spends a lot of time talking about vertical integration, but it doesn’t make its battery cells (but does have a lot of technology around the rest of the battery system to make them work well in their vehicles) and it has a long-term deal with Ford for engineering and tooling work. Overall, they mentioned 300 suppliers. It seems like Rivian will be vertically integrated like Tesla, but still heavily dependent on other companies for key components, which isn’t surprising. The one thing it won’t be dependent on is dealers – the company is going direct-to-consumer. That means they don’t have to share some margin with the dealers, but it also means there are 8 states (including New Jersey and Pennsylvania) where they can’t sell directly and another 28 where they may have difficulties being dealers (including Texas and New York).

2) Amazon deal: As mentioned above, we would love more details here, but it’s clear Amazon is going to be the main driver of revenue in the first few years. Amazon has exclusivity with Rivian for its commercial vehicles for 4 years, and then a first right to buy any of these vans for another 2 years. The clock starts on the first delivery of the vehicle, so through the end of 2025, plus another 2 years of only selling to Amazon. The latter doesn’t seem like that big a deal – they can make however many they like, if Amazon doesn’t want that many, they can sell them – but the first is pretty restrictive because it limits the amount of units that they can make to the amount that Amazon wants. Being an innovative car company is exciting! Being a contractor for Amazon is probably less so.

3) Mobility as a service: This is the hardest part for me to get my head around. The company talks a lot about the “lifetime revenue” of its customer base, beyond the sale of the initial vehicle. I covered real estate developers for well over a decade, and one thing I learned is that all the stuff outside of selling an apartment/home is good but not profitable. Rivian is betting a lot on the idea that these ancillary services (which very likely have much higher margins than the initial sale) will drive real revenue and profit. These include financing (which takes capital, see below), insurance (which takes underwriting skills and capital), autonomous driving features, and other services like infotainment. Excluding resales, this is supposed to bring in more than $33,000. I have my doubts, because that’s a lot of money to spend on top of a $70,000 car, which is already pretty pricey.

But in terms of the Amazon deal, which is delivery van-as-a-service, it seems pretty real. My view is that it could bring in something like $5bn a year (more on this next week). Investors love blank-as-a-service, because the cash flows are so steady and model-able. But I am not sure that the consumers paying love it as much. Especially for a big outlay like a car. Leasing hasn’t taken over the market, and I think that’s probably because not all customers like to have never-ending payments for their vehicle.

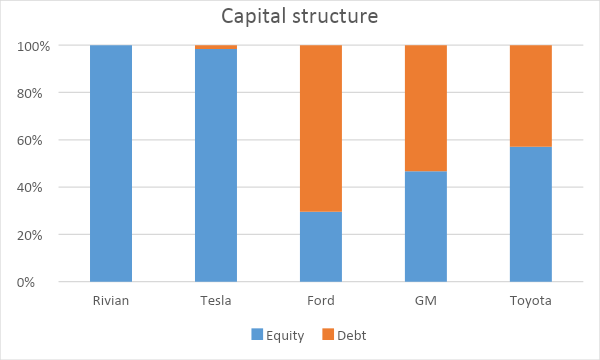

4) They are going to need a bigger boat…of money: Ford has $136bn in debt and $57bn in equity. GM is $90bn and $79bn. Toyota’s equity is higher, but still under 60% of the enterprise value. Rivian starts out with all equity, no debt and about $3bn in cash before the IPO money. All of this cash is supposed to last just one (1!) year. The company will have to go out for new cash almost as soon as it is finished with the IPO. And of course, it would probably start levering up too. But it seems unlikely to me that large amounts of debt will be coming until they start to have real revenues. In the meantime, there might be follow-on offerings within 12 months. Ouch.

And the company will need it. If I read the business plan correctly, it wants to own all of the commercial assets, and it also wants to offer good financing terms for the car sales plus insurance. The latter should be easy – banks and insurers will jump all over Rivian’s customers. But if Rivian wants to get more than a referral fee, then it needs to be involved in the transaction, which means more capital, which means debt financing. Expect Rivian to go to the debt markets over the next few years. Right now they have a revolving facility of $750 million.

Two other components that are going to take a lot of money are gross losses and SG&A.

Negative gross margin: The S-1 states boldly that Rivian is going to have negative gross profit per vehicle for “the near term” because they are spending so much on plants, chargers, and R&D. The goal is to build out all of this, including the technology and the service ecosystem, while selling tons of vehicles to funnel through so that they get this recurring revenue. This isn’t a software or tech company that has extremely high gross margins but spends all that on marketing. This is all investment up front.

SG&A: Tesla spent just 11% on all of sales, general and administrative (SG&A) expenses in the trailing twelve months or $3.9bn and $2bn in 1H21. Of that, 32% of that was stock-based compensation and the rest ($1.4bn) was mostly administrative expenses. Basically, the company spends nothing on marketing. Rivian wants to take the same tack on marketing – it says it won’t do any advertising expenditure, but they don’t have Elon Musk. After they go through their 50,000 customer deliveries, will they be able to drum up business without doing an expensive advertising campaign?

Beyond marketing, Rivian spent $307m on SG&A in 1H21, which seems pretty high. To get a sense of the overhead, the chart below show the employee count. It has gone up 6x in the past two years and more than doubled since the end of 2020. Of course, it is going to have to grow much more than this. This is a company with less than 1/10th of the employees as Tesla and no revenue but is spending about 25% of what Tesla is spending. Of course, Rivian’s SG&A expenses will increase from here. Tesla had 70,000 employees at the end of 2020, and Ford has 186,000, with the attendant personnel and (potential) union problems.

Note: Part 2 from Patrick will come in next week’s issue. In the meantime, you can reach out to him here.