The Founder's Guide to Hacking $27 Billion in Federal Money

Vol 61

This newsletter aims to separate the signal from the noise for making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

I joined friend of the newsletter Scott Shepard as a guest on his Cities First podcast, covering the transportation history of Los Angeles. Check it out!

Also, conference alert: Meet, connect and strike deals with mobility’s key stakeholders at #CoMotionLA. Join for three days of immersive and inspirational talks, demos, & workshops. November 14-16, 2023. Super Early Bird pricing ends Aug 31. Su$tainable Mobility readers get an additional 25% off using code SUSTAINABLEMOBILITY25OFF or directly here.

This week’s Deep Dive is the Founder’s Guide to Hacking $27 Billion in Federal Money.

First time reading? Subscribe so you don’t miss an issue.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Chargely (Maine, USA): Next-gen consumer charging app like PlugShare or Chargeway

Carbmee (Germany): Carbon accounting for complex supply chains

Clearly.Earth (United Kingdom): B2B SaaS to precisely measure real-time vehicle emissions

GigEasy (New York, USA): Insurance platform for gig employees (Uber, Doordash, etc.)

GoRolloe (United Kingdom): Hardware harnessing energy from passing vehicles to passively capture airborne pollutants

Hive Power (Switzerland): Energy management software, including V2G

Mbay Mobility (Senegal): All-electric ridehail network

Pando Electric (California, USA): Scalable EV charging solution designed for multi-tenant dwellings

Tructric (Sweden): Heavy-duty hardware to shift more truck volumes to rail

Sky Charge (Germany): Autonomous charging solution for drones

💰FUNDING: Capital raises from startups previously featured in Startup Watch

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🤠 What happens when a Tesla tries to charge in the most rural part of Montana? In short, it makes the local paper.

🍦New York City may force ice cream trucks to use zero-emissions generators. As solar and energy storage costs fall, the logic gets more and more compelling.

🎩 In New York’s posh Hamptons, 14 were arrested protesting private jets and their climate impact. Private jet protests are more common in Europe, so keep an eye on whether this trend grows in North America.

🔥 Burning Man has a very blunt policy for those who use e-bikes on the playa. An interesting example where e-bikes are cannibalizing traditional pedal-only bikes and walking.

🇬🇧 UK Prime Minister Rishi Sunak is taking a decidedly pro-motorist approach against traffic-curbing measures. In response to falling approval ratings, the PM is changing some of his positions.

🇩🇪 In Germany, the Lower Saxony Transport Authority (LNVG) has decided no more new hydrogen trains, opting instead to replace diesel trains with electric. The new electric trains will be about 80% battery electric and 20% overhead catenary charging.

💧The US government is struggling with how to make hydrogen fit the Inflation Reduction Act rules. In short, the tradeoff comes down to whether we want more hydrogen (some made from fossil fuels) or less hydrogen (all made without fossil fuels).

🇪🇺 The European Union has effectively finalized climate disclosure rules for large companies. Disclosing scope 3 emissions (e.g., emissions from the commute to work) is required for companies above 750 employees.

🔬Markets & Research

🕒 25% of new cars sold last quarter in California were all electric. Quite a contrast with the nation overall at 7.2%.

🛣️ MIT scientists are working on a type of concrete that can store energy. It’s a long shot, but it would certainly change the trajectory of induction charging.

🏭 Corporates & Later Stage

⚓️ Chinese shipping giant COSCO took delivery of the world’s largest battery-powered ship. Rivers like the Yangtze are a good match for the current limits of battery power.

🚌 Electric bus manufacturer Proterra went bankrupt. A big loss for American aspirations in the sector, leaving the field more open for competitors from Canada, China, etc.

💻 Meta (fka Facebook) has launched a public RFI to source cleantech solutions for heavy-duty trucking, maritime, and aviation. Kudos to them for doing the solicitation out in the open, which helps level the playing field for promising solutions.

🚛 Tesla wants $100M from the US government to build a heavy-duty truck charging corridor across the Southwest. Tesla proposes a 2:1 ratio of chargers for Tesla semis vs competitors’ semis.

