This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

I'm leading a series of Sector-Focused Networking Sessions for the Climate Techies community and would love to see you there. Are you interested in meeting other Transportation, E-Mobility & EVs focused folks to explore synergies, partnerships and connect? If so, RSVP today!

Join us for the inaugural call on Nov 16th @ 6am Pacific/9am Eastern/3pm CET. Register here

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Conical (Netherlands): Shared four-wheeled micromobility leveraging autonomy

COnovate (Wisconsin, USA): Graphene monoxide for lithium-ion battery anodes

Devorto (California, USA): Solar-enabled aviation

EV AI (Massachusetts, USA): Commercial EV fleets as a service

ExPost Technology (California, USA): Recycling process for end-of-life lithium-ion batteries

Fragile (California, USA): Subscription financing for hardware like micromobility

Kite Magnetics (Australia): Electric motors for aircraft

Solideon (California, USA): 3D printing for aviation and aerospace manufacturing

Surge Mobility (Turkey): EV charging management software

workride (Germany): Corporate shuttles as a service

Also: A startup in my network is looking for a founding data scientist. The company is building tools to help logistics fleets transition to use the of EVs and eventually interact in energy markets. The founder is looking for someone curious and not afraid of full stack data science, getting into building applications and even some software architecture. Message me for more (Alexmitchell at substack.com)

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Thread (formerly Airtonomy, Vol 6) raised a $15M Series A from Badlands Capital, Excell Partners, and others

ZeroJet (Vol 12) raised an undisclosed amount of funding from Investible

Active Surfaces (Vol 48) raised $550K in seed funding (investors undisclosed)

EVHACS (Vol 48) raised a $1M seed round (investors undisclosed)

Mitra EV (Vol 52) raised $2M in seed funding (investors undisclosed)

Fin (Vol 54) raised $15.9M in funding (investors undisclosed)

Stepwise (Vol 55) won $1M as a competition prize from 43North

Volteras (Vol 59) raised $2.9M in seed funding from Exor, Long Journey Ventures, and others

Amber Technologies (Vol 60) raised a seed round (amount undisclosed) from Virta Ventures

Fingreen AI (Vol 64) raised a 1M EUR pre-seed round from BlackWood Ventures, Habert Dassault Finance, and Plug and Play Ventures

As a reminder, the startup data set is open, for free to subscribers. If you’re a subscriber interested in accessing the Airtable with all the raw data about the 500 companies, please let me know.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🇸🇪Stockholm is moving forward to ban internal combustion engine cars from Jan 2025 in the city center. There’s a lot more of this coming in Europe.

🌭Is Chicago ready to reimagine its legendary Lake Shore Drive as multi-modal rather than car-centric? Hats off to Rep Kam Bucker for leading the charge.

🛂 New York’s JFK airport is getting renovated, with construction materials delivered by barge rather than by truck to ensure timely deliveries. What’s old is new again.

🌍 Just as East Africa leapfrogged many mature markets with fintech, it might do the same with electric motorcycles. Uganda or Kenya may have 100% zero emissions motorcycle sales long before the US.

🇷🇼 Rwanda continues its drone leadership thanks to its work with Zipline. Rwanda’s decision six years ago to prioritize medical deliveries via drone continues to pay off.

🇪🇸 While the UK is turning its back on high-speed rail, Spain’s love affair continues. A great example of how even late arrivers to high-speed rail can reap huge benefits.

Not a subscriber yet?

🔬Markets & Research

🚢 Ocean shipping continues to slowly adopt wind power as a way of cutting emissions. For a refresher on maritime, see the Deep Dive from Vol 29.

💽 PWC shared its 2023 state of climate tech report. Total VC investment has fallen 50% over the last year, but it looks like we might be at the trough.

🏭 Corporates & Later Stage

📲 Tesla has released its API kit for 3rd party developer apps. Another data point to suggest that Tesla may become the infrastructure layer for mobility transactions (charging, virtual power plants, etc.) thanks to its early lead in software and EVs.

🚐 Rivian founder RJ Scaringe gave one of his more in-depth interviews recently. Note his assessment that their business model will be 80% consumer (pickups, etc.) and 20% fleet (vans).

🛢️Toyota has paired up with oil refiner Idemitsu Kosan to target commercializing solid-state batteries by 2027-2028. Toyota’s best chance to leapfrog others in EVs may indeed be a major shift in battery chemistry.

