Su$tainable Mobility: The 12 Charts of Christmas

Vol 45

This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

Welcome to 2023! In this issue’s Deep Dive, we’re ringing in the New Year with the 12 Charts of Christmas: A dozen charts that help you visualize what’s happening in sustainable mobility. (The 12 days of Christmas start on Dec 25 and end on Jan 5, but you don’t have to wait until Jan 5 to look at the last chart.)

In other news: The U.S. Venture Sustainability Accelerator is approaching their January 9th application deadline. The accelerator invests in 5 sustainability and mobility startups every year and is the product of a partnership between gener8tor and U.S. Venture (a multi-billion, privately-held leader in transportation products and sustainability solutions).

Also, Los Angeles Cleantech Incubator (LACI) is accepting applications for their next Incubation cohort through January 6th. Startups receive hands-on mentorship, curriculum, $20-$50k funding for pilot deployment, and more.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🧑🏽💻 Crosswalk Labs (Arizona, USA): Hyperlocal emissions data

🔌 Deftpower (Netherlands): White-label SaaS for EV charging

🛺 EVZEE (India): EV fleet as a service

🛩️ Fluxart (United Kingdom): Hydrogen powertrains for aviation

🛴 Hooba (Belgium): Micromobilty fleet management as a service

👨🏾💻 Infyos (United Kingdom): Software to measure, track, and improve battery sustainability across the supply chain

👨🦯 Lazarillo (Florida, USA): App-based mobility for the visually impaired

💡 RiDERgy (Germany): Fleet charging optimization software

⚡️ Rhythmos (Colorado, USA): Grid and fleet-level software to optimize EV charging

FUNDING: Capital raises from startups previously featured in Startup Watch

Aviant (Vol 4) raised a $3M seed round from Luminar Ventures, Bring Ventures, and CoFounder

Vianova (Vol 38) raised a $6M Series A from Baloise Holding, RATP, Contrarian Ventures, and others

Reminder: The startup data set is open, for free. If you’re a subscriber interested in accessing the Airtable with all the raw data on ~300 companies, please let me know.

QUICK HITS: Notable news from the last two weeks

📦 Barcelona may impose a public space use tax on large delivery firms. Great idea to charge firms for the externalities of congestion; in the long-term, cities will charge for both parking and road use based on the use case, vehicle dimensions, emission, etc.

🚶🏾♂️New York City’s legendary 5th Avenue is getting a makeover focused on pedestrians, cyclists, and buses. Hopefully, success here will prompt similar efforts in other less famous streets of the Big Apple.

🚱 Wiesbaden, Germany is abandoning its hydrogen bus program after only a year. The window of opportunity for hydrogen buses is quickly closing. That said, electric powertrains are facing some limitations in heavy-duty applications: NYC is having trouble with its snow plow program.

📢 California is banning Tesla from promoting its vehicles as fully self-driving. Tesla had already stopped publicly reporting statistics about its driver assist safety results.

🇮🇩 Indonesia announced EV subsidies of up to $5k USD per vehicle. South and Southeast Asia continue to put in smart plans for the e-mobility era in a way that South America would be smart to emulate.

🇨🇦 Canada is proposing that 20% of new car sales be zero-emissions by 2026. Canada is a relatively small market in terms of vehicle sales but will punch way above its weight in the EV ecosystem.

📬 The US Postal Service is going electric-only for new trucks by 2026. This has been an 8-year journey filled with ups and downs but ultimately zero-emissions is prevailing.

🇺🇸US vehicle tax credits related to the Inflation Reduction Act (IRA) are getting messy. Manchin is right to claim that OEMs are trying to game the commercial tax credit.

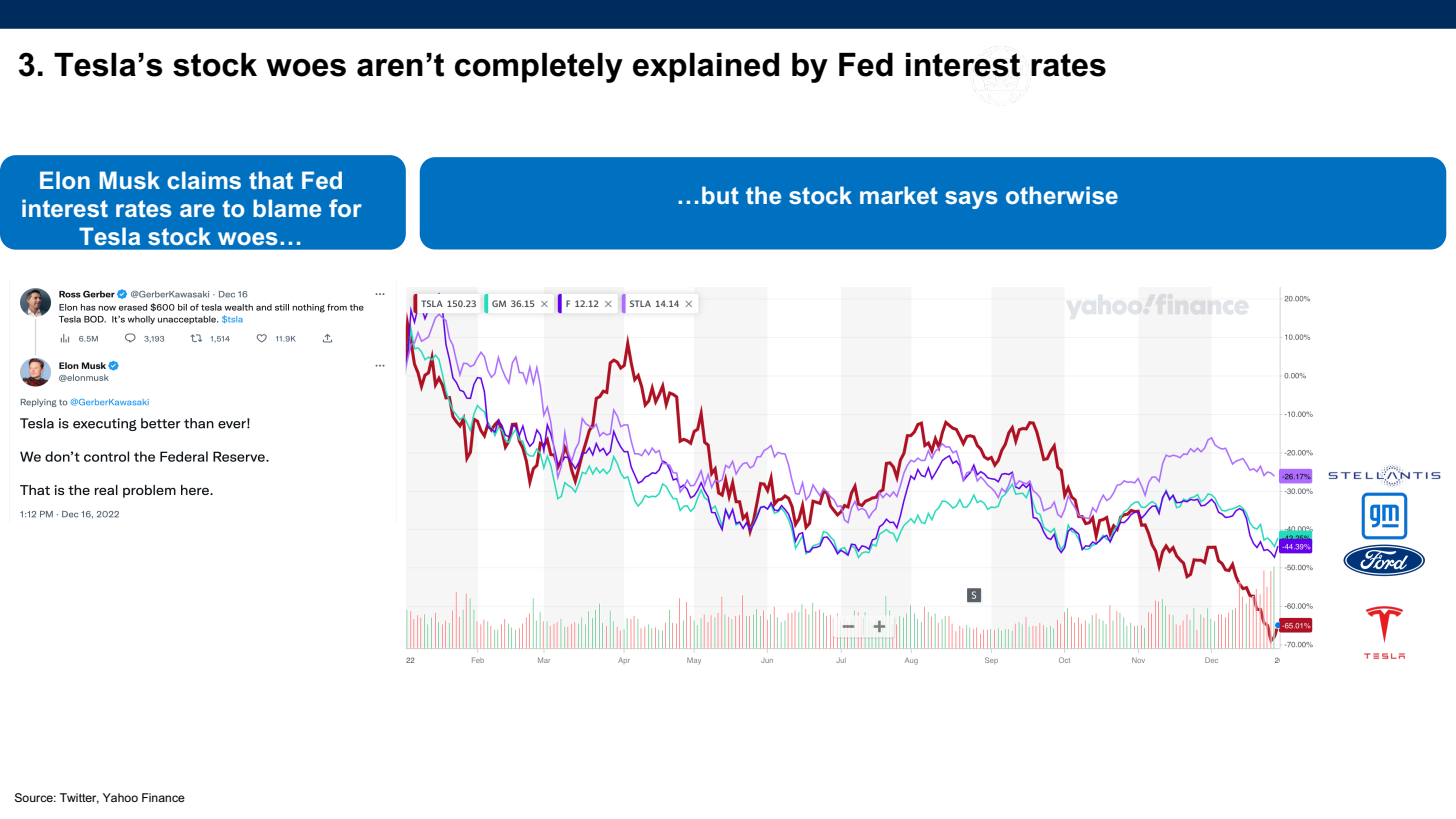

📉 It’s hard to keep track of how quickly Tesla stock is falling. Elon’s focus on Twitter is part of the problem, but there are other issues at play. Tesla’s fundamentals are strong, but no car company can go unscathed without a CEO at the helm.

