This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

The Deep Dive this issue: are Tesla’s Supercharger economics about to go from good to amazing?

QUICK HITS: Notable news from the last 2 weeks

🗽New York City is following a manslaughter case for a scooter hit-and-run. While this is certainly a novel case, it’s not statically significant. In the US, there are approximately 25 micromobility-related deaths each year and about 40,000 motor vehicle-related deaths.

🚲 In Paris, the proportion of journeys by car has dropped by almost 50% since 1990. A lot of this comes down to fearless (and sometimes disliked) mayoral policy.

♻️ Switzerland’s Zurich canton is enshrining circular economy in its constitution. If other governments outside Europe follow suit, expect this to generate end-of-life policies for vehicles.

🚫 California is proposing to ban the sale of internal combustion engine heavy-duty trucks by 2040. This is the kind of leadership that continues to make California one of the centers of the world’s EV market.

🚶🏾♂️California also decriminalized jaywalking. Great news, as the concept of jaywalking is a scam (see vol 9).

⛽️ New York state just announced it would follow California’s 2035 ban on sales of internal combustion engines (ICE), which effectively makes it national policy. California plus New York alone represent about 17% of US auto sales and of the 14 states that follow California emissions, several more are likely to adopt the ban. In many cases, the economics of selling ICE vehicles in non-California emissions states after 2035 won’t pencil.

🇮🇹 Italy’s incoming right-wing government wants a referendum on the EU’s 2035 ban on sales of ICE cars. Long term, the industrial policy choice is between fewer jobs than today to produce EVs or losing all jobs as other countries step up EV production.

🚙 Ford is giving dealers 2 months to accept its new terms or lose the ability to sell EVs, at least for several years. Vol 30 looked at how Ford is dropping a bomb on the traditional dealership model.

🥊 Toyota is going on the defensive trying to explain its laggard status on EVs. The comparison by Toyota’s CEO of EVs to autonomous vehicles is unfortunate, as full autonomy is nascent while EVs represent 10% of global sales.

⛏ Hertz is teaming up with BP Pulse (formerly Amply*) to turn some of its sites into EV charging hubs open to the general public. Hertz’s private equity owners are giving the company a shot being the rental car company that makes the transition to the modern era.

🇮🇳 Tata Motors launched a $10k EV in India. Tata’s last big bet at ultra low-cost was the disastrous Nano, which aimed to be an upgrade from 2 and 3-wheeled mobility solutions. Alas, consumers opted for a used car over a new Nano. In this case, time will tell whether people will pick a new EV over a used internal combustion engine car.

📲 Fitness tracker Strava added a bike share locator. Someday, somehow, someone is going to crack using gamification at scale to nudge people to better transportation behaviors.

💊 Uber Connect drivers worry that they are drug mules. As one driver notes, it’s not worth a $13 fare to run the risk of a felony possession.

🕊 Bird gets a new CEO. Bird’s leadership is flying the coop as the company’s market cap (~$90M in late Sept) is significantly less than cash on hand (about $141M in current assets). Shared mobility is a beast of a business.

🛺 McKinsey thinks quadricycles and 3-wheelers may be the next big thing in Western cities. I would love to see this happen, but I’m much more dubious about this sector’s scaling potential without a large policy or business model breakthrough.

🚝 Hyperloop is running out of hype. From the start, the concept worshipped engineering theory at the expense of financial and regulatory realities.

🛩 EasyJet is scrapping carbon offsets to focus on true emissions reductions. A lot of the carbon offset market is of dubious quality, so this kind of focus on emissions reduction in a hard-to-abate sector is laudable.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🔌 Epic Charging (California, USA): Software and hardware for electric fleet management

🛺 GoMylz (India): EV as a service for gig drivers

🚚 Popion Mobility (California, USA): Battery swap as a service for commercial vehicles

💽 Vianova (France): Urban mobility data provider

FUNDING: Capital raises from startups previously featured in Startup Watch

Leoparda (Vol 36) raised an $8.5M seed round co-led by Monashees and Construct Capital

FlexCharging (Vol 27) raised a $5.9M round from undisclosed investors

(Reminder: The complete startup dataset is free for subscribers. If you’re interested in accessing the Airtable with all the raw data of the 240+ companies, please let me know below.)

