This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

In this issue’s Deep Dive, we’re diving deep into the fundraising trends behind the $2 billion in follow-on funding for the startups who have been featured in the StartupWatch section of this newsletter.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Aeris Evolution (Washington, USA): Manufacter of zero-emissions electric planes

AluminAiry (Tennessee, USA): Manufacturer of aluminum-air batteries

Arc Train (California, USA): Gondola-like public transport system

Blaide (California, USA): Software tools to help contractors electrify homes (e.g., EV chargers, home batteries)

Fairway (California, USA): AI automation for fleet management

IonTech Energy Solutions (Ohio, USA): Manufacturer of sodium-ion batteries

Manta Aircraft (Italy): Manufacturer of electric air taxis for regional distances

Pivot Charging (California, USA): EV charging site management for fleets

PostX (United Kingdom): Software for zero-emissions delivery networks

Terbine (Nevada, USA): Charging network management for large multi-vendor EV charging infrastructure

Not yet a subscriber?

💰FUNDING: Capital raises from startups previously featured in Startup Watch

itselectric (Vol 26) raised a $6.5M Seed Round from Failup Ventures, Uber, LACI Impact Fund, and others

Spoke Safety (Vol 33) secured a strategic investment from Brembo (amount undisclosed)

Vammo (formerly Leoparda Electric, Vol 36) raised $5.4M in debt and equity from EXT Capital

ZeroMission (Vol 65) raised a $3M Seed round from Delta Partners and Greencode

Solideon (Vol 67) raised a $5M Seed round from 8090 Industries, 1517 Fund, Boost VC, and Shock Ventures

ByWay (Vol 72) raised a 5M GBP Series A from Eka Ventures, Heartcore Capital, and others

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🥊 In New York City, Comptroller Lander has launched a lawsuit challenging Governor Hochul’s indefinite pause on congestion pricing. The first lawsuit, but not the last.

⛴️ The world’s first 100% hydrogen-powered ferry has entered service in San Francisco. Other players in the California ferry industry, who must go zero-emissions by next year, are mostly adopting electric.

🚄 The Northeast High Speed Rail Coalition is assembling a group of labor and businesses to push for a long-shot plan to connect NYC to Boston in 100 minutes via high-speed rail. Acela’s potential has been hampered by Connecticut’s NIMBY community, so this audacious plan calls for bypassing the state’s bedroom communities.

🇲🇽 Mexico’s President Claudia Sheinbaum has promised to continue expanding the country’s electric passenger rail network. You love to see it.

🇨🇦 Canada’s Prime Minister Justin Trudeau confirmed a new permanent Canadian fund to spend $3 billion annually on public transit. Solid move.

🇪🇺 In a behind-closed-doors vote, the EU Commission struggled to get consensus on impending tariffs on Chinese-made EVs. Countries home to the production of lower-priced brands (Italy and France) supported the tariffs, while Germany and Finland abstained or opposed.

🇪🇺 The EU Commission has acknowledged that American pickups are being imported into the EU via a regulatory loophole. Trucks as large as the Dodge Ram weren’t even on the radar screen of regulators, and now there’s tens of thousands of them on European roads.

🔬Markets & Research

👷🏽♀️The Chicago Fed has published a study on the geography of EV production in the US. The key conclusion is that EV production largely mirrors internal combustion engine (ICE) production, implying that the EV era won’t result in a giant production shift between regions.

↘️ In China, EVs are now cheaper than ICE vehicles. It will take a bit longer to reach that inflection point in Europe and North America.

Enjoying this issue? Share it with 3 people…

🏭 Corporates & Later Stage

⏲️ Electrify America is running a pilot to limit customer charging to 85% state of charge. Another step in the long journey to make the best utilization of charging infrastructure.

🪙 Consumers in China are debating whether Baidu’s robotaxi fares are too low. Fare prices per mile can be over 75% cheaper than human-driven taxis.

💧Australian giant Fortescue is dialing its green hydrogen ambitions way back and cutting 700 related jobs. High cost and low demand continue to hold green hydrogen back.

🔔 South Korean battery giant SK On has declared an emergency over slow growth of its batteries. The company had invested in anticipation of a much more rapid uptake of EVs and its batteries in particular.

⛓️ While Tesla’s stock is on a recent tear, equity analyst concern is growing. Tesla fans believe in the huge long-term potential of AI, robotics, and clean energy while skeptics point to a deteriorating automotive business.

🥃 Tesla’s market share in EVs fell below 50% for the first time. This was inevitable, but the timing didn’t help as the company delayed its robotaxi unveiling by a few months.

💅🏽 In the reality TV world, rumors are swirling that part of Kim Kardashian’s finger was ripped off by her Cybertruck. Let’s hope her fans don’t try to imitate her injury.

🐣 Startups & Early Stage

🚀 Orkid (Startup Watch Vol 4) secured an LOI to deliver 100 drones to Singapore’s DroneDASH. Delivery drones are coming to a neighborhood near you…

🚁 Electric air taxi company Lilium signed a firm sales agreement with Saudia Group for 100 units. Gulf countries will be some of the most notable early adopters of the technology.

💨 Nybolt has unveiled a battery it says can charge in just under five minutes. Outlandish battery claims are par for the course, but the startup has raised over $80M, and battery improvements are inevitable.

🇿🇲 Metals and mining unicorn KoBold may have discovered a massive copper reserve in Zambia. Copper is in high demand for both EV batteries and data centers.

DEEP DIVE: PORTFOLIO ANALYSIS ON THE SU$TAINABLE MOBILITY STARTUP DATABASE

In each issue’s Startup Watch section, I share a handful of pre-seed and seed-stage startups that have come across my radar screen. To celebrate them hitting $2 billion in follow-on funding, I’m sharing a bit of portfolio analysis of what has been learned so far.

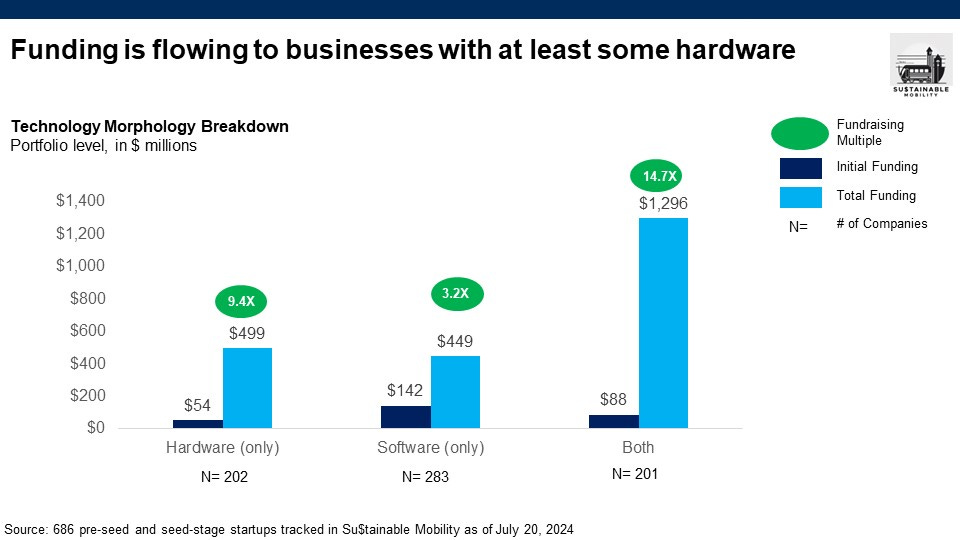

One of the most fascinating differences in the fundraising success of these companies is technology morphology. The classic adage is that investors prefer software over hardware, but this data proves that having some element of hardware is a significant predictor of future fundraising success, at least in the world of cleantech mobility.

A similar dichotomy exists for use cases. After years of VCs throwing money at people movement focused businesses like ridehail and scooter networks, attention has turned to how to move goods with low or no carbon.

Looking to the rest of 2024, I’m expecting that certain sub-sectors like fleet management cool off. The database now tracks 36 zero-emissions fleet management companies in a category that may only have a few big winners.

As far as growth, I continue to see an array of startups trying to build the next generation of batteries, with a particular focus on building a near-shore or domestic supply chain from sustainable mineral discovery through to recycling. And multi-modal green logistics continue to be a hot bed of innovation, whether that be by boat, small electric aircraft or micromobility.

As a reminder to the newcomers: The startup data set is currently open, for free. If you’re a subscriber interested in accessing the Airtable with all the raw data about the companies, please let me know below. Thanks for joining along so far on the journey!

Not yet a subscriber?