💬 Paul Krugman's column in the New York Times argues that Tesla is just another bitcoin-like investment fad. I generally disagree with Krugman here, notably his assertion that “electric vehicle production just doesn’t look like a network externality business”; many elements of the EV ecosystem can exhibit network effects when done right (e.g., charger networks, virtual power plants).

🚲 A New Yorker reporter recounted her experiences entering the world of e-bikes. The article underscores the sales and service gap that is wide open between mom and pops bike shops, e-commerce direct-to-consumer, and big box retailers like REI and Best Buy.

🐣Bird (Global) was saved by a proposed acquisition from its Canadian partner, Bird Canada. This saga is far from over.

🚛 The US Environmental Protection Agency (EPA) just made its first heavy-duty truck emission rules in 20 years. It’s a good but belated move; California is already out in front on this topic with much more aggressive goals.

✈️ Amazon is trying to sell excess cargo space on its planes. This is a temporary hiccup; the long-term trajectory still points towards Amazon owning and operating its own e-commerce supply chain.

⛴️ In maritime, vessel charterers like Maersk are refusing to use a new carbon regulatory clause. A good illustration of the principal-agent problems in maritime between ship owners and those who charter them.

🏢 Can we turn unused office space into housing? This article is a good primer on why it’s so much harder to pull off than most people think.

DEEP DIVE: The 12 charts of Christmas

In the (non-denominational) spirit of the “12 Days of Christmas”, here are 12 charts that should orient you to some of the big sustainable mobility issues as we ring in 2023.

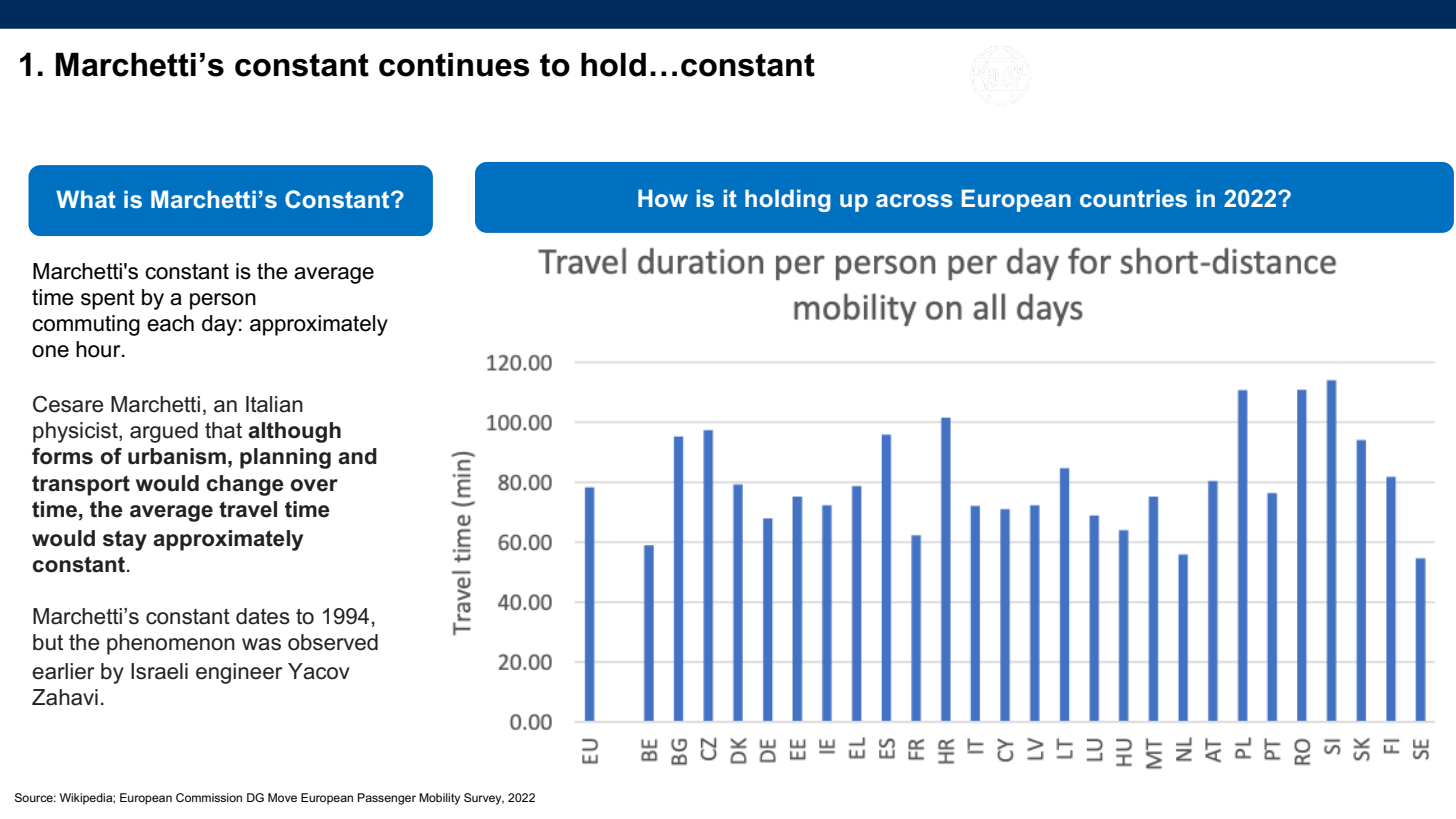

Despite the pandemic ushering in a new era of hybrid office work, Marchetti’s constant is holding up quite well in 2022. Next up, Marchetti’s constant will face off with Meta’s attempt to get us all to move to the Metaverse.

