🤖 BYD is the new Android

Vol 66

This newsletter aims to separate the signal from the noise for investment in all things sustainable transportation: Electrification, mode shift, active and public transit, and mobility aggregation, across both people and goods movement.

🌱STARTUP WATCH: Sustainable mobility startups (pre-seed or seed) to keep an eye on

Carbmee (Germany): Supply chain decarbonization software

Dash Air Shuttle (Washington, USA): Airline network pre-emptively designed for electric planes: rural, short-haul, small aircraft

DeepVolt (Tunisia): Software to help cities and businesses identify profitable locations for EV charging stations

GaiaHub (Estonia): City traffic management software

Gridtractor (California, USA): Electrification services for farms utilizing electric tractors and heavy equipment

Material Hybrid Manufacturing (Florida, USA): 3D-printed batteries

Moon Five (California, USA): Low-cost modular EV charging for apartments

RareTerra (California, USA): Rare earth elements extraction via bacteria

Sun-Ways (Switzerland): Solar panels embedded in train tracks

Terraprisma (Netherlands): Advanced satellite tech for sustainable mining analytics

💰FUNDING: Capital raises from startups previously featured in Startup Watch

Arc Boats (Vol 4) raised a $70M Series B from Abstract Ventures, Andreessen Horowitz, Eclipse Ventures, Lowercarbon Capital, and Menlo Ventures

Enjoying the ability to track the next climate tech startup? Share this issue with 3 folks:

📰QUICK HITS: Notable news from the last week

👩🏽⚖️Government, Policies & Cities

🇩🇪 Hanover’s mayor is getting rid of on-street parking. Parking supply creates its own demand.

🇳🇱 Amsterdam is planning to lower vehicle speed limits to 30 kilometers per hour (19 miles per hour). What started in Graz (Austria) in 1992 has now spread to well over a dozen notable European cities.

💰Santa Monica is running a pilot to pay residents to not drive. Getting American urban dwellers to shift modes is one of the defining behavioral challenges of our era; every experiment helps us understand what will ultimately work.

🌊 New York’s Metro Transportation Authority (MTA) outlined how much climate change will require resiliency investments to keep trains running. Hard to keep subways running if they’re frequently flooded.

🚦Having reduced private car usage, Paris is now experiencing bike traffic jams. Even detractors admit that a bike traffic jam is less polluting than a car traffic jam.

🚄 UK Prime Minister Rishi Sunak canceled the rest of the UK’s high-speed rail plan and offered local mobility projects instead. Sunak’s political legacy may be defined in part by how he took UK mobility in a very different direction than the rest of Europe.

🇩🇪 Germany’s EV home charging grants sold out in one day. Perhaps selling out in one day is a sign that the program was rewarding those who would have purchased anyway.

🇨🇦 Canada is struggling with whether its massive mineral deposits in Ontario’s Ring of Fire can be sustainably mined. Everyone wants minerals, but mining, processing, and recycling them are fraught with challenges.

🇺🇸 The US Treasury clarified rules on EV tax credits. This is hugely helpful to consumers. Starting next year, qualifying buyers can assign their $7.5k (new) or $4k (used) EV tax credit to a selling dealer.

Enjoying the ability to track the next climate tech startup? Share this issue with 3 folks:

🔬Markets & Research

🚛 North American Council for Freight Efficiency (NACFE) is running a fantastic real-time dashboard of Pepsi’s deployment of Tesla semi-trucks. This is huge. For those who claim that EV trucks can’t handle drayage or regional trucking, this data proves otherwise.

💧The International Energy Agency (IEA) unveiled its first update to the 2021 Net Zero Emissions by 2050: A Roadmap for the Global Energy Sector. Key changes are less hydrogen and carbon capture, and more batteries and EVs.

🏭 Corporates & Later Stage

🤖 UPS is testing an autonomous cargo vehicle at the UK’s East Midlands Airport. Controlled environments like airports make great use cases for autonomy.

