The Galapagos Syndrome in EVs

Vol 113

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

I’m excited to be teaming up with Laura Fox of Streetlife Ventures to co-host a Mobility Happy Hour in Brooklyn on Tuesday, Sept 9. It’ll be a great chance to chat about our summers, mobility trends, and New York Climate Week later in the month. Join us and spread the word! Be sure to sign up here.

In this issue’s Deep Dive, we’re looking at how the US is starting to lag way behind in the EV transition, snatching defeat from the jaws of an early victory. The country that gave birth to Tesla is risking becoming an also ran if something big doesn’t change.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Atoba Energy (France): Financing mechanism for sustainable aviation fuel

Cycling Batteries (New York, USA): Batteries designed for micromobility

IonRoad (California, USA): Battery lifecycle management software

Maxi Mobility (Italy): Electrification as a service for the taxi sector

Power Shelter (Netherlands): E-bike battery charging lockers

Resollant (Texas, USA): Novel reactor designed for clean hydrogen/syngas for aviation fuels and other applications

💰FUNDING: Capital raises from startups previously featured in Startup Watch

McEasy (Vol 16) raised a $3M extension to their Series A from Granite Asia

Valar Atomics (Vol 69) raised a Series A from Blackwing (amount undisclosed)

AIR EV (formerly AIR EVTOL, Vol 87) raised a $23M Series A from Entrée Capital and Shmuel Harlap

MobyFly (Vol 92) raised a $12.5M Series A from the Environmental and Solidarity Revolution Fund, Crédit Mutuel, and others

Cervo AI (Vol 111) raised a $5M Seed round from Crossbeam Venture Partners and Zetta Venture Partners

As a reminder, the startup data set is free (for now) to subscribers. If you’re a subscriber interested in accessing the Airtable with how these startups raised $3.5 billion in follow-on funding, please let me know.

📰QUICK HITS: Notable news from the last two weeks

👩🏽⚖️Government, Policies & Cities

⛴️ In New York City, the Governors Island ferry is going electric. That’s one ferry down and many more to go.

🇨🇳 China warned its EV makers to stop the price cuts. Competition in the Chinese EV market is still absolutely cutthroat.

🚅 In the US, Amtrak’s higher-speed rail service Acela will finally deploy part of its fleet of faster trains later this month. The new trains offer almost 30% more passenger capacity and cut travel time from DC to Boston by about 15 minutes.

🔬Markets & Research

🚶♀️New MIT research shows that we now walk about 15% faster in cities than we did in 1980. The ubiquity of cell phones may mean that public spaces are becoming more transactional rather than community-centric.

🗽Geotab has a fantastic overview of the benefits of NYC’s congestion pricing. It’s a runaway success, even if the fee is lower than originally planned.

Not yet a subscriber?

🏭 Corporates & Later Stage

🏨 According to Hilton Hotels, the availability of EV chargers is one of the highest-converting features on their website. Any EV owner will tell you the pain of trying to plan charging on a road trip.

👩🏽⚖️Uber may receive a report of sexual assault or harassment every in the US every 8 minutes. This explains why many have tried to scale ridehail networks by women drivers for women passengers.

🤖 Lyft plans to launch robotaxis in Europe next year with Baidu. Fresh off entering Europe via M&A, Lyft has a lot to prove on the continent.

🤠 Waymo has launched a robotaxi partnership with Avis to serve the Dallas market. Waymo and Uber (and Lyft) are now in an arms race to lock up potential partners in the robotaxi market.

👨🏽⚖️A Florida jury decided that Tesla was partially responsible for an accident involving its “Autopilot” technology and ordered it to pay a $243M fine. This is a precedent-setting outcome.

🌪️In other Tesla bad news: brand loyalty continues to plummet, and the new Tesla diner in LA is getting tepid reviews. But in good news, the US military may purchase Cybertrucks for missile practice, the company secured a permit to run a robotaxi network in Texas, and Elon Musk got a $29B stock grant from the board to keep him engaged.

🚢 Shipping giant Matson will no longer ship EVs. Other shipping giants may adapt their approaches in response.

🦊 Foxconn’s dreams of contract manufacturing EVs in the US appear to have come to an end, at least for now. This is eerily reminiscent of Foxconn’s broken promise to build a mega electronics factory in Wisconsin.

🐣 Startups & Early Stage

🔋 B2U (Startup Watch Vol 50) began construction on a 24MWh grid storage site in Texas with repurposed EV batteries. That’s enough to power about 800 homes for a month.