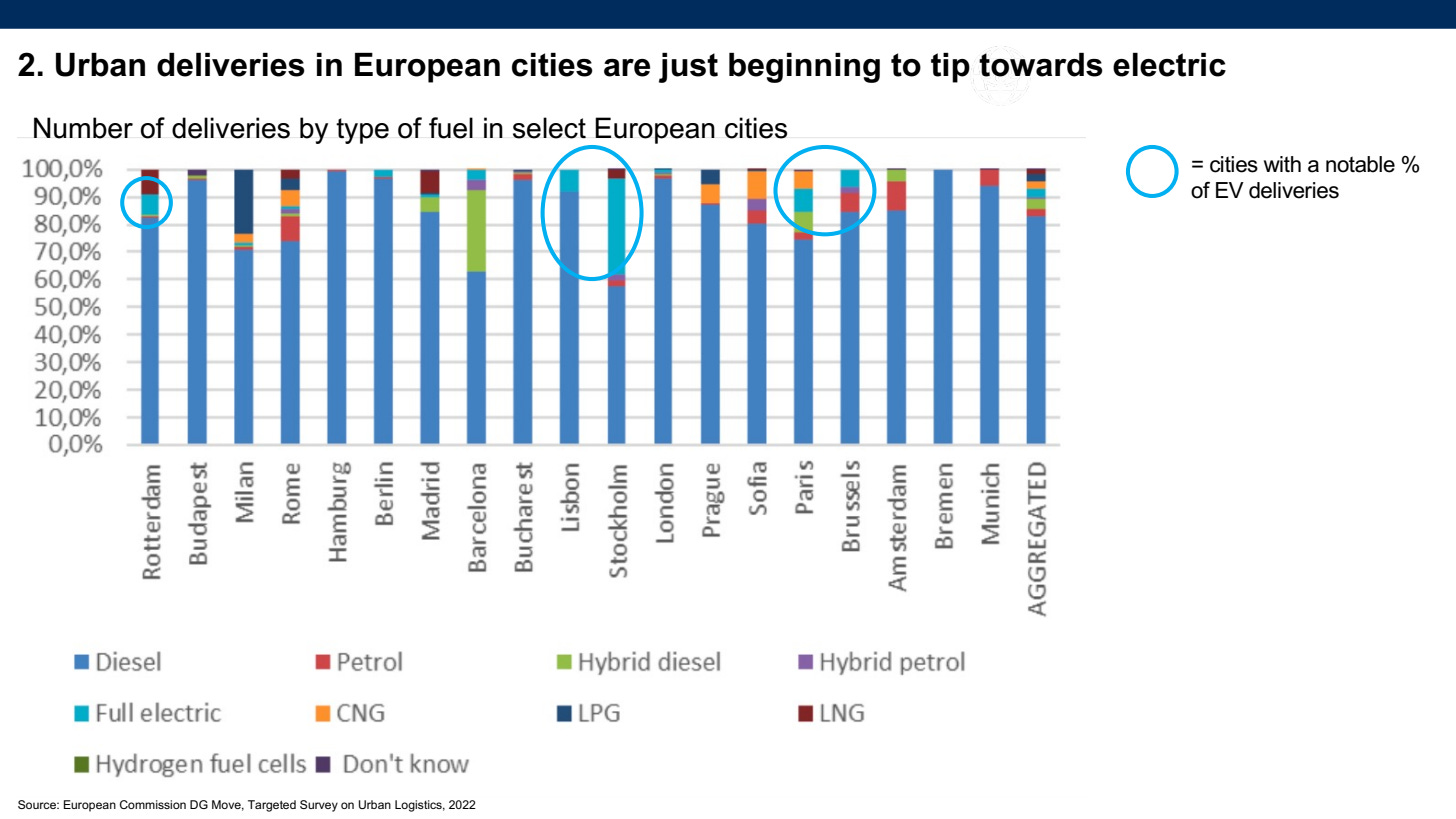

EVs of all sorts (electric vans, as well as e-cargo bikes) are just entering duty for urban deliveries. By the end of 2023, cities like Paris, Lisbon, Rotterdam, and Brussels will likely have a mix a lot closer to Stockholm in 2022.

Elon Musk blames Tesla’s stock woes on the US Federal Reserve’s interest rate policy. But other auto stocks like Stellantis (-26% for the year as of Dec 29), GM (-42%), and Ford (-44%) aren’t down nearly as bad as Tesla (-66%).

