🚘 Su$tainable Mobility, Volume 13

This newsletter aims to separate the signal from the noise for making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This week, we have a Deep Dive on Inside Rivian’s S-1 (part 2 of 2) by guest contributor Patrick Gaffney, a former equity analyst at HSBC, Citi and EFG Hermes. He has a long-standing interest in economic sustainability, having previously served as CFO of Good Food Markets, which targets bringing fresh produce and groceries to food desert communities. He currently serves the US Dept of State as an economic analyst in Vietnam.

After today’s issue, Su$tainable Mobility will be taking a hiatus for 3 weeks due to travel. Instead, I will be organizing some mobility meetups in Paris (Oct 20) and Brussels (Oct 21). Send me a message if you want to join us!

Disclaimer: This newsletter represents individual thoughts and not those of any employer. I will always disclose when I have a financial relationship with a company cited.

QUICK HITS: Fast takes on notable news from last week

🚌 Electric buses are the Swiss army knife of sustainable transportation. I had a chance to share my thoughts with the United Nations Sustainable Transport Conference. More on that here and here.

🔌 Ford will use “Charge Angels” to solve the EV charger challenge. Ford has identified the right problem, but the ChargerHelp! * solution seems much more robust.

🚘 Tesla is moving to Texas. This is a symbolic loss for California. But getting Texans excited about EVs is fantastic.

🚲 Watch groups are popping up to protect bike owners from theft. Bikes, and e-bikes in particular, are becoming a big business. Some e-bikes offer theft protection features, but the theft problem is definitely acute and widespread.

🚫 Berlin may become the biggest car-free city. It’s not an issue of if, but of when and how major cities significantly limit private car ownership and usage. This dramatically helps shared mobility operators reach profitability.

🔂 Gogoro has entered China with its battery swap system. Another example of how the interesting battery swap progress is mostly being made in Asia.

🇫🇷 France has a new industrial plan for EVs. This seems more like the status quo when de Gaulle-level ambition is needed.

🚫 BMW is ready for an internal combustion engine (ICE) ban as of 2030. Every car company is getting ready for this, but it leaves a lot of unanswered questions about what happens in emerging markets from both a sales and production standpoint as it relates to ICE vehicles.

🅿️ Portland may move ahead with mandatory “cash out” parking for employees. “Cash out” parking offers employees the option of "cashing out" their subsidized parking space and taking transit, biking, walking, or carpooling to work. This is a great policy move and one employers should adopt even without government intervention. For many large employers, offering cash out parking is probably one of the fastest ways to impact indirect emissions.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🔋 Aviloo (Austria): EV battery diagnostic hardware and software

🏪 Hurry (Oregon, USA): Direct to consumer delivery via retail stores serving as micro depots

🤳🏽 Tandem (United Kingdom): Tech platform to let taxi, minibus, and coach providers monetize their capacity

🧾 Vene Rides (Florida, USA): Retail chain for e-mobility products and services

DEEP DIVE: Inside the Rivian S-1 by guest contributor Patrick Gaffney (part 2 of 2)

Thanks for reading my dissection of Rivian’s S-1 last week. A few comments:

I told a friend, who is a real car freak, about it, and he said: “Damn, those trucks are supposed to be really good.” So the word on the street is that people love the trucks. They should for $70,000 (starting, of course).

Please feel free to reach out with any comments or things I got wrong (or right!). I would love to hear from you. You can reach me by emailing me here.

And one follow-up to what I wrote about last week. The company is hoping to have minimal marketing spending, something that Tesla has gotten away with, given it has Elon Musk as its hyper-famous CEO. I really am not sure that Dr. Scaringe will be the same. Before doing this, I had heard of Rivian, but I haven’t heard of him. In fact, one article said that its buyers liked that he isn’t out there much.

Looking at other car companies besides Tesla, sales and marketing budgets are enormous. Ford spends between $10 and $11 billion a year for all of SG&A. GM actually spends less, at between $7bn (2020) and $9.7bn (2018). On a percentage of revenue basis, it’s 6-10%. For all of them, SG&A is considerable, and a fair amount of it is marketing. For example, GM spent almost $3bn on advertising alone in 2019, while Ford did $2.3bn, according to Statista. Even if Rivian just spends anywhere close to that at the beginning, then it would severely cut into profits.

