This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

Reminder! Enduring Planet (where I serve as a venture scout) has launched Enduring Planet CFO, a trusted startup partner for bookkeeping, accounting, financial planning and analysis, and fundraising.

This week Deep Dive is the obituary of the hydrogen-powered plane.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Airship Industries (California, USA): Autonomous airships for cargo hauling

Ichiban Motorcycles (Japan): Emerging manufacturer of electric motorcycles

FleetGlue (California, USA): Hardware-agnostic fleet management software for mobile robot operations

Joint AI (California, USA): Software to automate multichannel freight operations to drive efficiency

KAV Helmets (California): Mass-customized production, starting with custom 3D-printed cycling helmets

Lunatrain (California): Overnight sleeper train service

Saferide (Nevada, USA): Aftermarket safety hardware for cars

Selar (France): Sustainable cruise expeditions serving the the polar regions

Sunchem (California, USA): Technologies for the precision separation of critical metals used in batteries

Valo (California, USA): Electric hydrofoil technology

Know someone who likes to follow startups in this space?

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Fetii (Vol 24) raised a $7.4M Seed round led by Mark Cuban, with Y-Combinator and Goodwater Capital

About Energy (Vol 57) raised a 4M GBP funding round (investors undisclosed)

Spark e-fuels (Vol 58) raised a 2.3M EUR pre-Seed round led by Nucleus Capital, with Zero Carbon Capital, IBB Ventures, Chemovator, Voyagers.io, and 1.5° Ventures

Valar Atomics (Vol 69) raised a $19M Seed round led by Riot Ventures, with AlleyCorp, Initialized Capital, Day One Ventures, and Steel Atlas

Bingo Tech (Vol 93) raised $1.9M from Trucks VC

Not yet a subscriber?

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🚲 New York City is fulfilling its promise to let delivery workers swap out fire-prone e-bikes with UL-certified options. That’s leadership.

🏙️ Portland has released an RFI to explore a micro-delivery hub pilot in a city-owned parking garage. That’s also leadership.

🚄 The Trudeau government in Canada committed to building high-speed rail connecting Toronto, Ottawa, Montreal, and Quebec City. This has long been a “no brainer” infrastructure project, but getting it across the finish line will fall to subsequent Prime Ministers.

😡 The US General Services Administration (GSA) may shut down EV charging at federal properties and sell EVs purchased by the federal government. This is cutting off your nose to spite your face.

😤The US Department of Commerce may take over the US Postal Service. While the clear risk to the electric van program falls within the scope of this newsletter, the broader risk is a potentially catastrophic development for vote by mail.

🤬The Trump administration continues to pursue various tariff policies that would add thousands of dollars to the cost of cars. If you’re wondering whether that’s good long term: Ford and GM stock are both down by more than 10% over the last month.

😡 The Trump administration appears to be strong-arming Ukraine into giving up mineral rights. Deep Dive “The Next Cold War is Already Here” outlines why countries are scrambling to secure long-term supply of minerals used in batteries.

😖Following a spate of air crashes, the US FAA now has a team from SpaceX trying to help modernize the US air traffic control system. Meanwhile, a coalition of aviation industry and union groups re-iterated their long-standing request to boost staffing levels that everyone agrees are painfully overstretched.

😠The US federal government announced plans to try to kill NYC’s congestion pricing program and California’s high-speed rail program. Neither state is going back down without a fight.

🔬Markets & Research

🚕 A new University of Michigan study again shows ridehail customers use Uber and Lyft in a way that undermines public transit. If you don’t get a handle on this now, it gets infinitely harder when robotaxis scale…

Not yet a subscriber?

🏭 Corporates & Later Stage

🤖 BYD announced that it will offer its “God’s Eye” self-driving technology on most of its cars without additional cost, including some cheaper models. This kind of move can destroy profit pools that players like Waymo and Tesla were banking on.

🇨🇳Tesla is having difficulty getting “Full Self-Driving” driver assist software approved in China. There are always casualties in a trade war.

📲Tesla is allowing 3rd party chargers in its own navigation ecosystem so long as they hit a 90% charging success rate and hit frequency targets. Another move that will force players to invest in charger operations and maintenance.

🪧Anti-Musk activists are protesting at Tesla stores, vandalizing SuperChargers, and egging Cybertrucks. Tesla sales are crumbling, but a very stale product range is probably more to blame than Musk’s politics…for now. Things could get very uncomfortable for Tesla sales in overseas markets and with fleet customers.