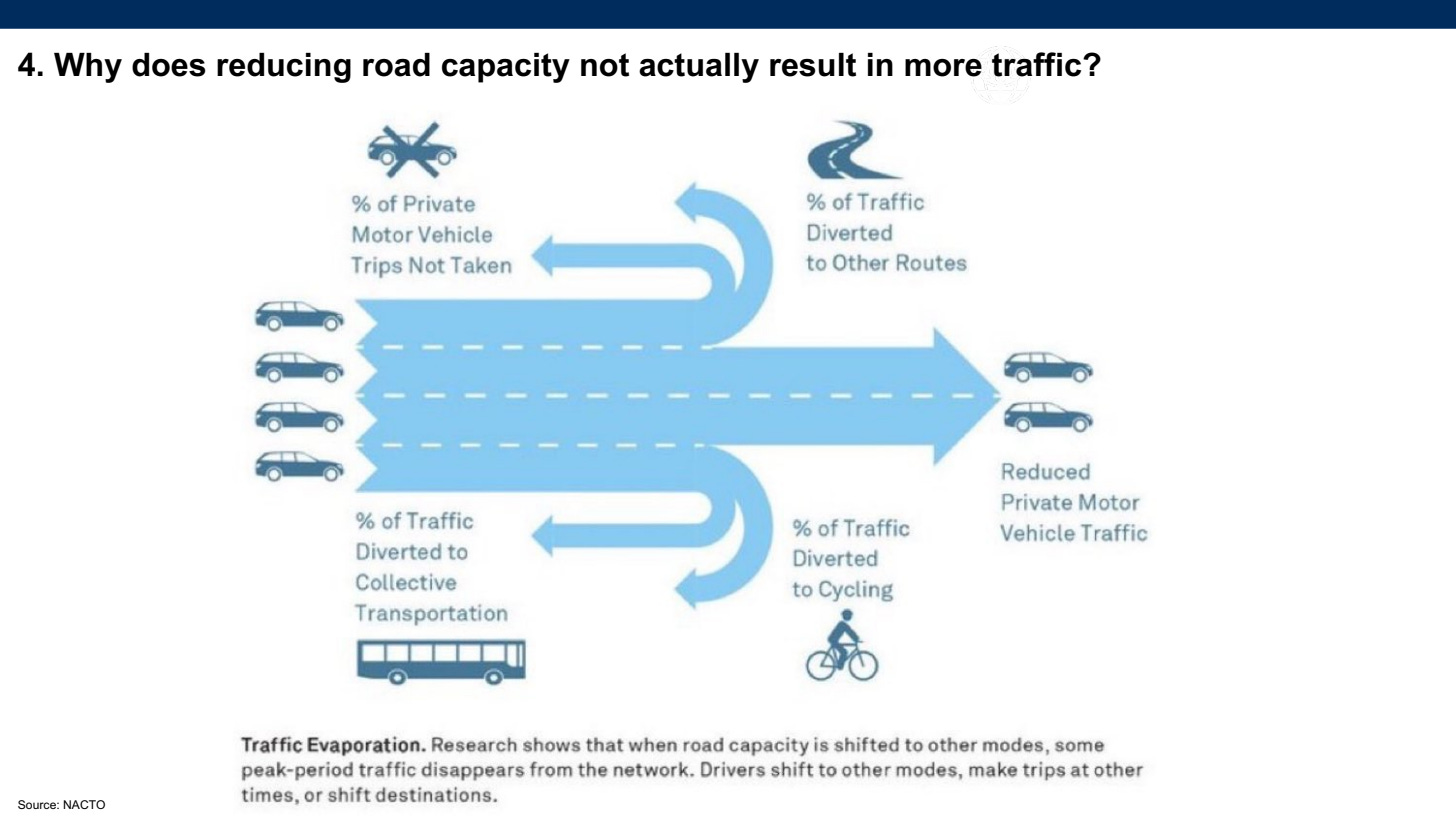

Speaking of Elon Musk, he’s not a believer in the data-proven concept of induced demand, whereby adding additional road capacity generates more car traffic. Alas, it’s unlikely that he would believe in its opposite, traffic evaporation, whereby eliminating road capacity doesn’t actually increase traffic.

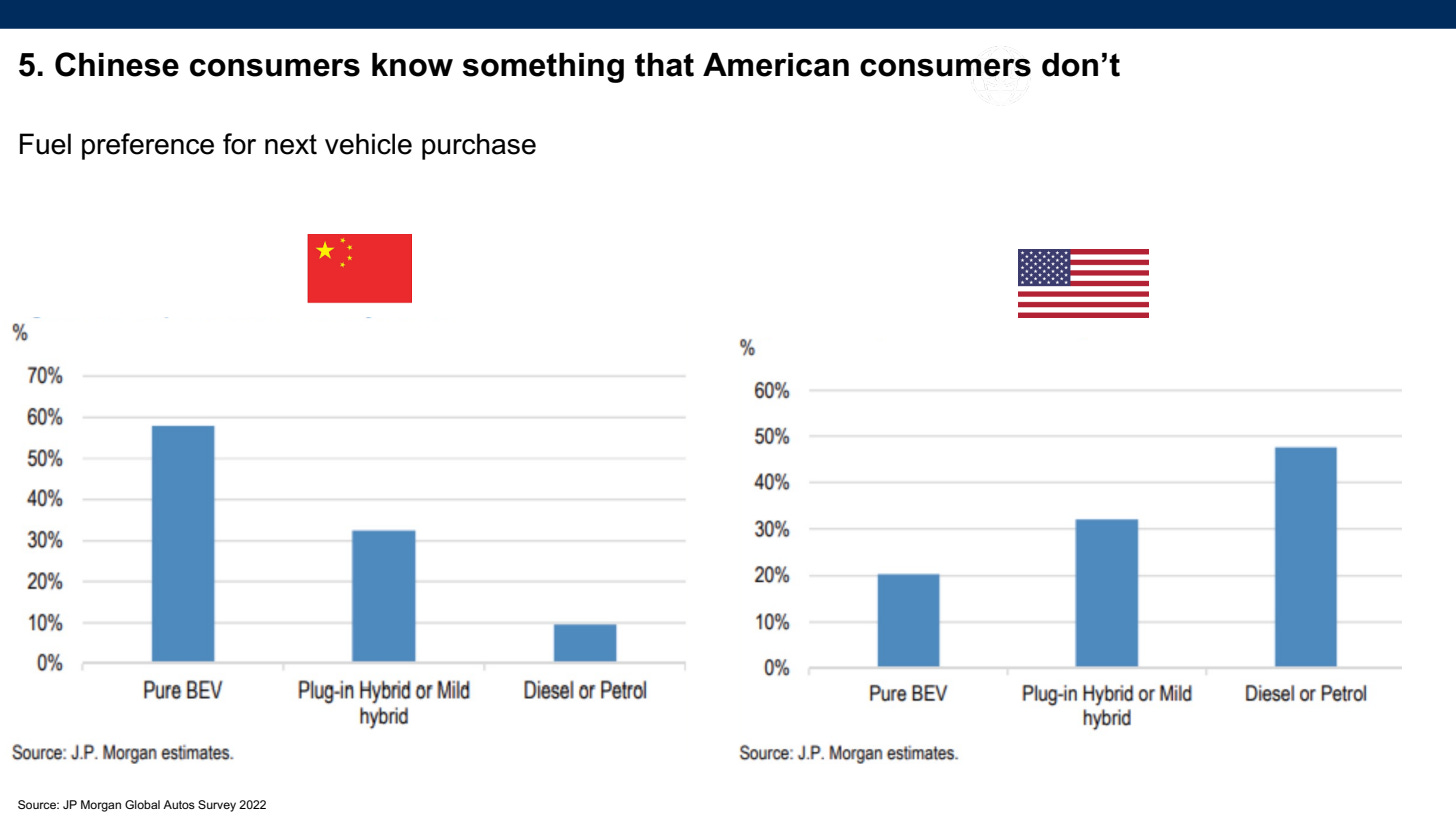

Chinese consumers who are in the market for a new car have very different aspirations than their American counterparts.