♻️ The assets of battery recycling startup Li-Cycle, which entered bankruptcy earlier this year, were acquired by mining giant Glencore. Li-Cycle had raised $1.5B, but Glencore purchased the assets for $40M.

🔋U.S. battery startup Lyten has agreed to buy most of bankrupt Swedish battery maker Northvolt. For more on Northvolt, see the Deep Dive Northvolt is the canary in the coalmine for Europe and North America.

🚁 Air taxi (eVTOL) company Joby bought the passenger business of Blade for $125M. The acquisition makes Joby both an equipment manufacturer and a network operator, akin to how United Airlines was once part of Boeing.

✈️ JetZero continues to gain traction, increasing the likelihood that it eventually challenges the Boeing-Airbus duopoly. For more on Boeing’s vulnerability, see the Deep Dive Boeing's Nosedive is Our Climate Problem to Fix.

🚲 Belgian e-bike maker Cowboy may be on the verge of bankruptcy (article in French). Dutch rival VanMoof entered bankruptcy in 2023…

Enjoying this issue? Share it with 3 people…

DEEP DIVE: THE GALAPAGOS SYNDROME IN EVs

In the early 2010s, the US was the beating heart of the EV revolution, driven by California’s bold climate policy and Silicon Valley’s appetite for disruption. Today, it risks becoming an EV island, drifting from global momentum and standards, a modern “Galapagos syndrome” in the making.

Supported by California’s policy leadership, Tesla’s bet on EVs turned out to be a global game changer. Tesla is now the world’s most valuable carmaker by a large margin and inspired dozens of other companies, from Rivian in the US to Nio in China.

That early lead is rapidly slipping away, and changes in federal policies may isolate the US market from the rest of the world. On July 29, the Trump Administration proposed to revoke a landmark EPA greenhouse gas finding that would alter the trajectory of EVs in the US. If the proposal ultimately passes, it would repeal all greenhouse gas standards for cars and trucks, including medium and heavy-duty. And the federal government continues to try to undermine California’s policy making authority.

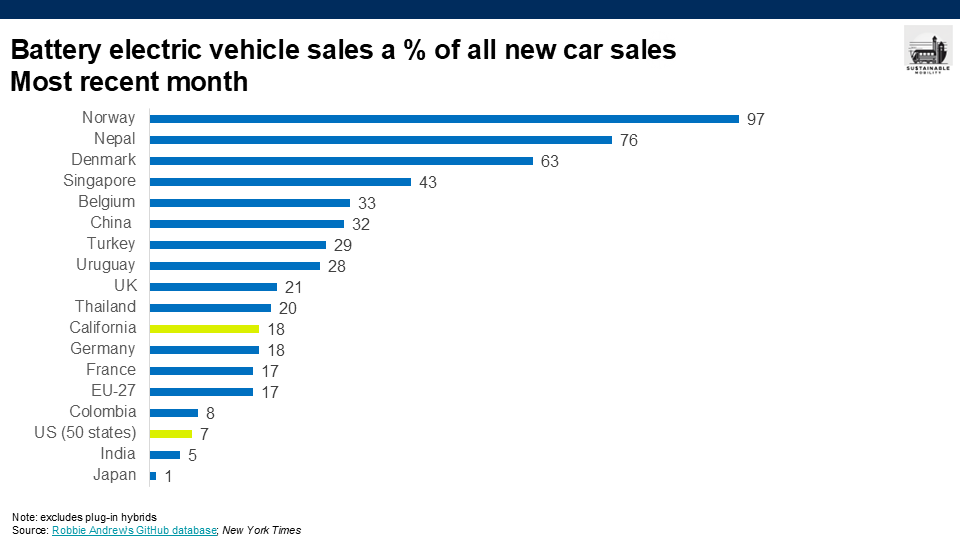

While California is still holding its own, the US overall is now behind a wide variety of markets across population size (e.g., China and Singapore), income level (e.g., Denmark and Nepal), and domestic production-oriented vs import-oriented.

If things don’t reverse course, the US runs the risk of falling victim to the Galapagos syndrome. The syndrome is inspired by Japan’s mobile phone market in the early 2000s, where domestic devices evolved in isolation from global norms, creating products highly adapted to the local market but incompatible abroad. The result: technological irrelevance for previously global cell phone players like Kyocera.

That’s the kind of impact that takes companies like General Motors and Ford and slowly turns them into marginal players. It also increases the risk that the US startup innovation ecosystem around EVs can’t compete on the global stage.

The US can still compete, but only if it re-engages with the global EV race on the terms the rest of the world is setting. The alternative is clear: an industry that innovated for the future will find itself stranded in the past.

Not yet a subscriber?

Not yet a subscriber?