🧟♀️Japanese investors are preparing a proposal to sell beleaguered Nissan to Tesla. This wouldn’t make strategic sense for either company.

📈Rivian reached its first gross profit. A huge success, but reaching operating profit was predicated on a lower-cost model built at a new plant with support from the US Dept of Energy Loan Program Office. The loan is now in jeopardy.

🥊 Uber sued Doordash over anti-competitive practices. Uber’s inability to gain back market share from Doordash in food delivery underscores how powerful a Doordash/Lyft merger could be.

🐣 Startups & Early Stage

👋Peer-to-peer carshare operator Getaround abruptly shut down its business in the US. Rival Turo formally withdrew its long-awaited IPO plans.

🛴Lime inched ever closer to an IPO, claiming 30% annual growth in gross bookings and a second year of positive free cash flow. Even with an IPO, Lime investors won’t likely be getting a great return.

📌 Humane, whose AI Pin was unveiled just over a year ago, has been absorbed by HP in a fire sale. Keep an eye on how technologies like this can help users on the go seamlessly navigate mobility decisions across public transit, scooter, and bike.

🚁eVTOL maker Archer secured another $300M and FAA approval for its pilot training program. Archer is one of the rare SPAC examples that is now trading fairly close to its initial stock price.

🚄 Revenues at Brightline, America’s not-quite-high-speed rail experiment in Florida, grew over 100% last year. The company is ordering more railcars to meet demand, but whether it will reach profitability is an open question.

🛬 DEEP DIVE: R.I.P. TO THE HYDROGEN-POWERED PLANE 💦

In April of 1997, Mercedes owner Daimler-Benz shook up the auto industry with an investment in Canadian fuel-cell company Ballard.1 The company projected that by 2005, 100,000 of its cars sold each year would be hydrogen-powered. Given that Mercedes sold about 700,000 cars per year at the time, the entire auto industry paid attention.

And so did US politicians. In 2004, US President George Bush committed to a national program to ensure that it would be “practical and cost-effective for large numbers of Americans to choose to use clean, hydrogen fuel cell vehicles by 2020.”2

The actual result? After almost a decade on the market, sales of fuel-cell cars in California reached only 600 vehicles in 2024, down from 3,119 in 2023 (California is effectively the only state in the US where fuel-cell cars are sold in real numbers). In California, Toyota is almost giving away hydrogen-powered fuel-cell cars for free.3 Other automakers have given up on fuel-cell cars, including Mercedes.

Meanwhile, battery-powered electric cars accounted for 21% of all new cars sold around the world last year. No worries, hydrogen proponents claimed. The *real* transportation application for hydrogen would be in aviation, maritime, and heavy-duty trucking.

So it was not great news for Team Hydrogen when Airbus announced earlier this month that it had delayed the commercial launch of its hydrogen plane from 2035 to “the late 2040s.”4 Boeing is even more dubious about hydrogen5; given that it lost $12B last year, it has other emergencies to worry about. (For more on why Boeing is a geopolitical and a climate risk, see the Deep Dive in Vol 76).

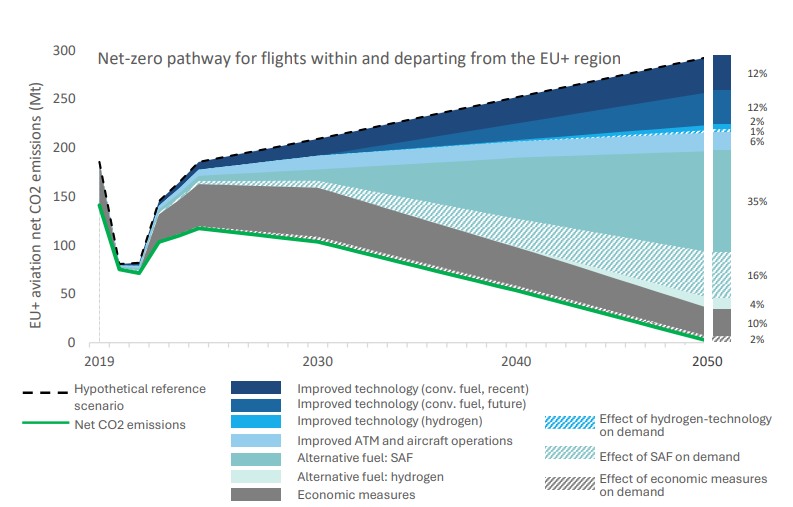

It’s not just Airbus and Boeing that are growing more dubious on hydrogen. Destination 2050, a sustainability initiative for the European aviation sector, unveiled its first decarbonization pathway in 2021 which showed hydrogen-powered planes accounting for 20% of the net emissions reduction by 2050. Earlier this month, it updated that figure to 6%.