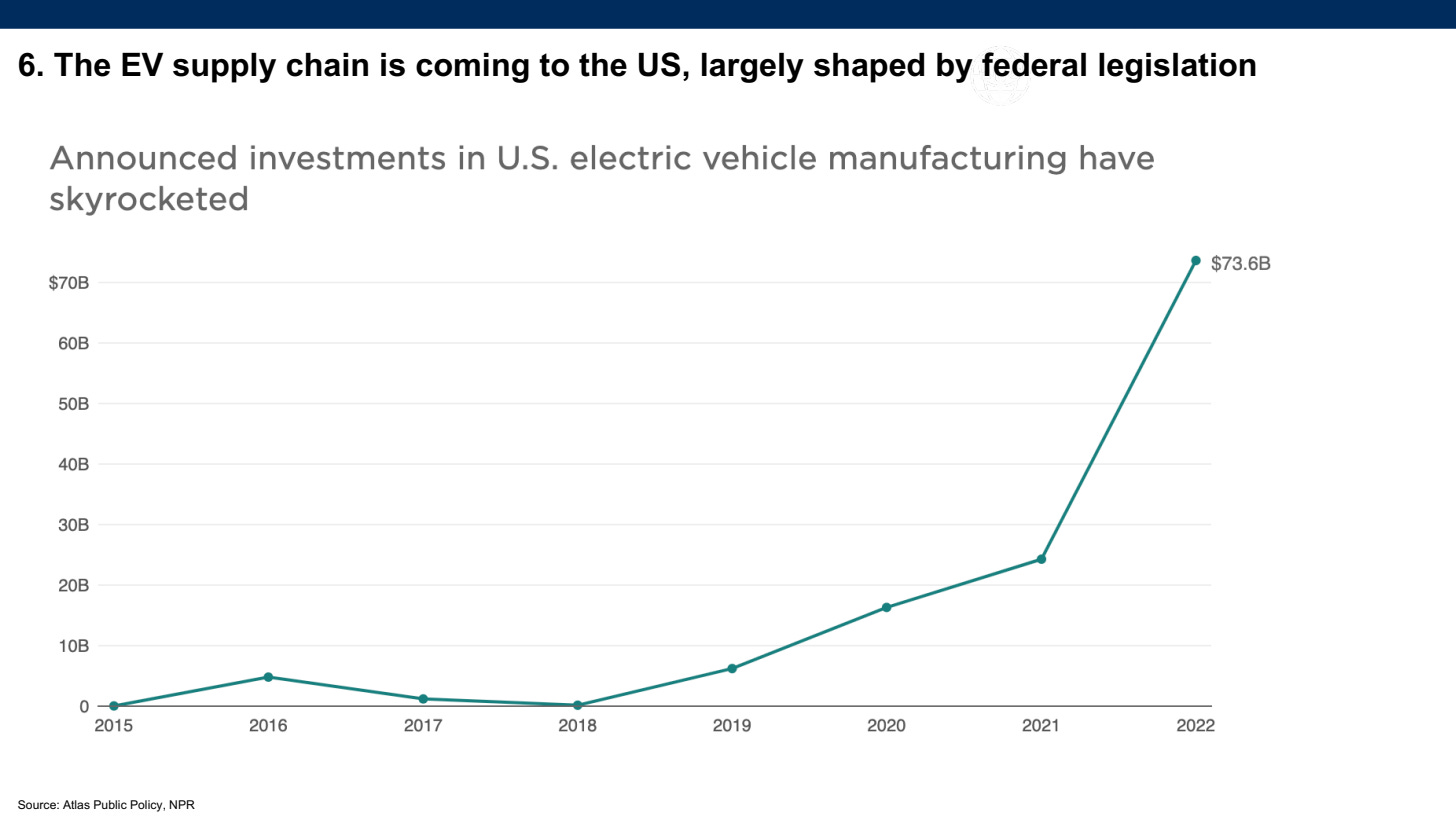

If you’re looking for an example of federal policy building a market, look no further than the announced EV investments in the US since the passage of the Inflation Reduction Act (IRA).

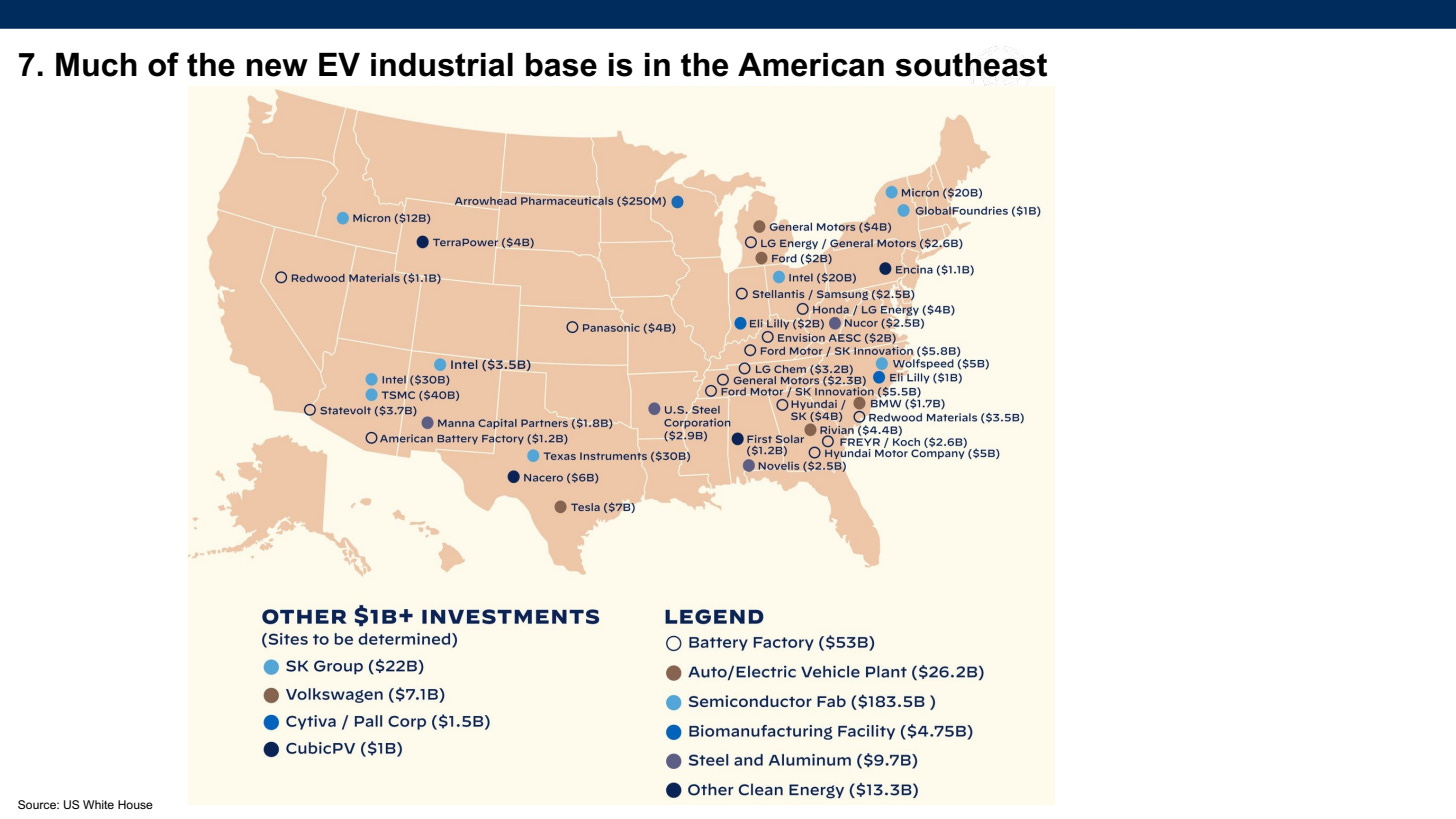

Alas, the real beneficiary of this is the American southeast. It’s not exactly code red for the traditional Detroit 3 stronghold in Michigan, Ohio, and Indiana, but those states risk missing out if they don’t step up the pace.

