This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

This issue features new air taxi rules, over $80M in follow-on funding from previously-mentioned startups, and a Deep Dive on how batteries, like those found in EVs, are already saving California’s electrical grid.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Bingo Tech (California, USA): Shopify-like solution for micromobility fleets

E-lixr (Florida, USA): Manufacturer of zero-emissions ferries

Gaian Footwear (California, USA): Footwear that stores energy generated while walking

Ionworks (Pennsylvania, USA): Battery simulation software

Infinite Machine (New York, USA): Manufacturer of 2-wheeled micromobility

NAV Robotics (California, USA): Shared autonomous micromobility network

Shipflow (California, USA): Software to automate logistics operations

Tvisi Motors (United Kingdom): Manufacturer of fuel-cell commercial vehicles

Volt Air (California, USA): Zero-emissions cold chain logistics

💰FUNDING: Capital raises from startups previously featured in Startup Watch

BasiGo (Vol 32) raised a $24M Series A led by Africa50, with Trucks VC, Moxxie Ventures, and others, along with $17.5M in debt financing from British International Investment

Moment Energy (Vol 48) secured a $20.3M grant from the U.S. Dept of Energy

Beacon AI (Vol 52) raised a $15M Series A from Costanoa Ventures, Scout Ventures, JetBlue Ventures, Sam Altman, and others

Fin (Vol 54) raised a $7M Seed round from MaC Venture Capital, Side Door Ventures, and others

Nevoya (Vol 68) raised a $3M Seed round led by Third Sphere and RedBlue Capital, with Necessary Ventures, Ciri Ventures, and Never Lift

Universal Fuel (Vol 70) raised a $3M round led by TO VC, with Alchemist Accelerator, Claire Technologies, and World Star Aviation

General Galactic (Vol 74) raised a $9M Seed round (investors undisclosed)

Electroflow Technologies (Vol 91) raised a $2.8M pre-Seed Round from Fifty Years, Breakthrough Energy, Harpoon Ventures, and others

Enjoying this issue? Share with 3 friends…

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

🤔 Palo Alto, California is considering becoming the home for Tesla’s robotaxi pilot. Any such plan would require state approval, and Tesla so far has been reluctant to follow state programs on autonomous vehicle testing.

🔂 New York City launched its trade-in program for e-bikes, allowing food delivery workers who own low-quality battery bikes to trade them in for certified products. Kudos to NYC for stepping in to fix a problem caused by low-quality bike manufacturers.

🤝 Washington, DC has launched a universal basic mobility micro-pilot. While small, it’s a good example of public-private cooperation.

👎 New York’s state comptroller says the Metro Transit Authority finances are far worse than anyone thought. The comptroller primarily blames the numerous side-effects of “pausing” congestion pricing.

👛 Arlington, Virginia has started experimenting with variable pricing for public parking. Surge pricing was popularized by Uber, but it’s inevitable for roadway access (congestion pricing), curb access, and parking.

🚁 The US Federal Aviation Administration unveiled long-awaited rules for certifying air taxis. The news boosted the stock of Archer and Joby, who can’t launch without such rules. Meanwhile, Germany’s Lilium will enter insolvency.

🔋 The US Department of the Interior announced a massive lithium brine find in Arkansas that stunned the world. Estimates project the reserves could meet 2030 global battery demand nine times over; finding ways to sustainably extract it is the next step.

🇵🇦 Panama Canal volumes are growing again, mostly thanks to the use of land bridges. Low water levels in the canal continue to pose a challenge.

✈️ The US Department of Energy’s Loan Program Office made a $3 billion commitment to sustainable aviation fuel (SAF) programs. The three-way race between SAF, batteries, and hydrogen to power the future of aviation is just gearing up.

⛏️ The US Treasury clarified that certain mining operations supporting EV batteries and solar are eligible for Inflation Reduction Tax credits. Having domestic upstream mining capabilities will be essential for economic competitiveness.

🇨🇦 Canada may reboot plans for a Toronto-Quebec City high-speed railway. Few corridors in North America can compare with this one for density and proximity.

🇪🇺 The European Union stuck to its plans to prohibit the sale of gas and diesel-powered cars by 2035. Countries and corporations are divided on the issue.

🔬Markets & Research

🚗 Bloomberg has a great deep dive into BYD’s global leadership in EVs. For more, see Volume 66 Deep Dive: BYD is the new Android.

Not yet a subscriber?

🏭 Corporates & Later Stage

💰Waymo raised a $5.6 billion funding round. Robotaxis are (finally) coming to a city near you.

🚌 Waymo has launched a pilot in San Francisco to discount robotaxi rides to public transit. Ultimately, regulators have the choice to either mandate that robotaxis support public transit or be allowed to undermine it.

🧳 Uber may acquire Expedia. Diversifying into travel would help the company in its ambitions to be a ‘superapp.’

↗️ Tesla finally reversed its multi-quarter sales decline and the stock popped 20%. Long-term concerns about the feasibility of the robotaxi business still linger.

‼️Rivian’s “production hell” includes scary stories about worker safety. Nobody ever said launching a car company was easy.

📉 Hertz stock was downgraded, primarily over the botched EV situation. Important to remember that Hertz’s problems long predated EVs.