⚡️Tesla acquired German inductive charging startup Wiferion. Like Apple, Tesla prefers in-house innovations to acquisitions.

🥤Pepsi has lifted the curtain on its experience with 21 Tesla Semis in Sacramento. Some pertinent numbers: 3 megawatts of new service to the facility, 750kw chargers on site, and 3 trucks doing “over the road” routes up to 450 miles, consumption less than 1.7 kWh per mile (1.1 kWh/km)

🤖 Driverless taxi deployments are swiftly multiplying: Cruise is heading to Nashville and Los Angeles while Waymo is heading to Austin. And the California Public Utilities Commission will finally signed off on expanding service within San Francisco.

💪🏾The United Auto Workers (UAW) are gearing up for autumn contract negotiations. As EV car factories require many fewer workers, one of the key issues is whether battery joint ventures (e.g., GM/LG Energy) will have UAW representation.

🐣 Startups & Early Stage

4️⃣ Heavy-duty truck manufacturer Nikola named its 4th CEO in 4 years. Former Opel CEO Michael Lohscheller was replaced by former Opel CEO Stephen Girsky.

🚲 Vanmoof’s bankruptcy is making life difficult for its bike owners. Given a lack of spare parts, many Vanmoof owners worry that their bikes will be stolen to be stripped for parts.

DEEP DIVE: The Founder’s Guide to Hacking $20 Billion in Federal Money

For cleantech startups with a hardware element, finding the right balance between equity, debt, and grants is key. (In Volume 54, I shared a Founder’s Guide to Debt.)

Finding government dollars can help prevent unnecessary dilution from equity. For example on a $3M raise at $12M post-money valuation, doing the raise completely by equity costs the founder 25% of company ownership. However, getting $3M via a $1M federal grant and a $2M raise costs the founder only 17% of their company ownership. Similarly, securing a grant before the first equity raise can help generate traction and metrics that help justify a higher initial valuation.

This deep dive isn’t going to go into the entire world of grants, but instead into an extremely timely federal development that every cleantech founder should understand since the time to prepare for $20 billion is now.