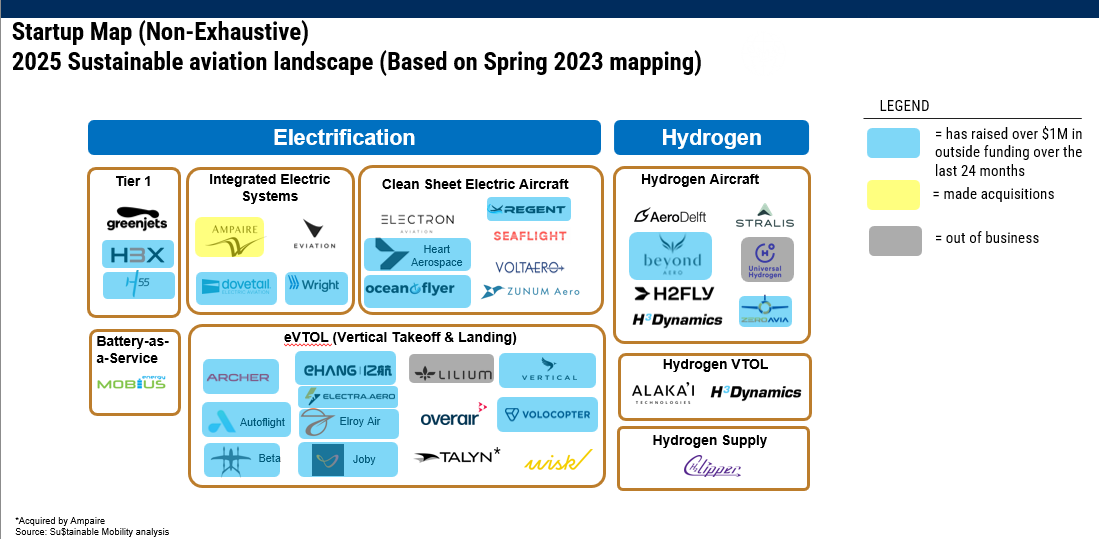

And things are similarly dubious on the startup front. The Deep Dive in Vol 50 (March, 2023) profiled several startups in both hydrogen and electric. It’s been fairly slim pickings for the hydrogen crowd since then. Universal Hydrogen, which raised over $80M, went bankrupt last year. And ZeroAvia continues to attract funding, but calling them a hydrogen player is somewhat misleading: though the company started as a hydrogen-powered plane, it has since added selling electric propulsion systems to others.6

This isn’t to say that the idea of sustainable aviation is dead. Instead, it implies that the pathway is getting clearer. As shown above, the electrification of short-haul aviation continues at a swift pace. And sustainable aviation fuel continues to secure significant investment as the likely pathway for long-haul aviation.

Just as with automotive, hydrogen may be more of a distracting mirage rather than a genuine technology alternative. Time will tell whether the same happens in long-haul heavy-duty trucking and maritime.

Enjoyed this issue?

https://www.wired.com/1997/10/hydrogen-3/

https://georgewbush-whitehouse.archives.gov/ceq/hydrogen_090908.html#:~:text=The%20President's%202009%20budget%20seeks,one%20delivered%20to%20CEQ%20today.&text=For%20more%20information%20on%20Executive,://www.ofee.gov.

https://www.hydrogeninsight.com/transport/toyota-reduces-price-of-new-hydrogen-car-in-california-to-just-over-15-000-with-15-000-of-free-fuel/2-1-1769729

https://www.reuters.com/business/aerospace-defense/airbus-postpones-development-new-hydrogen-aircraft-2025-02-07/

https://fortune.com/2023/01/26/boeings-chief-sustainability-officer-we-cant-count-on-hydrogen-powered-commercial-flights-before-2050/

https://www.fastcompany.com/90388931/this-plane-can-fly-500-miles-powered-entirely-by-hydrogen and https://zeroavia.com/zeroavia-confirms-first-sale-of-standalone-electric-propulsion-system/