Other things that I picked up:

Governance/Dual Class Structure: Rivian plans to have a dual-class share structure, meaning one class of stock for the founder that retains control of the company through extreme voting rights (undisclosed in the S-1). There are plenty of companies with this structure (more than 170 in 2017 by my very quick count), including Facebook, Alphabet, Alibaba, and Volkswagen. But the index makers are pushing back against this. It could mean that Rivian can’t get into the S&P 500 index, which would mean that a vast amount of EFT/index fund money couldn’t buy the stock. Not great for the company. But it does mean that CEO Scaringe has control of the company, for good or bad.

Founder pay reaches almost to Musk levels: Dr. Scaringe, despite his relatively low profile, actually is going to be very well compensated if things work his way. He had 9.7 million share options that will either vest over time or be based on some performance metrics at the end of 2020. This could be worth $776m at a price of $80 per share. Then in 2021, the board gave him another option for 6.8m shares that vest over time and a performance-based option for 20.4m shares. These were valued at $241m at the time. If it prices at $80, it would go for $1.6bn. Nice payday. But the performance goals are pretty aggressive – share price must rise to $110, $150, $220, and $295. These prices all seem crazy, but remember it did happen for Musk, and he got a payday of $2.9bn.

Material weakness in controls: In preparing the S-1 the accountants decided that Rivian had “material weaknesses” in its internal controls, specifically over financial reporting. This sounds both bad and (maybe) unimportant, but actually it just means that the company had poor financial systems in place, which is a little disheartening for a company that had already received over $11bn in financing. You would think that their investors would have demanded a bit more. The company is now fixing it by hiring a lot of new people in finance and accounting. It will be interesting to see if this fixes the problem, because public reporting requirements are killer.

Tesla is suing them: Actually, Tesla is suing some employees that left Tesla for Rivian, because they allegedly brought trade secrets with them. It’s unlikely to lead to anything material, although last year’s ruling against Anthony Levandowski by Google is a bad precedent. It does speak to the amount of competition for EV employees now.

Abdul Latif Jameel: I used to work in Saudi, so my eyes perked up when I saw that ALJ invested in Rivian. This is a large Saudi conglomerate that also owns the right to sell a number of auto brands, including Toyota and Ford. Good for them. Total investment will be something like $300m (depending on some warrants) and the take home (at a $70/share valuation) is $4.5bn, or almost 15x. I think the bigger thing to say is that Rivian has a lot of partners that can help them ultimately sell cars (ALJ) or that will buy cars (Amazon). They also have Ford as an investor and competitor.

Foundation set up: The Forever foundation will be granted 1% of outstanding shares at the IPO. That’s a cool $800m (if the company is valued at $80bn) in funds right from the start to combat climate change.

Last valuation (private) and first valuation (public): The Series F round was just completed in January 2021, and the stock was valued at $36.85 per share for a total raise of $2.7bn. Then in July, the company issued a convertible note for $2.5bn. Just to add that up, the company has raised $5.2bn, or almost half of the total amount raised, in just the last 9-10 months. Good job.

Interestingly, the convertible…converts into shares of common stock (no special voting rights here!) at the IPO. The conversion price is the lessor of:

$71.03

The IPO price by a discount rate (0.85 until yearend).

What does this mean? Good question! Well, basically if the IPO goes well, then the conversion price is $71.03, which is partly why I chose $80 for my “guestimate” value per share ($83.56 x 0.85 = $71.03). If it goes poorly (meaning below $83.56), the owners of the convert (Amazon, Ford, Cox, and Wells Fargo accounts) will get more shares than they expected, and they probably won’t be too excited about that.

So the psychological test for a successful IPO is this: did it get above $83.56 per share.

Valuation

News articles have given a potential valuation of $80 billion for the company’s shares. I am sure every auto analyst is building up their model now to see if this makes sense. I was an equity analyst for many, many years, and so I know what these guys do (and they are still mostly guys). They open Excel, meticulously enter all of the historicals, make very specific assumption after very specific assumption (e.g., 267,985 cars will be sold in 2028 up 5.71% from 2027), and calculate the resulting free-cash flow estimates that they then feed into their DCF. The resulting enterprise value is compared to the stock, and voila, you have a Buy or Sell (but mostly Holds!).