🐣 Startups & Early Stage

✈️ eVTOL manufacturer Beta Technologies has installed the first public access charging station for electric aircraft in Massachusetts. As with other deployments, the station can also charge ground vehicles.

🚛 Electric truck manufacturer Volta went bankrupt. The culprit appears to be Volta's reliance on battery supplies from Proterra, who also surprised people with its unexpected bankruptcy.

🚄 A Spanish startup aims to compete with Eurostar by offering high-speed rail services between Paris and London via the Chunnel. Perhaps, one day, Amtrak and Brightline will be competing along the same rail tracks in the US.

Enjoying the insights? Share this issue with 3 folks:

DEEP DIVE: Hydrogen's Make-or-Break Moment

In 1993, a Canadian company named Ballard Power went public, promising to usher in a fuel-cell era powered by hydrogen. Ballard and its original parent entity Automotive Fuel Cell Cooperation promised an imminent future where everything from cars to trains would run on hydrogen.

Fast forward thirty years and hydrogen is still waiting in the wings. While it’s likely to be essential for applications like fertilizers and methanol, there’s been fierce debate about what role hydrogen will play, if any, in transportation applications.

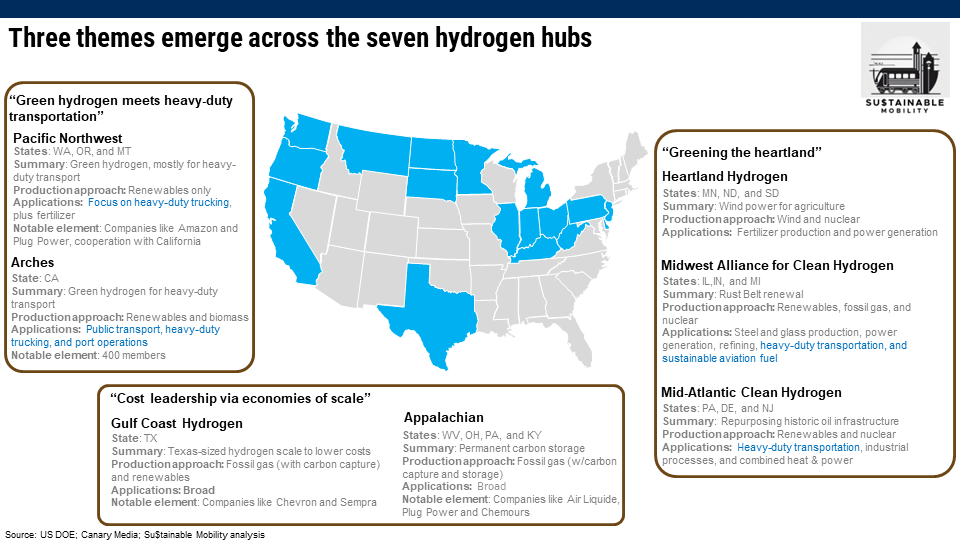

Recent funding by the US DOE gives hydrogen a make-or-break moment in transportation applications. Last Friday, the Department of Energy announced the selection of seven “clean hydrogen hubs,” eligible for up to $7 billion in funding. The hubs should produce about one-third of the DOE’s target of 10M annual tons per by 2030. While certain details of the applications are confidential, we can piece together hints on the big bets in transportation use cases.

The Texas and Appalachian applications focus on cost leadership via economies of scale, and therefore being industry-agnostic in applications.

The Midwest and Northeast applications share elements of greening the aging backbone of the American heartland. That includes some explicit customer applications in heavy-duty trucking and aviation.

Finally, the two West Coast applications paint the picture of green hydrogen used to power heavy-duty transport. Given the coordination between the two, it’s not hard to imagine the country’s first hydrogen fueling corridor eventually running from the length of Interstate-5 from San Diego to Seattle.

In short, while mobility doesn’t dominate the hydrogen hubs, at least four of them will be aiming to scale the use of hydrogen in heavy-duty transportation.

The zero-emissions transportation game has changed dramatically since Ballard went public in 1993, when hydrogen and batteries appeared primed for a potential VHS vs Beta format standards. In the last 30 years, the battery electric vehicle absolutely trounced hydrogen in passenger car applications.

Now, with $7 billion ready to be deployed, it’s time for hydrogen to prove that it can be competitive in transport sectors like heavy-duty trucking. The hydrogen hubs better move quickly into deployment, because battery-powered solutions like the Tesla Semi are aiming to do the same for heavy-duty as they did for the passenger car.

Not a subscriber yet?