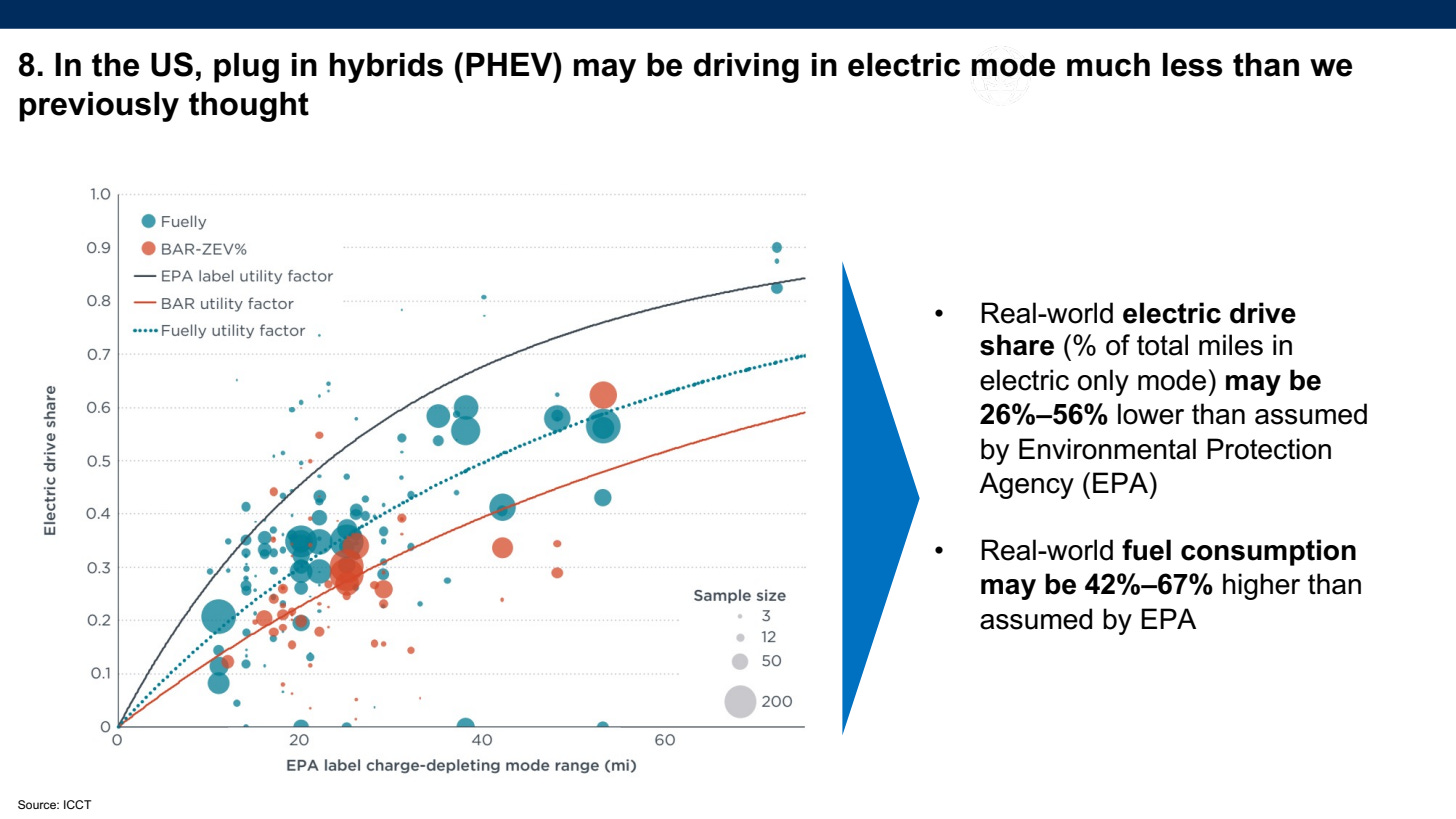

The real-world usage of plug-in hybrid vehicles (PHEVs) has been the source of a lot of hand-wringing in Europe. Thanks to the ICCT, we now have fresh data about the same issue in the US market. While discouraging, it highlights the need to make regulations much more dynamic based on real-world usage.