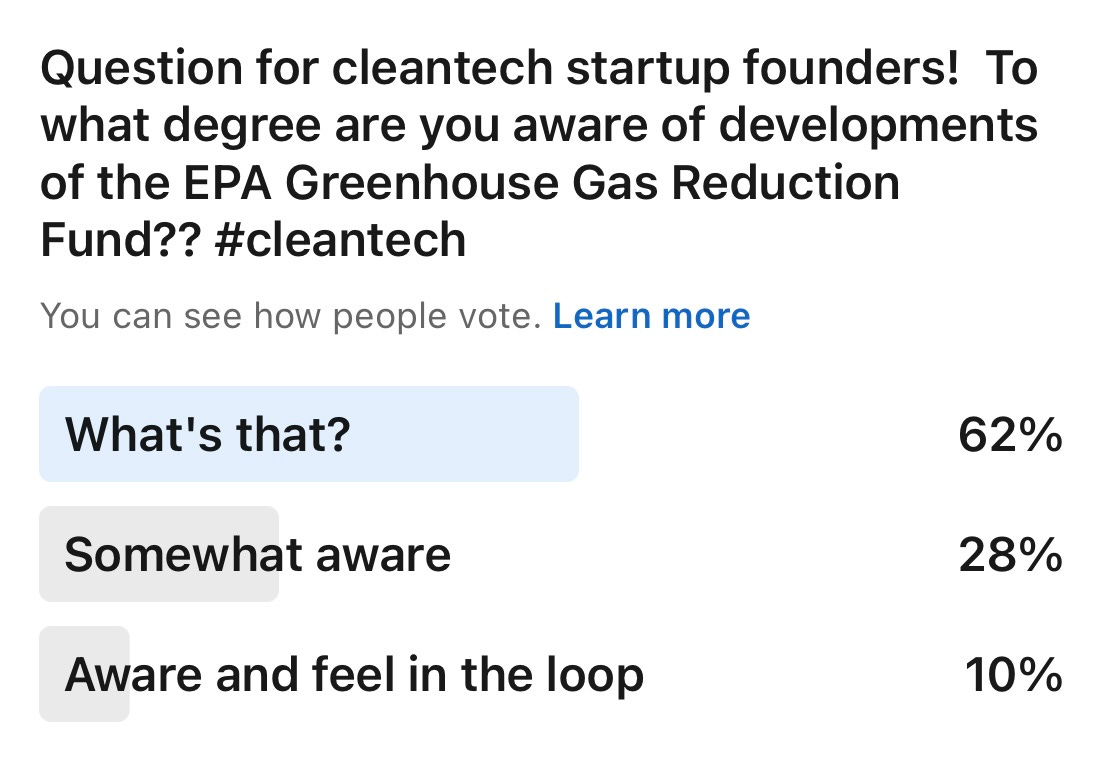

And, based on my survey of a couple dozen cleantech founders, it would appear that there’s a knowledge gap:

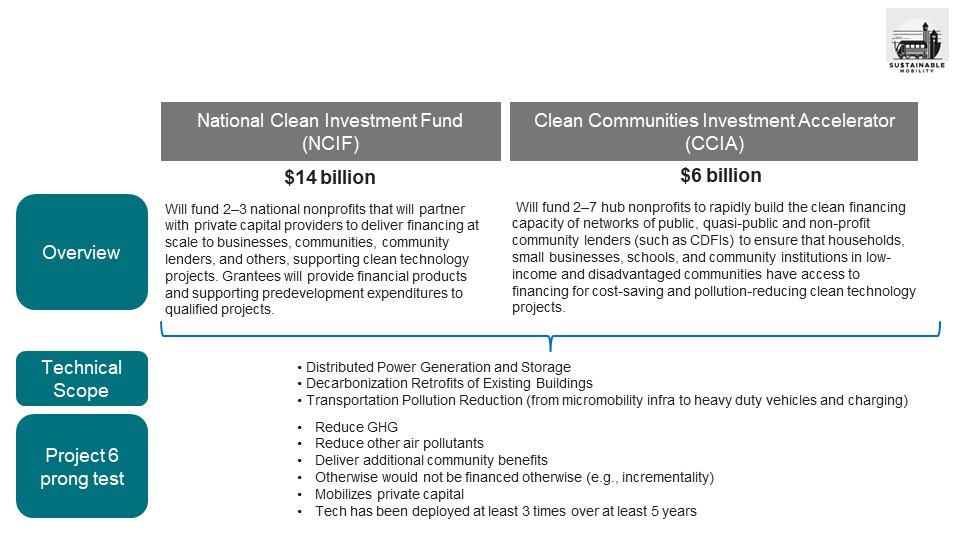

The US Inflation Reduction Act (IRA) contained so many climate gems, you can be forgiven for not tracking them. But one of those gems, namely the EPA Greenhouse Gas Reduction Fund (GGRF), is slowly taking shape. Over the last few weeks, the feds have released the official applications. And while (for-profit) startups aren’t currently eligible to apply, the framework by which startups and other technology providers can tap into the funds in one year is now clear.

Given that Solar for All is focused on, well, solar, it’s worth diving a bit deeper into NCIF and CCIA as both explicitly support transportation-related projects. The notice for NCIF is now live, with submissions from non-profits due in October; the same goes for CCIA. Non-profits who win are expected to be able to start funding projects (including with startups) as of July 2024.

The “so what” for a startup?

Don’t panic if your startup isn’t 5 years old. The NCIF fund has a 7-year deployment period, for example.

Do, however, make sure you can hit the “3 times over at least 5 years” deployment test as quickly as possible.

In fact, for the whole 6-prong test: start developing bulletproof data for how you pass the test with flying colors. Things like 3rd party validations and pilots that quantitatively demonstrate community benefits.

For NCIF, start thinking about how it can help get you from deployment #3 through enough iterations to secure traditional project finance or support from the DOE Loan Program Office.

For CCIA, develop relationships with a handful of lenders in your community (such as CDFIs) who know your product and how it could be deployed in their territory. You want to be top of mind for their consideration set when they secure their funds from the feds.

Know someone who could use $27 billion? Be sure to share with them…