But sometimes, we like to do it backwards: back into the public valuation to see if it is realistic. If Rivian is worth $80bn, what does that have to mean for sales or margins or multiples? If any of these are crazy, say the company needs an EBITDA margin of 89%, you might illuminate something more clearly than a model with hundreds of assumptions. Here’s my cut:

My assumptions

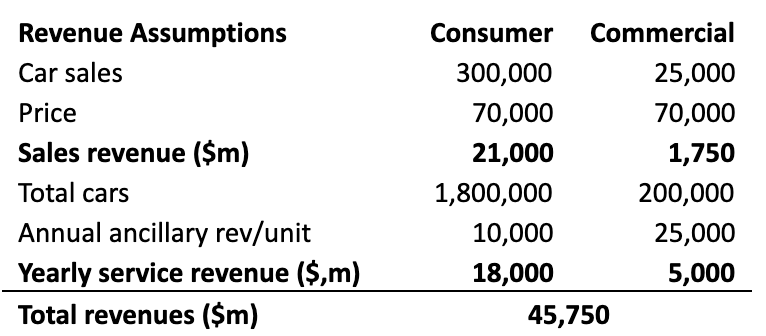

Revenues: This is the big one. Let’s talk about passenger cars first. Let’s assume the company gets to about 2.5-3.0% of the US market with car sales of around 300,000 a year. And we use their pickup base price of $70,000 to get car sales revenue of $21bn. This compares to Tesla of $42bn, Ford of $136bn, and GM of $140bn (all trailing twelve months). Now, to add in the ancillary revenue, we assume they get up to 1.8 million units out on the road (average life of 6 years of Rivian getting revenue, not the life of the car), and annual revenue of $10,000 per car. This adds another $18bn in revenue.

Second, for commercial vehicle sales, we assume the company is successful with a market share of around 5%, equating to sales of 25,000 units a year at an average price of $70,000. [Alex, the owner of this newsletter thinks this is low, but let’s keep it here for argument’s sake. If you have a more positive view on Rivian’s commercial prospects, then the company looks more attractive.] After 8 years, which we are assuming is the average life of the vans (which may be a bit short), the company has 200,000 vans in the fleet. We then assume it charges about $25,000 per unit for all charging, maintenance, services, etc. This results in annual revenue of $5bn for fleet-as-a-service for total commercial annual revenue of $6.75bn

Added all together, that’s total revenue of $46bn.

EBITDA: This is the big assumption because we skip all the other lines in the income statement and go straight to what matters: the cash proxy of EBITDA. And let’s be generous here and assign a 15% EBITDA margin. That’s significantly higher than Ford (its high was 10.2% back in 2016, at least for the last 5 years), a bit higher than Tesla’s is now (14.3% TTM), and in line with Toyota (14.7% for the year ending in March). GM has had an amazing last 12 months (TTM EBITDA margin of 18.4%) but prior to that 13.5% was a high in 2016 (again for the past 5 years).

EV/EBITDA: Where does that put us: $46bn in revenue x 15% margin = $6.9bn EBITDA. With an $80bn valuation, that implies an EV/EBITDA of just under 12x. Compared to Tesla (133x), it’s cheap! But, almost everything is cheap compared to Tesla. But surprisingly, it’s cheaper than Ford.

But, let’s not forget a few things:

It’s gotta go up from here: It is based on an IPO valuation of $80bn, but if you bought into the IPO at $80bn and it stayed there, you would be very unhappy – you want it to pop! So the actual valuation needed is probably more like $120bn, or 17.5x EV/EBITDA.

We don’t even reach these figures until 2025, at the earliest: These are assumptions for a future steady-ish state. But this future may take a while to reach, say 2025 at the earliest, not least because they only have capacity to produce 150,000 cars now (rising to 200,000 by 2023). Hard to sell 325,000 units out of that plant. With the time value of money, we need the final valuation even higher than $120bn to justify our valuation today. Luckily, people are discounting the future at a very low rate these days.

Aggressive assumptions: My assumptions are pretty aggressive, at least for the consumer side. If you are more negative, then it will look a lot more expensive - and vice versa. Or to say it differently, the potential variance is extremely high - especially since they’ve sold a few thousand trucks at this point.

Ultimately, the company needs to relatively quickly reach these sales figures and go beyond them. Every 100,000 in new car sales adds $2bn in EBITDA or 28% over our base case. Let’s say they sell 100k more each year from our assumptions, then EV/EBITDA falls by half every 3.5 years.

Buy or not to buy? So where does that leave us? I actually am a bit reassured that EV/EBITDA isn’t so crazy based on my assumptions. Really though the stock needs to grow aggressively from our base case to justify this valuation. That means a bigger share of the overall market, despite extremely strong competition and a high price point. I don’t know. I am probably not going to buy into the IPO, but that’s because most of my money is in index funds. But I am thinking about buying the SUV coming out in December. It looks cool.

* My employer has incubated and invested in ChargerHelp! More info here.