👏🏽American Airlines has joined forces with Embraer’s consortium to design a zero-emissions 50-passenger aircraft. Embraer’s smaller aircraft will go zero-emissions long before many of American Airline’s larger planes.

⚡️Lufthansa’s CEO claims that the airline would consume half of Germany’s electricity if it switched to Sustainable Aviation Fuels (SAF). Still lots of work to make SAF actually sustainable.

💧Airbus may be ready to deploy hydrogen aviation by 2035. This isn’t a market launch commitment, but Airbus noting what other stakeholders need to do for them to be ready by 2035.

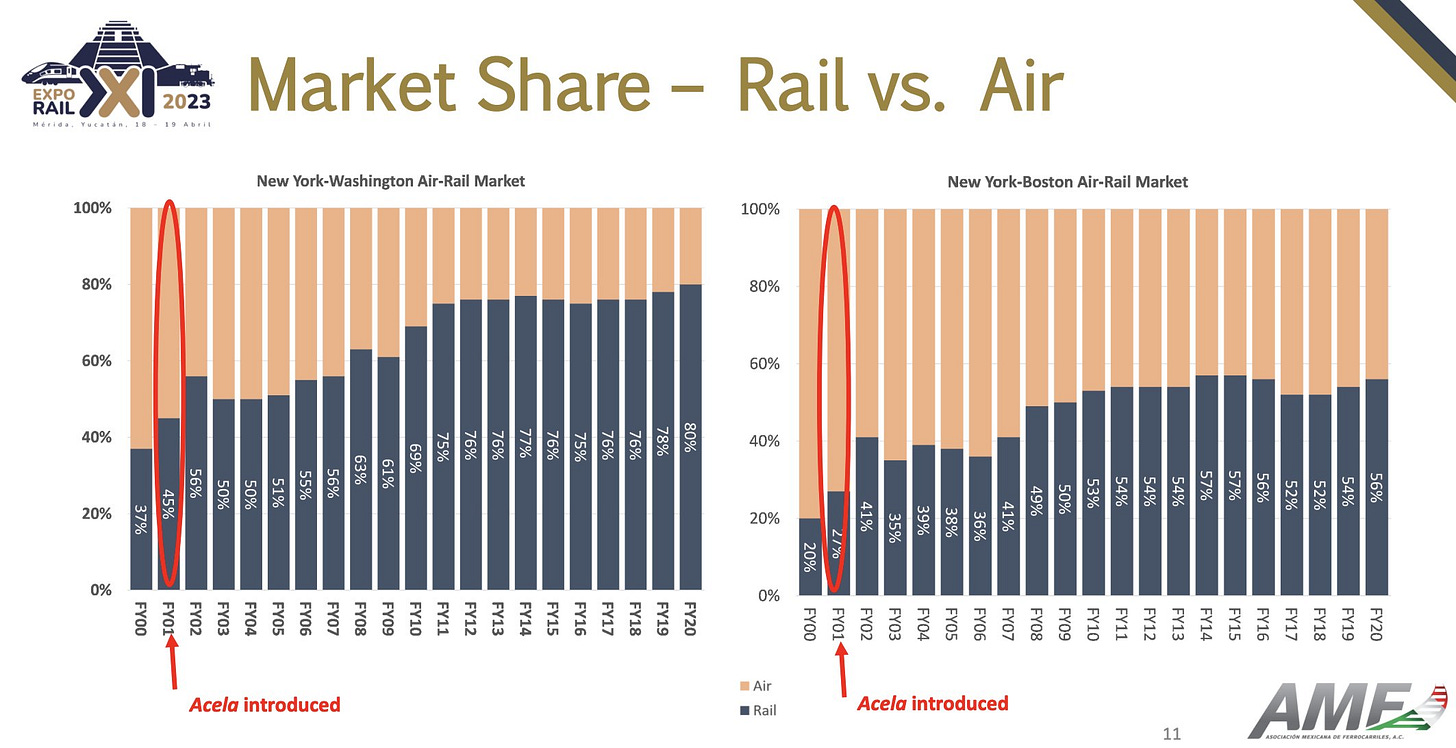

🚄 Curious as to whether the Brightline train linking Miami to Orlando will impact airline travel? Take a look at the impact Acela had on the Northeast US.

