Su$tainable Mobility, Volume 8

This newsletter aims to separate the signal from the noise for making money in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

Feedback is always welcome. Feel free to DM me on Twitter or send an email with your thoughts on what else you might like to see as content.

This week, we have a Deep Dive on what it will take to scale micro-EVs (4-wheeled devices that are more than a scooter but less than a car).

Disclaimer: This newsletter represents my own thoughts and not those of any employer. I will always disclose when I have a financial relationship with a company cited.

QUICK HITS: Fast takes on notable news from last week

🛢 After an almost decade-long battle, Harvard is divesting from fossil fuels. Other universities are sure to follow. The Divest Harvard movement targeted holdings in “companies that produce or own reserves of oil, natural gas, and coal, and large utilities powered by natural gas and coal.” We may find large chunks of the transport sector added to that list over time.

🚗 New York has joined California in banning the sale of internal combustion engine (ICE) cars after 2035. California and New York alone represent about 17% of US auto sales. This quickly reaches a tipping point where OEMs decide it’s not worth manufacturing ICE at all in North America if there are only a few holdout states still allowing ICE sales.

🏡 A new study on how land-use influences mode choice. “Land use entropy” (i.e., diverse land use types across commercial, residential, etc) is found to be negatively associated with car passenger travel mode.

📦 UPS acquired gig-delivery company Roadie. UPS is the single largest employer in the Teamsters Union, but the gig delivery market is probably too important to pass up. Look for lots more acquisitions from UPS, FedEx, etc. as they try to maintain prominence in last-mile delivery.

🏙 Car-free community Culdesac (Tempe) announced its mobility providers. Valley Metro, Bird, Envoy*, and Lyft will be part of each resident’s $3,000 per year in mobility benefits. This will be a fascinating experiment in how individual services can be part of a seamless mobility offering for residents who are all prohibited from owning personal cars.

🏜 A new $400bn “sustainable city” is being planned. Lots of eyebrow-raising details in here, including the notion of trying to build a 5 million person sustainable city in the desert.

🗽 New York City transport mode usage looks quite different in a COVID world. Automotive traffic is up, as is shared bike usage. But bus and subway ridership are still way down.

📲 Ford poaches the head of Apple’s car project. The legacy OEMs have done a surprising job of making sure that some talent from Silicon Valley ends up (back) in Detroit.

STARTUP WATCH: Sustainable mobility startups (generally pre-seed or seed) to keep an eye on

🛰 Airio (California, USA): Shared airspace operations for drones and other electric aircraft

📦 Danfo (Nigeria): Last-mile logistics marketplace for Africa

🏍 Kofa (Ghana): e-motorcycles & mobile battery network for sub-Saharan Africa

🛰 Mobility Insight (Israel): B2G SaaS for traffic congestion and management

👩💻Fleetport (Austria): Open source fleet management software, including carbon tracking

🛴Parkinete (Spain): Smart parking for electric scooters

🚲 Wiibike (Vietnam): e-bike manufacturer

DEEP DIVE: Figuring out how to scale micro EVs

The last 5 years have been a golden era for “micromobility”, a term meant to capture minimalist vehicles such as e-bikes and scooters. Expert Horace Dediu slices the market into 5 sub-segments (scooter/bike, e-bike, moped, light quadricycle, and heavy quadricycle). To date, the vast majority of venture investment in micromobility has been into scooters and e-bikes, with some new interest in e-mopeds as well. So what will it take to make the quadricycle (i.e., 4-wheeled micro-EVs) an investable segment?

First, an explanation of why we might want 4-wheeled micro EVs:

Trip length: Scooters and e-bikes are limited in their distance capabilities

Customer demographics: Not all ages or ability levels are able to safely use e-bikes or scooters

Geography: Scooters and e-bikes aren’t ideal during the winter in Quebec City, or in a blazing hot summer in Dubai; sometimes you need the benefits of an enclosed cabin for protection from the elements

Climate and economics: The average passenger car in the US weighs about 3,000-4,000 pounds, gets about 25 miles per gallon, and has about 1.5 occupants when moving. This is economically wasteful and devastating for the environment, especially for trip lengths and speeds that do not require highways

So far, micro-EVs have been a dud of a business. In the EU, the most prominent example over the last decade has been the Renault Twizy, which has only sold 31,000 units by the end of last year. In the US, the “neighborhood electric vehicle” market has primarily been focused on selling golf-cart-like vehicles to retirement communities.

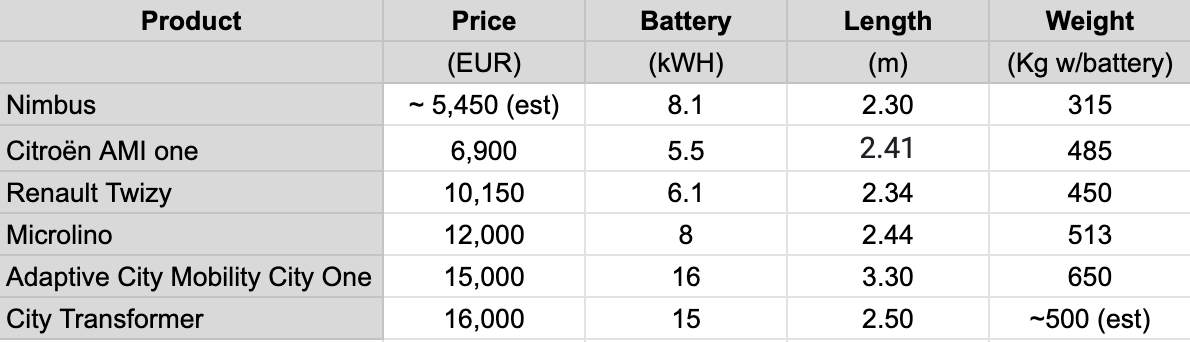

But there’s a lot of startups and corporates out there now experimenting in this space. On the corporate side, Stellantis’ Citroën Ami One demonstrated some breakthroughs on price and business model. And on the startup side, Nimbus, City Transformer, and Adaptive City Mobility are all coming to market with some fresh thinking.

An incomplete overview of the market looks something like this:

In order for this segment to reach the big league, 3 big changes need to happen: policy, business model, and technology.

Policy:

Parking laws in many places are still unclear about whether “head in” parking is legal. Without the ability to park two to four of these vehicles per traditional parking spaces, much of the space-saving gains don’t materialize.

The built environment will ultimately need to accommodate protected “micromobility only" lanes that will define which exact vehicles are allowed the right to use that lane. By the same token, ultimately cities will restrict which lanes and roads that highway-speed capable vehicles are allowed to use. This is probably the hardest to make happen, but is likely the single biggest thing that could grow the category.

Business Model:

Moving from ownership to access. Selling quadricycles to consumers is an underwhelming business model. Shared mobility, while still struggling on the profitability front, has the potential to dramatically scale the market for micro-EVs.

Technology:

Most of the vehicles on the list above still aren’t hitting the right price targets. It’s too easy for a shared mobility operator to compare a new micro-EV at 10K EUR vs a used Nissan Leaf and opt for the Leaf. The bill of materials and manufacturing strategy need to reflect a max price point closer to the mid 4 figures, which may more of a “scooter plus” design thinking than trying to de-content a Smart Car.

It’s early days in this space, so expect a significant amount of evolution in the next 5 years as we find a way to make 4-wheeled micromobility a legitimate business.

* My employer, LACI (Los Angeles Cleantech Incubator), has incubated and invested in Envoy.

This is a great collection of info on the progress and challenges facing micro-EVs. I especially liked the analysis you provided detailing the changes needed for micro-EVs to reach the "big leagues." One recommendation would be to include pathways for readers to engage and help foster changes like naming specific public officials to contact to push for policy changes. We all can be part of the solution sometimes a push in the right direction helps make a movement happen. My 2 cents... Thank you for helping to lead the changes for a better world for all of us🙏🏽😊🤙🏽