⛽️ Amazon announced that Prime members get a 10 cents per gallon discount on gas at BP stations (Amoco, AM/PM, etc.) in the US. The company also announced plans for a similar EV charging deal with BP Pulse.

🙅♂️ French energy giant is Engie shutting down its EVBox business. Let’s hope this wind-down is more orderly than the EnelX withdrawal from the US market.

🐣 Startups & Early Stage

🛒Rove (Startup Watch Vol 58) opened its first full-service EV charging station in Santa Ana, California complete with free wifi, restrooms, and a 3,000 sq foot Gelson’s market. It’s not clear that this is the future of EV charging, but the existing public charging model desperately needs improvements.

🚲 Onomotion, the German quad e-cargo bike startup, entered insolvency. The overall quad e-cargo bike sector appears to be accelerating, boosted by NYC’s adoption of the format pioneered in Europe.

🪁 Rental car startup Kyte, which has raised more than half a billion across equity and debt, is scaling back to just two markets in an attempt to survive. Kudos to friends at Curbivore for breaking the story.

Enjoying this issue? Share with 3 friends…

DEEP DIVE: Batteries are Already Saving the Electrical Grid

One of the frequent concerns about the mass adoption of EVs is that the grid just won’t be able to handle the incremental load. Like any criticism, there is an element of truth to it - grid capacity will need to be bolstered to support the incremental demand.

But over the last few years, California has proven that the same batteries used in EVs are vital in supporting the grid. And, as EVs reach mass adoption, the grid and EVs will ultimately support each other in ways that critics are ignoring.

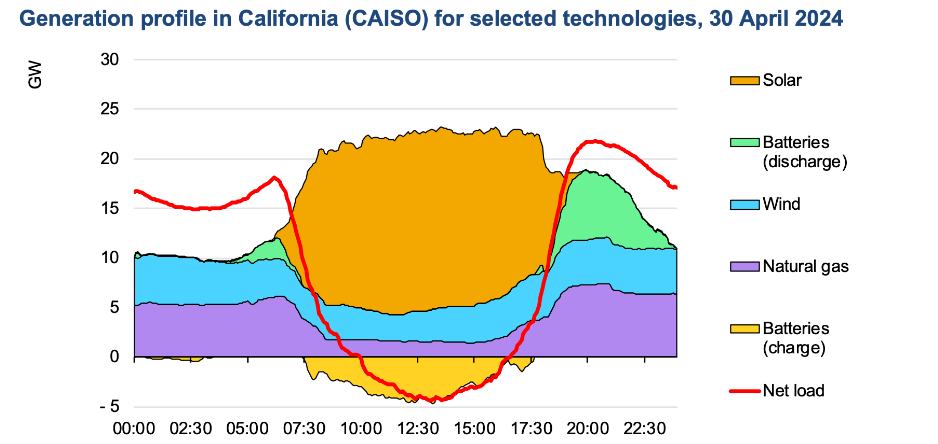

California’s grid is ground zero for decarbonization. In 2023, renewables, including hydropower, provided 54% of the state’s electricity. To critics, this reliance on renewables is a recipe for disaster given that EV sales now account for over 20% of new car sales. After all, what’s going to happen to the grid when all those drivers come home from work after sunset and plug into a grid powered by solar?

Source: International Energy Agency

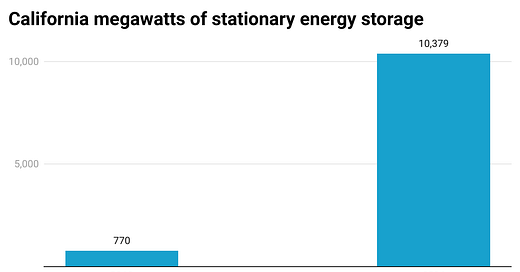

Enter the battery, which stores all that energy generated by solar during the daytime and dispatches it to the grid at night, just when consumers are running their dishwashers, cranking their AC, and charging their EVs. California’s adoption of the stationary storage battery has been nothing short of astronomical, growing by 1,250% over the last five years. Despite ongoing heat waves, California hasn’t experienced any grid outages due to load imbalances since 2020.

And that’s before we tap into the power of batteries in vehicles. According to friends at BNEF, battery capacity in vehicles will outnumber stationary storage by a factor of ten to one. If we’re able to manage peak electricity demand in California with just stationary storage, what happens when we can tap into 10X that capability with vehicles? Can we retire fossil gas plants earlier than planned if consumers respond to push notifications on their smartphones that reward them with a free coffee if they give 10% of their charge back to the grid?

Using vehicles to give power back to the grid when needed is an inevitability. Last month, California Governor Newsom signed a bill into law clarifying that California regulators have the power to mandate Vehicle-to-Grid capability in new vehicles, albeit with a timeline still to be decided.

This is not to discount the challenges in Vehicle-to-Grid. The US has approximately 20 automakers and 3,000 electrical utilities. Someone needs to build a data infrastructure layer that allows those entities to communicate between each other seamlessly. And someone needs to make the consumer experience around that frictionless. That’s not the kind of thing that any carmaker or utility does well. So this business is up for grabs between Big Tech (Google/Amazon/Apple) and some very qualified startups.

Enjoyed this issue? Share with 3 friends…