DEEP DIVE: Is Tesla’s Supercharger flywheel entering hyperdrive?

When Tesla launched its first Superchargers in 2012, many observers thought Elon Musk was crazy. After all, car companies don’t own and operate gas stations. Even those who thought it was a clever way to build an initial market guessed that Tesla would offload the network or halt its growth after a few years.

Recent history, however, has shown that the Supercharger network is one of Tesla’s most important competitive moats. And, if anything, it’s likely that a few recent changes will further deepen the moat and force competing EV networks into some tough decisions.

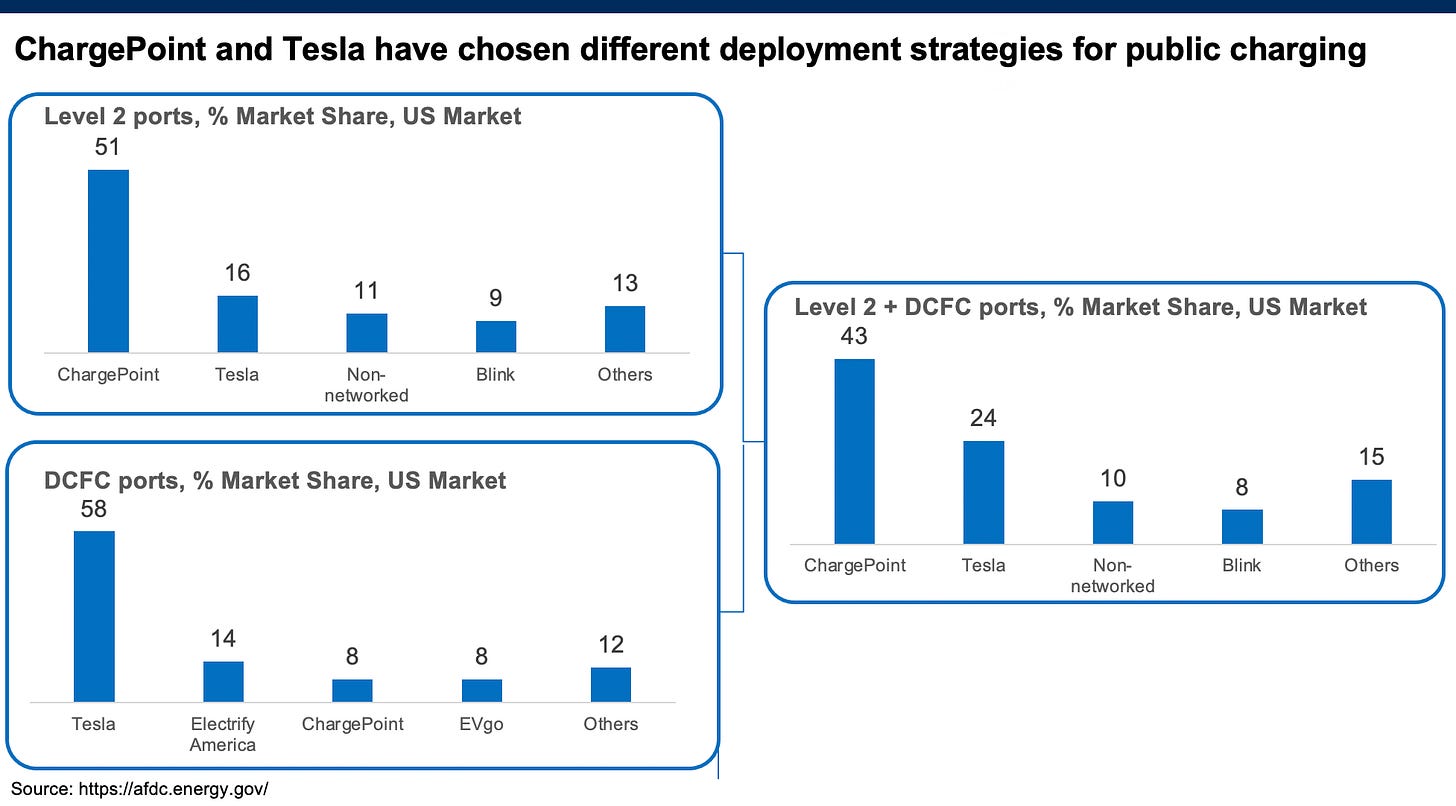

One of Tesla’s boldest initial decisions was to opt for expensive DC fast charging (DCFC) for the Supercharger network versus the Level 2 (220V) charging favored by early competitors like ChargePoint. Between hard costs and soft costs, a decent rule of thumb is that DCFC is an order of magnitude more expensive to install. Critics claimed Tesla was wasting money on an overly expensive charging solution that put the car battery at risk for faster degradation.

As a car manufacturer, Tesla had warranty responsibility for battery degradation and could take necessary steps to change this aggressive charging approach if it did indeed prove harmful to battery life. This would prove to be one of the first examples of how Tesla’s integrated approach across vehicle and energy systems helped them create a superior charging experience. There are now dozens of examples across software and hardware, virtual and in-person where this integrated approach created a seamless customer experience.

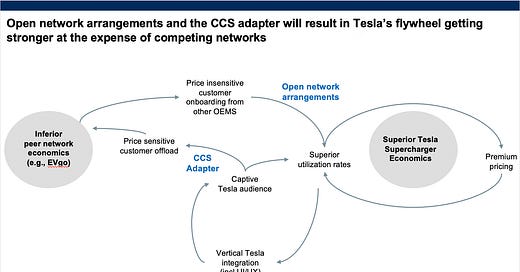

That seamless customer experience and captive customer base led to what appears to be significantly higher utilization rates of Tesla chargers versus peers. In fact, while other charging network operators generally suffer from underutilization, the Tesla Supercharger network frequently suffers from overutilization, with drivers complaining about how long it can take to nab a spot to charge.