🐣 Startups & Early Stage

🍁Sweden’s Northvolt is building a battery gigafactory in Canada. Canada can thank the US Inflation Reduction Act’s trade partner approach for this one.

📦 Germany’s B-ON, the electric van manufacturer born out of DHL’s Streetscooter project, entered bankruptcy. Given how quickly other manufacturers are scaling electric vans, don’t expect this project to get resurrected.

DEEP DIVE: BYD IS THE NEW ANDROID

We’re coming up on 15 years of the smartphone wars, with Apple and Google’s Android in fierce rivalry. Android is the global volume leader (~70% market share versus Apple’s ~28%), but most signs point to Apple leading Android in profits.

Tesla has often been compared to Apple: closed ecosystems made up of tightly integrated hardware and software, a highly controlled sales and service experience, etc. And, at least until Tesla started an EV price war, enviable margins.

So who is is playing Android to Tesla’s Apple? While legacy car makers (GM, BWM, VW, etc.) would love to be Tesla’s most formidable rival, the automaker with the most sustainable differentiation versus Tesla in EVs is BYD.

And how is BYD, with its humble roots, better equipped to rival Tesla than, say, GM? It comes down to roughly three things: a battery-first approach, a focus on lower-end products and markets, and an openness to partner throughout the value chain.

Battery First

BYD first came to attention in the West in 2008, when Warren Buffet’s Berkshire Hathaway took a 10% stake in a battery manufacturer that had recently acquired a struggling small-scale automaker selling Toyota knockoffs.

BYD’s continued focus on in-house battery innovation has paid dividends. Like many others in China, BYD has focused on LFP (lithium iron phosphate) batteries, known for low costs and lower energy density. Western competitors, including Tesla, have historically used more premium NMC (nickel manganese cobalt) to get longer range.

In 2020, BYD changed the game by introducing the Blade battery. Putting LFP into a blade-like packaging resulted in improvements in density, safety, battery life, and cost.

How good are BYD batteries? Good enough for Tesla, among multiple other car brands. Tesla uses BYD batteries for production at the Berlin Gigafactory. This isn’t to say that Tesla’s not a battery powerhouse, but for much of Tesla’s history, they relied on Panasonic know-how.

Lower-End Products and Markets

BYD Auto first showed its aspirations in China with the lowly F3 plug-in hybrid in 2008 and the all-electric e6 in 2009. When initial consumer interest was lacking in EVs, the company pivoted hard into a “fleet and bus” strategy: convincing local Chinese municipalities to convert their taxi operations to all-electric at the same time as they switched their transit operations to BYD e-buses.

The same holds for markets. Tesla is in Europe and China, but has avoided middle-income markets like India and Brazil. Not so for BYD, who has a factory in Brazil and has been selling in India for years.

Open for Partnerships

Tesla can be a tricky partner; just ask former shareholders Daimler and Toyota. And although Tesla has opened up its charging network to competitors, that’s mostly been competitors having to accept Tesla’s terms as is.

BYD, on the other, is notable for how many different types of collaborations it has with other players. For example:

BYD supplies its batteries to not just Tesla, but also Toyota, Kia, Lincoln, and potentially soon Mercedes

On vehicle design, BYD has a joint venture venture with Toyota for battery research

In China and Europe, BYD partnered with Shell Recharge for charging networks

In North America, BYD partnered with Cox Automotive for heavy-duty fleet support

Google’s Android has thrived thus far by doing things that Apple can’t or won’t do: lower-cost products integrated into a highly global, relatively open ecosystem of partners with their own agendas (e.g., Samsung). That’s effectively the role that BYD plays in the EV space.

While it may never capture Tesla level margins, it’s better than sitting in Stuttgart (or Detroit, or Munich…etc.) trying to figure out how to prevent further customer defections to Tesla.

Enjoyed this issue? Share it with 3 friends in your network: