This bi-weekly newsletter aims to separate the signal from the noise for making money in sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

The Deep Dive this issue: why did the US Congress leave micromobility out of the landmark Inflation Reduction Act (IRA)?

QUICK HITS: Notable news from the last 2 weeks

🚕 In NYC, cab drivers fear that the upcoming congestion pricing will destroy their business. This is the storm before the calm. Other cities show that the actual implementation is easy enough, it’s getting there without too many carveouts that’s the hard part.

🌬 London’s congestion pricing and emissions pricing have had a notable impact on local air quality. As American cities like NYC, LA and others implement congestion pricing, keep an eye out on which ones also include an emissions element.

🚊 Barcelona is using trains to recharge scooters. Novel, but perhaps not the most efficient energy play.

🚲 In NYC, delivery workers won their first charging hub. It’s the least NYC can do after the NYC Housing Authority has tried to crack down on e-bike storage in public housing.

🚚 US communities are fighting back against warehouses. Urban hinterlands don’t want large Amazon warehouses and dense urban cores don’t want dark stores, but everyone wants last-mile delivery.

🚄 The future of California’s high-speed rail project continues to look challenging. Some major details were left out here. For example, the author critiques the inclusion of the Central Valley in the plan, but doesn’t acknowledge that getting voter approval required a statewide proposition that only passed 53%/47%. Without the Central Valley vote, the project probably wouldn’t have passed.

👀 In the US, the National Transportation Safety Board (NTSB) is recommending that cars use digital devices to limit top speed. Cities request this already from e-kickscooters and the concept is taking off in Europe; I’m hard-pressed to articulate a reason why we shouldn’t move forward with this.

💸 The US EPA may let EVs into the biofuel credits program. This is another example of the Biden administration’s “whole of government” approach to sustainability.

⛏ The US opened its first cobalt refinery in 30 years. Onshoring of minerals mining, refining, and recycling is a marathon, not a sprint.

✈️ The UN reaches a goal for net zero aviation by 2050. Given the claims by some that aviation and shipping were outside the scope of the Paris agreement, this is a necessary but insufficient step toward aviation decarbonization. Look for individual countries to start setting targets for short-haul first, as Norway has done.

⚡️General Motors makes a giant bet on energy services. It’s about time that a non-Tesla automaker made a run at smart charging and grid services.

🤖 FedEx, Amazon, and others are shutting down sidewalk robot delivery programs. With economic uncertainty comes the culling of special projects.

📦 Amazon made a billion-dollar commitment to zero emissions goods movement in Europe. Keep an eye on the doubling of Amazon’s micro-mobility delivery hubs and what models might help get large vans off the road in city centers.

🥤Pepsi may get Tesla’s first EV Semi deliveries in December. Let’s wait until Pepsi confirms delivery before we celebrate, as the Semi has had a long series of delays.

🚚 Nikola founder convicted of fraud. The SPAC hangover continues.

🤝 Motional signed a 10-year deal with Uber. GM Cruise and Waymo are pushing a more vertically integrated approach to self-driving vehicles; Motional may be the best example so far of partnering for access to the transportation networks.

📲 TikTok may be chasing Amazon into the last-mile delivery space via e-commerce. What Meta failed at, TikTok may succeed at.

🚲 Will e-bikes go mainstream? My bet: quickly in Europe and slowly in North America. See the Deep Dive for more on why.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

👨🏾💻 Ampcontrol (New York, USA): EV charging optimization software

💨 Cedar Carbon (New York, USA): Carbon capture for road tunnel ventilation systems, targeting emissions from vehicles

🧑🏽💻 Mina (United Kingdom): Fleet management & charging software for EVs

👩💻 Palmo (Germany): Software for last-mile delivery logistics

🔂 Ride Up (United Kingdom): E-bike subscription-as-a-service for bike manufacturers

FUNDING: Capital raises from startups previously featured in Startup Watch

Rapid Flow (Vol 5) was acquired by Miovision (deal size undisclosed)

Gigforce (Vol 9) raised a $940k round from 9 Unicorns Accelerator Fund, ZNL Growth, and Venture Catalysts

Fetii (Vol 24) raised a seed round from Goodwater Capital and Stonks (amount undisclosed)

Bauen Energy Technologies (Vol 26) was acquired by Decarbonfuse

EdgeEnergy (Vol 32) raised a round from C2Ventures (amount undisclosed)

DEEP DIVE: Why micromobility got left out of the Inflation Reduction Act

When the Inflation Reduction Act (IRA) was signed, nearly every sector in sustainability celebrated. Tax credits galore were handed out for battery cell manufacturing, zero-emission passenger cars, solar modules, and sustainable aviation fuel.

What was notably missing, however, was micromobility, a term covering bikes, e-bikes, e-kickscooters, quadricycles, etc. Many in the micromobility were up in arms asking “If this bill is all about moving the needle on climate, why didn’t they include the most efficient vehicle category on miles traveled per kilowatt hour?”

In a nutshell, politics, not climate science.

Like any bill, the IRA was about the art of the possible, not just environmental ideology. For members of congress facing re-election, they needed to be able to defend their vote to their constituents in terms of local economic benefits, including jobs created.

Alas, right now, the US doesn’t really have a viable manufacturing sector for micromobility. In the entire United States, the biking sector employs the equivalent of one car factory. That’s a stark contrast to Europe, where there’s a genuine employment base in micromobility manufacturing.