In turn, that utilization rate is likely one of the drivers behind the strong economics of Tesla’s charging network, especially versus industry leaders like ChargePoint. Tesla doesn’t break out charging results but triangulating data (caveat: including from Elon Musk’s tweets) suggests that Tesla is not panicking about charger profitability like its peers. ChargePoint, for example, has over half of the Level 2 market in the US and still operates at a -100% operating margin. The situation isn’t better for other network operators: EVgo operates at a -30% gross margin and a -400% operating margin.

Tesla adapts to this high utilization by raising prices. Tesla has made periodic announcements about price hikes in California, some of which are driven by exogenous factors such as utility electricity prices. To get a sense of that impact, Tesla owner Richard Hart, who has documented his Supercharger costs over time, provides a great illustration.

With prices now averaging $0.40/kWh and as high as $0.60/kWh, it’s enough to make a Tesla owner wish they could charge elsewhere, especially when Electrify America advertises a fixed rate of $0.31/kWh for DCFC.

Which brings us to the first new flywheel effect. Until a few weeks ago, Tesla didn’t allow its owners to undertake DCFC outside the proprietary Supercharger network. With the new release of a $250 CCS adapter, bargain-shopping Tesla owners now have the chance to go to EVgo, Electrify America, and other DCFC network operators. Hart reckons it would only take about 6 months for a typical Tesla owner to see a payback from buying the adapter.

And that’s before the other flywheel effect of Tesla opening the American Supercharger network to other car brands. As happened in Europe expect them to have to pay a price premium versus Tesla owners.

So, in short, Tesla already has high utilization, high profitability, continues to build out a larger network, and has skimmed the most profitable customers.

This puts loss-making networks like Electrify America and EVgo in a tough spot. Is their best path to profitability to intentionally locate close to Supercharger locations and accept a role as lower margin overflow for price-sensitive Tesla customers? It’s a terrifying thought that effectively means giving up business independence, but clearly, something has to give. At this point, Tesla’s adding two new elements to its flywheel against peers who haven’t articulated a path to profitability.

* Disclosure: As a startup, Amply was affiliated with my employer LACI