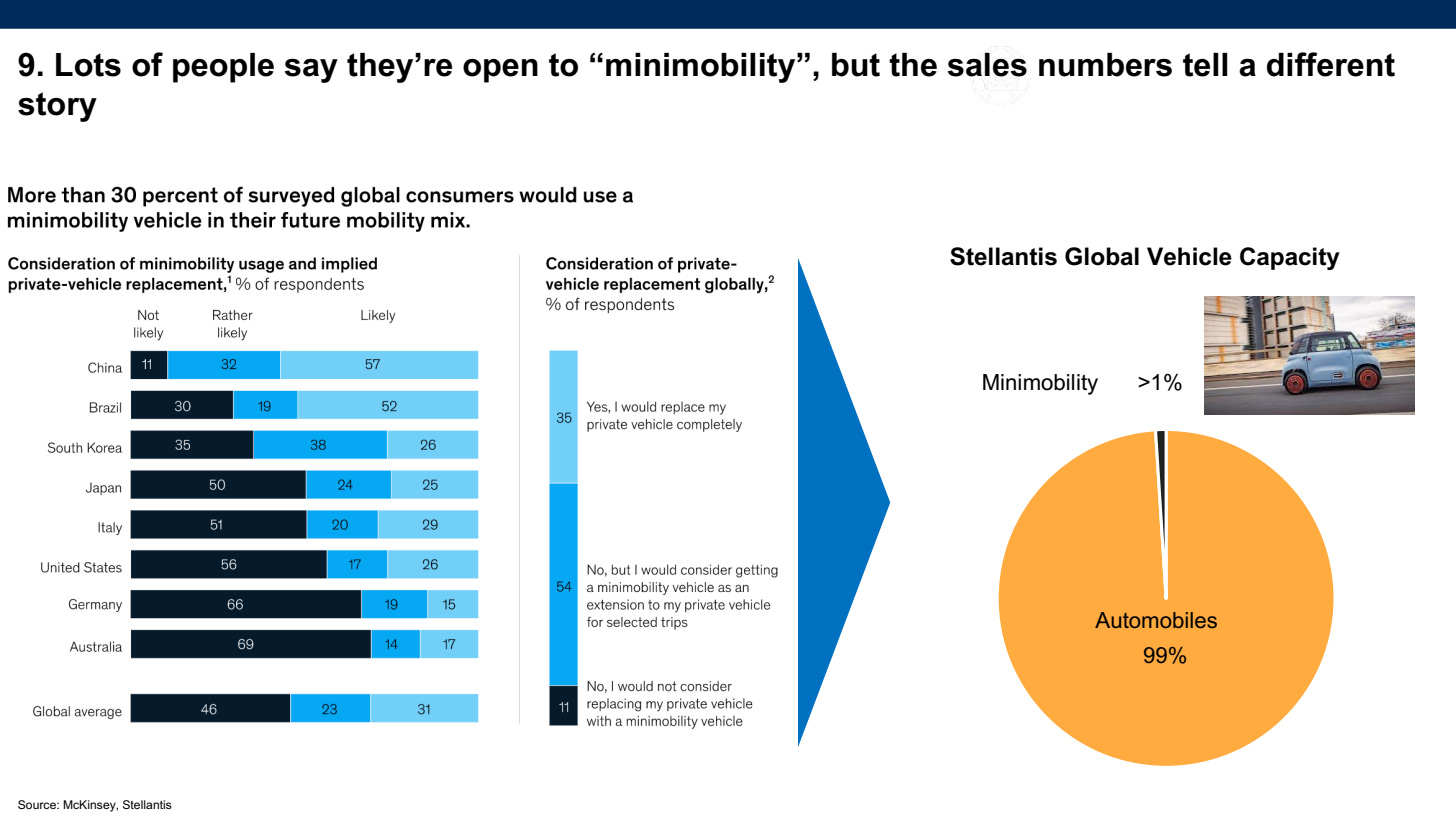

Minimobility (small 3 and 4-wheelers) is having a moment, with startups like Nimbus and incumbents like Renault prepping new launches. But there’s a huge gap between what people say they will buy and what they end up buying. By almost any measure, brilliant Citroën Ami from Stellantis is the most successful entrant in the 4-wheel minimobility market and it’s still a drop in the bucket compared to auto sales.

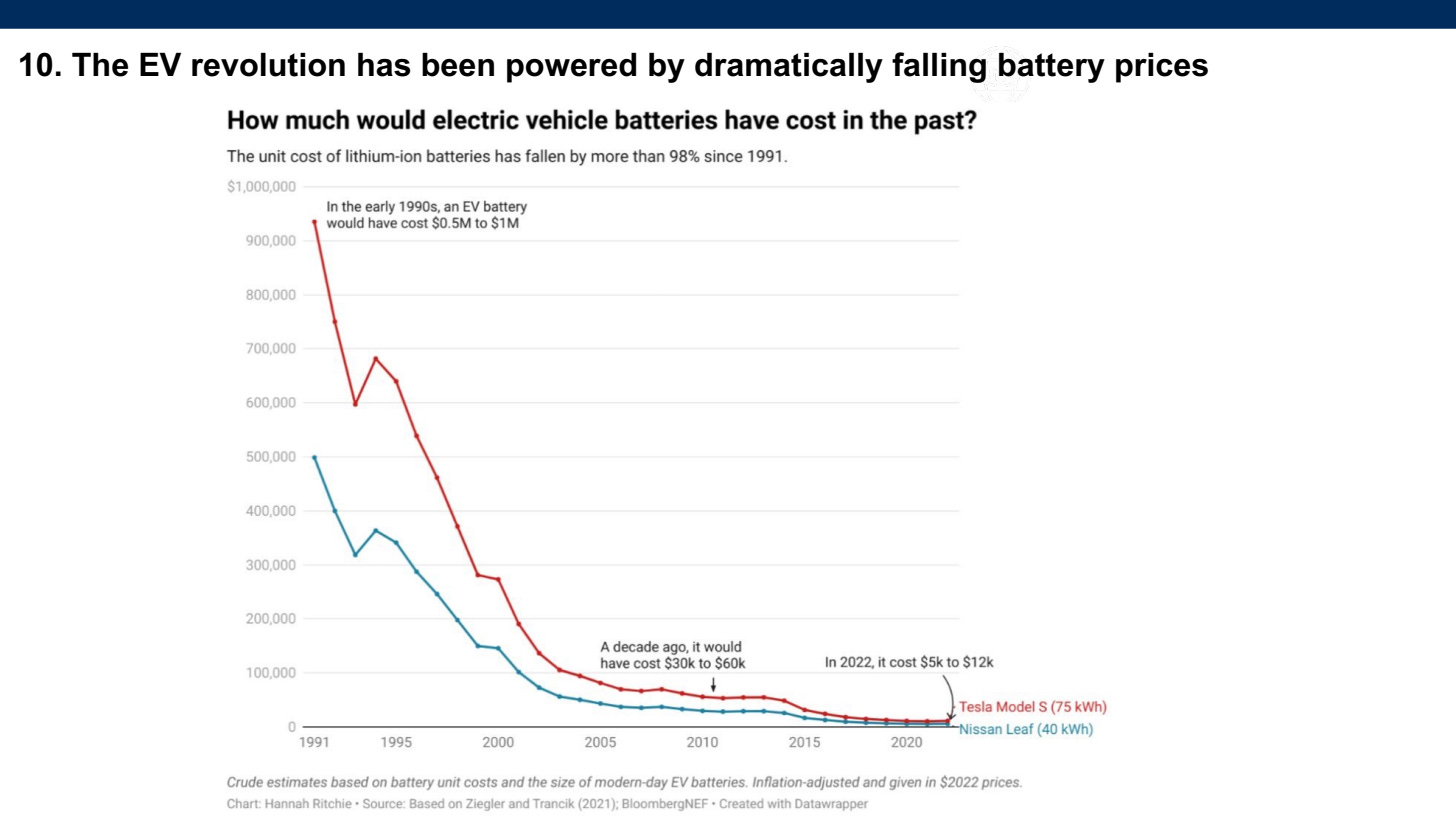

If you’re looking for the answer to why EVs didn’t start hitting volume manufacturing until circa 2010, here’s your answer.