There are no meaningful jobs in micromobility manufacturing because the US imports nearly everything it sells. The comparison with Europe shows that even in a high-wage market, domestic micromobility manufacturing is feasible.

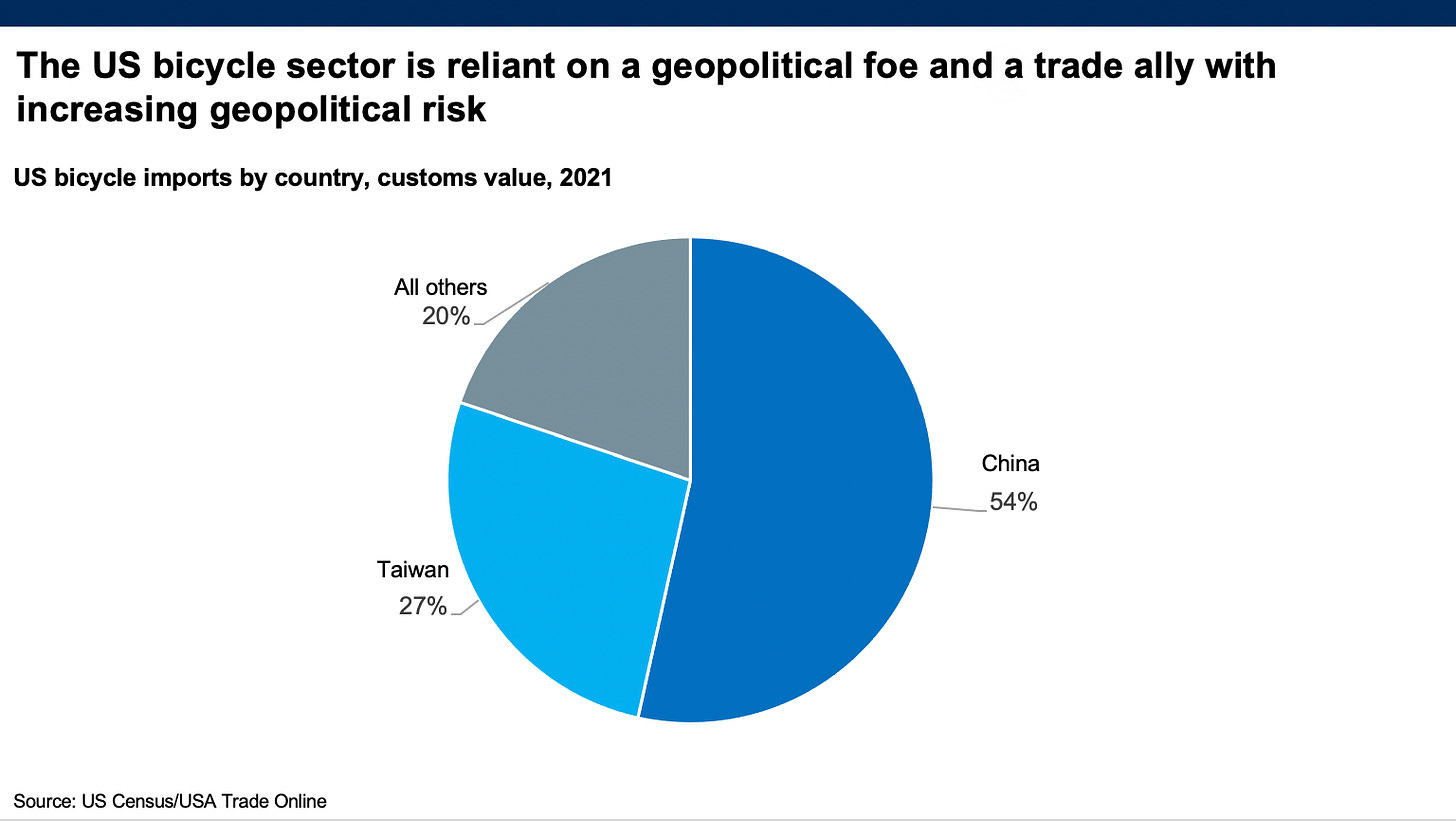

And it gets worse. Not only does the US import 97% of the micromobility vehicles it sells, but over 50% of them come from China

Giving tax credits to spur the Chinese economy along is exactly the kind of sound bite that strikes fear in a member of Congress. And that helps explain why there aren’t micromobility tax credits in the US yet.

So where do we go from here? To start, the industry needs to stop seeing itself as a grouping of cottage industries and start communicating on Capitol Hill with one unified voice that covers everything from Trek Bicycles to Lime shared scooters to 3-wheeled last-mile delivery devices.

Most of the tax credits approved in the IRA require some amount of domestic production, but nobody carried the message to Congress that there was real potential for US micromobility manufacturing. It’s going to take innovators painting a better picture of “what could be.” A great place to start is with the US Treasury, which is seeking comments on the rules for how the Energy Security Tax Credits for Manufacturing will be implemented, including battery cells and battery modules. If you can’t get a tax credit for micromobility purchases, at least try to access tax credits for inputs like batteries.

In an ideal world, the US would create some industrial policy for micromobility like what Europe did. Alas, this is the real world and it’s time for micromobility innovators to lean on industrial innovation to build a market and then let Congress turbocharge growth via tax credits.