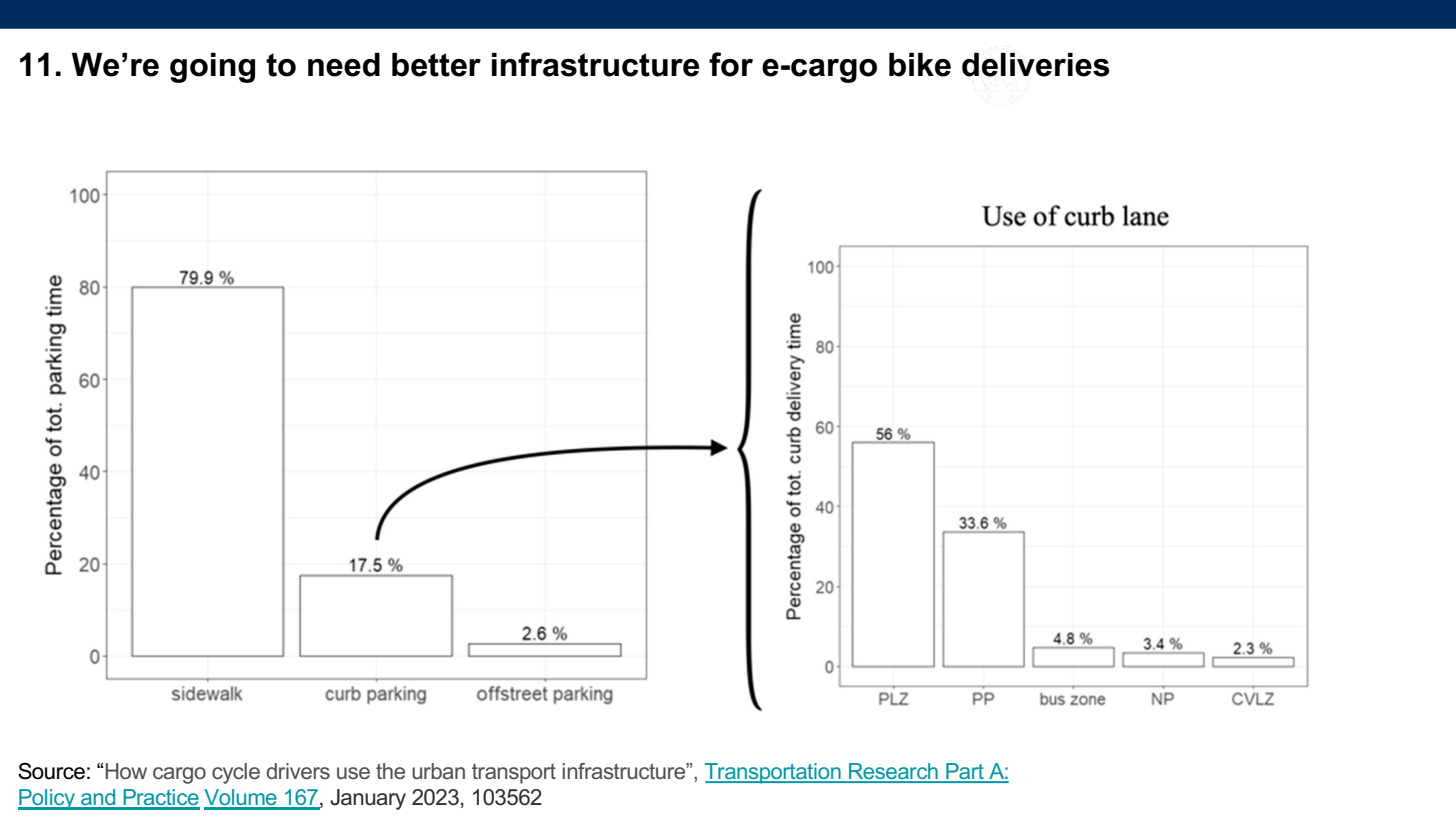

The brilliant folks at the Urban Freight Lab at the University of Washington have been running a great pilot on the real-world use of cargo bikes in Seattle. And now we’re getting fantastic insights: Drivers are parking on the sidewalk about 80% of the time when they make deliveries. That’s going to have to change if we’re going to scale cargo bikes as a delivery solution.

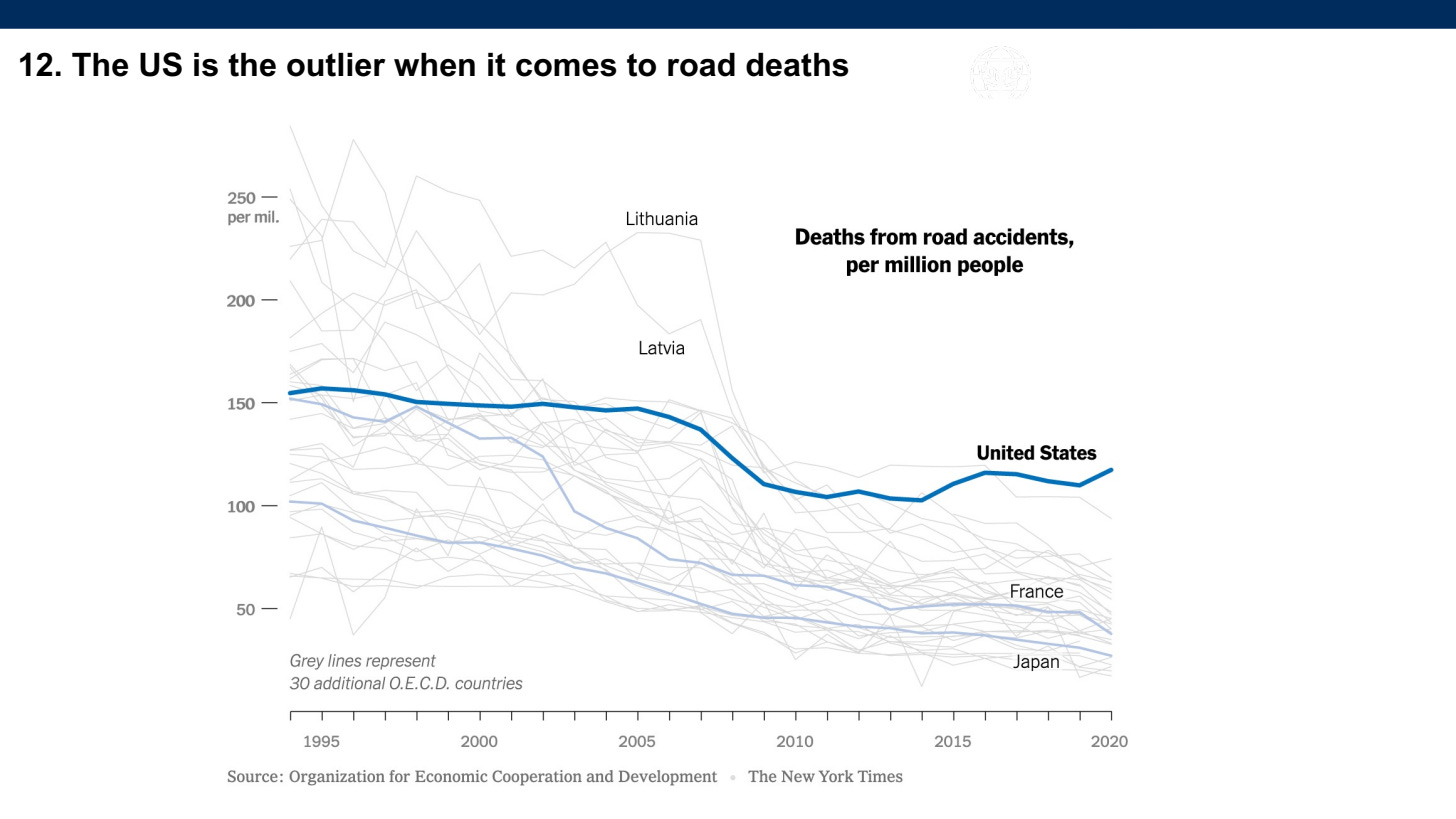

The New York Times took a look at why the US is such an outlier in road deaths. It’s a great recap if you’re new to the topic.

So there you have it! A bit of an overview to bring you into 2023. Thanks for reading and please share with your network.

Fluxart is now Hyflux www.hyflux.aero

Alex, this is just an epic post. Thank you for the work you put in. Would I you be cool if I recommended your newsletter on my (tiny, new) substack?